PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913354

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913354

In-Vehicle Payment Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

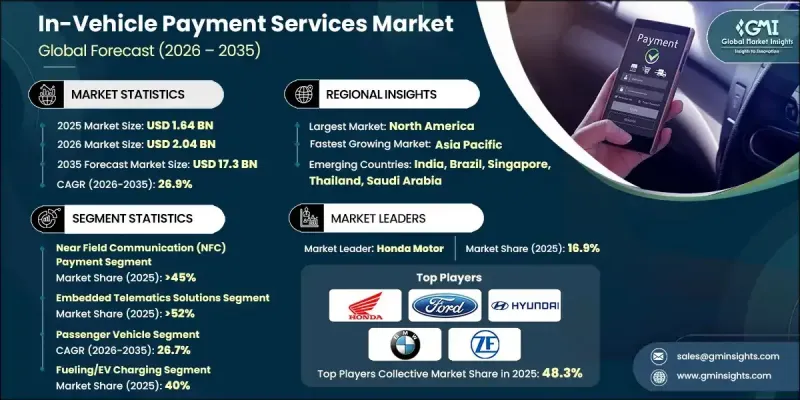

The Global In-Vehicle Payment Services Market was valued at USD 1.64 billion in 2025 and is estimated to grow at a CAGR of 26.9% to reach USD 17.3 billion by 2035.

Market momentum is driven by the growing preference for seamless and contactless digital transactions across mobility-related activities, encouraging automakers and mobility service providers to embed secure payment functionality directly into vehicles. The rapid expansion of connected vehicle platforms equipped with sophisticated infotainment and telematics architectures is creating a robust base for integrated payment capabilities and real-time transaction processing. Increasing consumer reliance on digital wallets and cashless payment solutions is further accelerating compatibility between vehicle systems and broader financial ecosystems. Automakers are actively partnering with financial institutions, payment processors, and technology firms to streamline development cycles, address regulatory requirements, and unlock new revenue opportunities from connected services. In parallel, the integration of advanced technologies such as IoT, AI, and high-speed connectivity is enhancing communication between vehicles, payment infrastructure, and service platforms, reinforcing the scalability and reliability of in-vehicle commerce solutions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.64 Billion |

| Forecast Value | $17.3 Billion |

| CAGR | 26.9% |

In 2025, the near field communication payment segment held 45% share and is forecast to reach USD 8.7 billion by 2035. Adoption is supported by widespread acceptance of contactless payment methods and increasing integration within vehicle hardware ecosystems.

The embedded telematics solutions segment held 52% share in 2025 and generated USD 852.9 million. These solutions are favored for enabling secure, native payment functionality while improving data ownership, system reliability, and long-term service monetization.

U.S. In-Vehicle Payment Services Market reached USD 653.1 million in 2025 and is expected to record strong growth through 2035. Market expansion is supported by high penetration of connected vehicles and strong demand for convenience-oriented digital payment experiences.

Key companies operating in the Global In-Vehicle Payment Services Market include Volkswagen, PayPal, BMW, ZF, Ford Motor Company, Shell, Hyundai Motor, Jaguar Land Rover Automotive, Honda Motor, and ParkMobile. Companies in the In-Vehicle Payment Services Market are focusing on strategic partnerships to strengthen ecosystem integration and accelerate solution deployment. Collaboration with financial institutions, fintech providers, and mobility service platforms allows players to ensure regulatory compliance while expanding transaction coverage. Many firms are investing in cybersecurity, tokenization, and data encryption to enhance trust and protect user information. Continuous software innovation and over-the-air update capabilities are being leveraged to improve functionality and scalability. Market participants are also prioritizing user-centric interface design to improve adoption and engagement.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Payment mode

- 2.2.3 Technology

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising demand for contactless payments

- 3.2.1.3 Growth of connected vehicle penetration

- 3.2.1.4 Expansion of digital wallet ecosystems

- 3.2.1.5 OEM-fintech partnerships

- 3.2.1.6 Increase in EV adoption and charging infrastructures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Cybersecurity and data privacy concerns

- 3.2.2.2 High system integration and compliance costs

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of EV charging payment integration

- 3.2.3.2 Growth of fleet and commercial vehicle payment automation

- 3.2.3.3 Development of personalized in-car commerce services

- 3.2.3.4 Adoption of biometric and voice-enabled payment authentication

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States: PCI DSS (Payment Card Industry Data Security Standard) for secure in-vehicle payment processing

