PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666681

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666681

Caravans Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

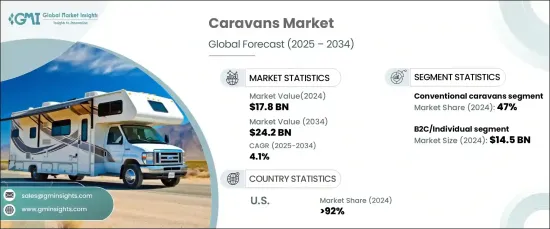

The Global Caravans Market reached USD 17.8 billion in 2024 and is expected to maintain a strong upward trajectory with a projected CAGR of 4.1% from 2025 to 2034. This growth is primarily driven by increasing investments in leisure activities and strong government initiatives to promote tourism. As more individuals seek unique, memorable travel experiences, caravans are emerging as a preferred alternative to traditional vacation options. The allure of road trips, camping, and exploring scenic landscapes is pushing the demand for caravans.

Additionally, people are increasingly looking for ways to travel that offer greater flexibility, comfort, and convenience. With a growing focus on outdoor recreation, caravans provide a sense of adventure without sacrificing comfort. This market expansion is supported by shifting consumer preferences, rising disposable incomes, and the widespread availability of caravans at varying price points, making them accessible to a broader demographic. The growing enthusiasm for sustainable and eco-friendly travel further strengthens the demand for fuel-efficient, environmentally conscious caravan options. The widespread expansion of camping and caravan park infrastructure is also contributing to the rise in caravan adoption worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.8 Billion |

| Forecast Value | $24.2 Billion |

| CAGR | 4.1% |

The market is segmented into two primary end-use categories: B2C (individual consumers) and B2B (fleet owners). In 2024, the B2C segment led the market, contributing USD 14.5 billion to overall revenue. This segment's growth is largely attributed to the increasing number of families and friends opting for road-based holidays, offering flexibility, comfort, and adventure. Caravans cater to the growing desire for cost-effective travel without compromising on quality. With higher disposable incomes, people are more willing to invest in leisure products such as caravans, which offer a range of prices and models to meet various consumer needs.

When it comes to vehicle types, conventional caravans are the market leaders, holding a 47% share in 2024. These caravans are popular for their home-like comfort and practical features, including multiple rooms, built-in amenities, and strong security systems. They appeal to travelers who prioritize comfort and convenience. Additionally, the global expansion of camping sites and caravan parks has spurred manufacturers to design more affordable and efficient caravan models, which further supports the growth of the market.

In the U.S., the caravan market holds an impressive 92% share as of 2024. This is due to factors such as the increasing flexibility for remote work, rising disposable incomes, and a growing demand for outdoor recreation. Consumers are particularly attracted to smaller, fuel-efficient caravans that align with sustainability trends. Enhanced infrastructure for RV enthusiasts, as well as a preference for compact caravan designs that can navigate narrow European roads, are driving further growth in this market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material supplier

- 3.2.2 Component supplier

- 3.2.3 Manufacturer

- 3.2.4 Service provider

- 3.2.5 Distributor

- 3.2.6 End-user

- 3.3 Profit margin analysis

- 3.4 Pricing analysis

- 3.5 Cost breakdown analysis

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 The proliferation of the tourism industry and the rising number of caravans in North America

- 3.9.1.2 Increasing participation and consumer spending in recreational activities

- 3.9.1.3 Development of road infrastructure and rising numbers of caravans

- 3.9.1.4 Growing adoption of technologically advanced caravans across Europe

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High purchase and maintenance costs of caravans

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Conventional caravans

- 5.3 Tent trailer

- 5.4 Pop-top

- 5.5 Pop-out

- 5.6 Camper trailer

- 5.7 Fifth wheeler

Chapter 6 Market Estimates & Forecast, By Price, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Standard

- 6.3 Luxury

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 B2C/Individual

- 7.2.1 Conventional caravans

- 7.2.2 Tent trailer

- 7.2.3 Pop-top

- 7.2.4 Pop-out

- 7.2.5 Camper trailer

- 7.2.6 Fifth wheeler

- 7.3 B2B/Fleet owner

- 7.3.1 Conventional caravans

- 7.3.2 Tent trailer

- 7.3.3 Pop-top

- 7.3.4 Pop-out

- 7.3.5 Camper trailer

- 7.3.6 Fifth wheeler

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 Italy

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Sweden

- 8.3.7 Netherlands

- 8.3.8 Norway

- 8.3.9 Turkey

- 8.3.10 Greece

- 8.3.11 Hungary

- 8.3.12 Georgia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 LAMEA

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 UAE

- 8.5.4 Saudi Arabia

- 8.5.5 South Africa

Chapter 9 Company Profiles

- 9.1 Adria Mobil

- 9.2 Aeonrv

- 9.3 Airstream

- 9.4 Bailey of Bristol

- 9.5 Burstner

- 9.6 Coachmen

- 9.7 Compass Caravans

- 9.8 Dethleffs

- 9.9 Elddis

- 9.10 Fendt-Caravan

- 9.11 Fleetwood

- 9.12 Forest River

- 9.13 Hobby-Wohnwagenwerk Ing. Harald Striewski

- 9.14 Hymer

- 9.15 Jayco

- 9.16 Knaus Tabbert

- 9.17 Lunar Caravans

- 9.18 Swift Group

- 9.19 Thor Industries

- 9.20 Winnebago Industries