PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666917

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666917

Dermatology Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

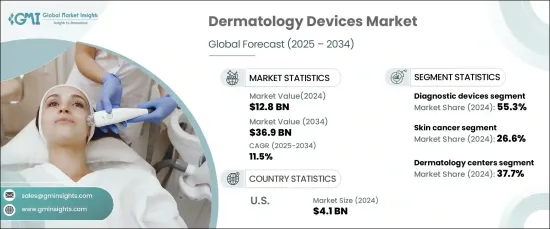

The Global Dermatology Devices Market was valued at USD 12.8 billion in 2024 and is expected to grow at an impressive CAGR of 11.5% from 2025 to 2034. This growth is primarily driven by the increasing prevalence of skin diseases, including skin cancer, as well as the rising focus on skincare in emerging economies. Additionally, technological advancements in dermatology devices are playing a key role in the expansion of this market, while developed regions are seeing heightened demand for cosmetic procedures. As consumers continue to prioritize skin health and aesthetic treatments, the market is set for sustained growth.

The market is categorized into diagnostic and treatment devices, both of which serve critical roles in addressing the increasing incidence of skin-related health concerns globally. Diagnostic devices are essential for early and accurate detection and include imaging systems, dermatoscopes, and biopsy tools. Meanwhile, treatment devices encompass light therapy systems, lasers, microdermabrasion units, cryotherapy tools, electrosurgical equipment, and liposuction devices. In 2024, diagnostic devices dominated the market, accounting for 55.3% of the total share. This is attributed to the growing need for timely identification of conditions such as eczema and skin cancer, as early detection is key to successful treatment outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.8 Billion |

| Forecast Value | $36.9 Billion |

| CAGR | 11.5% |

In terms of application, dermatology devices are widely used in the treatment of skin cancer, skin rejuvenation, hair removal, body contouring, psoriasis, and various other dermatological conditions. The skin cancer segment led the market in 2024, commanding a significant 26.6% share. This is due to the global rise in skin cancer cases, driving the demand for reliable diagnostic and treatment tools. Advanced dermatology devices are indispensable in identifying both cancerous and precancerous lesions, allowing for early intervention and improved patient outcomes.

The U.S. dermatology devices market, with a valuation of USD 4.1 billion in 2024, remains the largest in the world. This dominance is driven by the high rates of melanoma and non-melanoma skin cancers in the U.S., combined with extensive awareness programs and skin cancer prevention initiatives. Furthermore, the approval of advanced dermatology devices by the U.S. FDA has bolstered the availability of cutting-edge diagnostic and treatment solutions, contributing to the market's continued growth and innovation. As the demand for dermatological care intensifies, the U.S. will remain a key player in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of skin associated diseases and skin cancer worldwide

- 3.2.1.2 Increasing expenditure on skin care in developing countries

- 3.2.1.3 Technological advancements in skincare devices

- 3.2.1.4 Growing demand for cosmetic procedures in developed countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Excessive equipment cost

- 3.2.2.2 Stringent regulatory landscape

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Patent analysis

- 3.7 Future market trends

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostic devices

- 5.2.1 Imaging devices

- 5.2.2 Dermatoscopes

- 5.2.3 Biopsy devices

- 5.3 Treatment devices

- 5.3.1 Light therapy devices (LED therapy)

- 5.3.2 Lasers

- 5.3.3 Microdermabrasion devices

- 5.3.4 Cryotherapy devices

- 5.3.5 Electrosurgical equipment

- 5.3.6 Liposuction devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Skin cancer

- 6.3 Skin rejuvenation

- 6.4 Hair removal

- 6.5 Body contouring and skin tightening

- 6.6 Psoriasis

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dermatology centers

- 7.3 Hospitals

- 7.4 Clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alma Lasers (Fosun Pharma)

- 9.2 Ambicare Health

- 9.3 Bausch Health Companies

- 9.4 Biolitec

- 9.5 Bruker Corporation

- 9.6 Candela Corporation

- 9.7 Canfield Scientific

- 9.8 Carl Zeiss

- 9.9 Cutera

- 9.10 Cynosure Lutronic

- 9.11 Genesis Biosystems

- 9.12 Heine Optotechnik

- 9.13 Hologic

- 9.14 Image Derm

- 9.15 Leica Microsystems

- 9.16 Lumenis

- 9.17 Michelson Diagnostics (VivoSight)

- 9.18 Olympus Corporation