PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666890

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666890

Vital Sign Monitoring Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

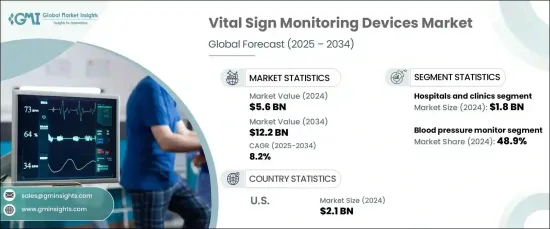

The Global Vital Sign Monitoring Devices Market reached USD 5.6 billion in 2024 and is expected to experience substantial growth, advancing at a CAGR of 8.2% from 2025 to 2034. The increasing prevalence of chronic diseases, such as hypertension, diabetes, and cardiovascular conditions, has made continuous health monitoring more essential than ever. These devices play a vital role in managing patient health by providing real-time data on critical parameters like heart rate, blood pressure, and oxygen levels.

As healthcare systems worldwide strive for more proactive care models, the demand for vital signs monitoring devices is expected to skyrocket. Innovations in technology, such as wireless and portable solutions, are also contributing to the market's expansion, providing greater accessibility and convenience for both healthcare providers and patients. The shift toward home-based healthcare and telemedicine, particularly in the wake of the global pandemic, is expected to further fuel this growth, creating significant opportunities for market players.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.6 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 8.2% |

The market is primarily segmented by product type, which includes blood pressure monitors, pulse oximeters, temperature monitoring devices, and other related categories. In 2024, blood pressure monitors took the lead, accounting for 48.9% of the total market share. This is driven by the growing incidence of hypertension and related health conditions worldwide. These monitors are further broken down into subcategories, including aneroid monitors, digital monitors, and accessories. Among these, digital monitors are becoming increasingly popular, gaining traction for their ease of use, portability, and high level of accuracy.

By end-user, the market serves a diverse range of sectors, including hospitals and clinics, homecare, ambulatory surgery centers, and others. Hospitals and clinics represented the largest share in 2024, valued at USD 1.8 billion. These healthcare facilities are particularly reliant on continuous vital signs monitoring to manage the high volume of patients dealing with both acute and chronic conditions. The growing number of hospitals, along with ongoing advancements in healthcare infrastructure, further supports the need for these devices. The demand for real-time monitoring continues to rise, ensuring effective patient management and timely interventions.

In the United States, the vital sign monitoring devices market reached USD 2.1 billion in 2024. A robust healthcare infrastructure and widespread adoption of these devices across various healthcare settings, including hospitals, clinics, and home care, are major factors behind this growth. The increasing burden of chronic diseases, such as cardiovascular issues, hypertension, and diabetes, is driving the demand for continuous monitoring of vital parameters like blood pressure and oxygen saturation. The emphasis on preventive healthcare and early diagnosis is also significantly contributing to market growth, making vital signs monitoring an integral part of the overall healthcare approach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of chronic diseases across the globe

- 3.2.1.2 Rising disposable income and healthcare expenditure in emerging countries

- 3.2.1.3 Technological advancement in developed nations

- 3.2.1.4 Growing adoption of remote vital signs monitoring devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.2.2 Stringent regulatory framework

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Blood pressure monitoring

- 5.2.1 Aneroid blood pressure monitors

- 5.2.2 Digital blood pressure monitor

- 5.2.3 Blood pressure instrument accessories

- 5.3 Pulse oximeters

- 5.3.1 Fingertip pulse oximeters

- 5.3.2 Hand-held pulse oximeters

- 5.3.3 Wrist-worn pulse oximeters

- 5.3.4 Table-top/Bedside pulse oximeters

- 5.3.5 Pulse oximeter accessories

- 5.4 Temperature monitoring devices

- 5.4.1 Mercury filled thermometers

- 5.4.2 Digital thermometers

- 5.4.3 Infrared thermometers

- 5.4.4 Temperature monitoring device accessories

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and clinics

- 6.3 Homecare

- 6.4 Ambulatory surgery centers

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 A&D Company

- 8.2 Baxter International

- 8.3 Beurer

- 8.4 BPL Medical Technologies

- 8.5 Contec Medical Systems

- 8.6 Dr Trust

- 8.7 GE Healthcare

- 8.8 Koninklijke Philips

- 8.9 Masimo Corporation

- 8.10 Medtronic

- 8.11 Nihon Kohden Corporation

- 8.12 Nonin Medical

- 8.13 Omron Healthcare

- 8.14 Smiths Group

- 8.15 SunTech Medical