- 3.4.1.2 Canada: PIPEDA (Personal Information Protection and Electronic Documents Act) governing payment and user data protection

- 3.4.2 Europe

- 3.4.2.1 United Kingdom: UK GDPR and PCI DSS compliance for in-vehicle digital payments

- 3.4.2.2 Germany: GDPR and ISO/IEC 27001 information security management for embedded payment systems

- 3.4.2.3 France: PSD2 (Revised Payment Services Directive) for secure electronic and in-vehicle payments

- 3.4.2.4 Italy: PSD2 and GDPR compliance framework for digital and embedded payment platforms

- 3.4.2.5 Spain: GDPR and PCI DSS requirements for in-vehicle payment data security

- 3.4.3 Asia Pacific

- 3.4.3.1 China: PIPL (Personal Information Protection Law) regulating connected vehicle and in-vehicle payment data

- 3.4.3.2 Japan: APPI (Act on the Protection of Personal Information) for automotive payment data security

- 3.4.3.3 India: RBI digital payment security guidelines applicable to in-vehicle payment services

- 3.4.4 Latin America

- 3.4.4.1 Brazil: LGPD (Lei Geral de Protecao de Dados) for in-vehicle and connected payment systems

- 3.4.4.2 Mexico: Federal Law on Protection of Personal Data (LFPDPPP) governing automotive digital payments

- 3.4.4.3 Argentina: Personal Data Protection Law (Law No. 25,326) relevant to in-vehicle payment platforms

- 3.4.5 Middle East & Africa

- 3.4.5.1 United Arab Emirates: UAE data protection regulations and PCI DSS for embedded payment services

- 3.4.5.2 South Africa: POPIA (Protection of Personal Information Act) for connected vehicle payment data

- 3.4.5.3 Saudi Arabia: Saudi Data and AI Authority (SDAIA) data protection regulations for in-vehicle payment systems

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Development cost structure

- 3.8.2 R&D cost analysis

- 3.8.3 Marketing & sales costs

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Future market outlook & opportunities

- 3.12 OEM Monetization & Business Model Analysis

- 3.12.1 Direct transaction revenue models (revenue share, MDR-based)

- 3.12.2 Subscription-based in-vehicle commerce models

- 3.12.3 Platform and ecosystem monetization (app stores, marketplaces)

- 3.12.4 Data-driven monetization opportunities (usage, behavioral insights)

- 3.12.5 OEM vs fintech vs payment network revenue ownership

- 3.13 OEM Integration & Deployment Framework

- 3.14 Ecosystem Power Dynamics & Strategic Control Points

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Payment mode, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Near Field Communication (NFC) Payments

- 5.3 QR Code-Based Payments

- 5.4 Embedded Wallets

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Embedded Telematics Solutions

- 6.3 Mobile Application-Based Integration

- 6.4 Cloud-Based Payment Platforms

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicle

- 7.2.1 SUV

- 7.2.2 Sedan

- 7.2.3 Hatchback

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Fueling/EV Charging

- 8.3 Smart Parking

- 8.4 Automated Toll Payments

- 8.5 E-commerce

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.3.8 Portugal

- 9.3.9 Croatia

- 9.3.10 Benelux

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Singapore

- 9.4.7 Thailand

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Turkey

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Amazon Web Services

- 10.1.2 Ford Motor Company

- 10.1.3 Hyundai Motor Company

- 10.1.4 IBM

- 10.1.5 Mastercard

- 10.1.6 PayPal

- 10.1.7 Shell

- 10.1.8 Visa

- 10.1.9 Volkswagen

- 10.1.10 BMW

- 10.1.11 Jaguar Land Rover Automotive

- 10.1.12 ParkMobile

- 10.1.13 ZF

- 10.2 Regional Players

- 10.2.1 General Motors Company

- 10.2.2 Honda Motor

- 10.2.3 Daimler / Mercedes-Benz

- 10.2.4 Toyota Motor

- 10.2.5 Telenav

- 10.2.6 Parkopedia

- 10.2.7 CarPay Diem / Kwalyo

- 10.2.8 SiriusXM Connected Vehicle

- 10.2.9 Gentex

- 10.2.10 Thales

- 10.3 Emerging / Disruptor Players

- 10.3.1 Car IQ Pay

- 10.3.2 Cerence

- 10.3.3 PayByCar

- 10.3.4 Verra Mobility

- 10.3.5 Apple

- 10.3.6 Samsung Electronics

- 10.3.7 Parkwhiz

- 10.3.8 Xevo