PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666671

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666671

Web 3.0 Blockchain Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

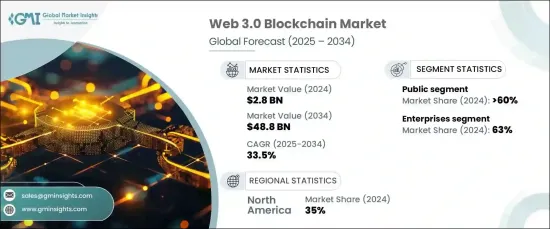

The Global Web 3.0 Blockchain Market, valued at USD 2.8 billion in 2024, is set to experience remarkable growth, with a projected CAGR of 33.5% from 2025 to 2034. This surge is fueled by escalating concerns about data privacy and security, alongside the widespread adoption of decentralized applications (dApps). These applications, which eliminate intermediaries, empower users with enhanced control over their data while boosting transparency and security. This transformative shift toward decentralization is redefining the digital landscape, solidifying blockchain as an essential technology.

The Web 3.0 blockchain market is categorized into public, private, consortium, and hybrid blockchain types. In 2024, the public blockchain segment led the market with a commanding 60% share and is projected to skyrocket to $25 billion by 2034. Public blockchains are increasingly favored for their unparalleled transparency, offering a secure, tamper-proof, and openly accessible ledger of transactions. This openness fosters trust and ensures accountability, making public blockchains indispensable to the decentralized Web 3.0 ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $48.8 Billion |

| CAGR | 33.5% |

By end use, the market is segmented into enterprises, government and public sector, and individual users. The enterprise segment dominated in 2024, capturing 63% of the market share. Enterprises are leveraging blockchain to streamline operations, enhance efficiency, and reduce costs. Through the use of smart contracts, businesses can automate critical processes like supply chain management and cross-border transactions, minimizing errors and operational expenses. Additionally, blockchain's immutable nature ensures data integrity, mitigating fraud risks and fostering trust across business networks. Key use cases include secure identity management, transparent audits, and intellectual property protection-crucial in today's digital economy.

North America Web 3.0 blockchain market accounted for 35% of the global share in 2024, driven by the region's thriving ecosystem of tech innovators, startups, and significant venture capital investments. This technological leadership accelerates blockchain adoption across multiple sectors, particularly finance, where institutions are leveraging the technology for enhanced payment systems, decentralized finance (DeFi) solutions, and digital asset management.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Blockchain platform providers

- 3.1.2 Decentralized app developers

- 3.1.3 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 The role of web 3.0 in metaverse development

- 3.9 Emerging applications and use cases

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing funding in Web 3.0 applications

- 3.10.1.2 Rising demand for tamper-proof ledgers

- 3.10.1.3 Growing demand for decentralized and trustless systems

- 3.10.1.4 Rising decentralized finance applications

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Increasing popularity of Non-Fungible Tokens (NFTs)

- 3.10.2.2 Extensive regulatory uncertainty

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Blockchain, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Public

- 5.3 Private

- 5.4 Consortium

- 5.5 Hybrid

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cryptocurrency

- 6.3 Conversational AI

- 6.4 Data & transaction storage

- 6.5 Payments

- 6.6 Smart contracts

- 6.7 Digital identity

- 6.8 Governance

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Individual

- 7.3 Enterprises

- 7.4 Government & public sector

Chapter 8 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 Retail & e-commerce

- 8.4 Media & entertainment

- 8.5 Healthcare

- 8.6 Real estate

- 8.7 IT & telecom

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alchemy

- 10.2 Aptos

- 10.3 Autograph

- 10.4 Binance

- 10.5 Chainlink

- 10.6 Coinbase

- 10.7 CoinList

- 10.8 Consensys

- 10.9 Decentraland

- 10.10 Filecoin

- 10.11 Helium

- 10.12 Immutable X

- 10.13 Kadena

- 10.14 Livepeer

- 10.15 Ocean Protocol

- 10.16 OpenSea

- 10.17 Polkadot

- 10.18 Polygon

- 10.19 Terra

- 10.20 The Sandbox