PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666669

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666669

U.S. Off-Road Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

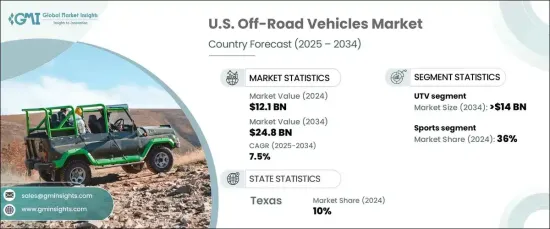

U.S. Off-Road Vehicles Market, valued at USD 12.1 billion in 2024, is on track for impressive growth with a projected CAGR of 7.5% from 2025 to 2034. This rapid expansion is primarily fueled by the surging popularity of outdoor recreational activities, as more consumers seek versatile vehicles capable of conquering a wide range of terrains. Whether it's navigating rugged trails, snowy landscapes, or mountainous paths, off-road vehicles have become essential for adventure seekers and professionals alike. The market has evolved beyond traditional utility purposes, catering to an increasing demand for off-road experiences and activities. Factors such as enhanced vehicle designs, improved performance features, and better comfort and durability are leading the way for growth in both recreational and utility markets.

The market is primarily divided into UTVs (Utility Task Vehicles), ATVs (All-Terrain Vehicles), snowmobiles, and off-road motorcycles. Among these, UTVs dominate, holding a 60% market share in 2024. The demand for UTVs is expected to rise significantly, generating an estimated USD 14 billion by 2034. These vehicles are highly favored for their combination of off-road capabilities, cargo capacity, and comfort. They are particularly popular for farming, hunting, and recreational trail riding, offering an excellent mix of functionality and versatility. The increased use of UTVs for outdoor adventures such as camping, racing, and competitive off-road sports is also driving their growth, making them the go-to choice for consumers looking for a rugged yet comfortable vehicle.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.1 Billion |

| Forecast Value | $24.8 Billion |

| CAGR | 7.5% |

In terms of application, the market is further segmented into utility, sports, recreation, and military uses. The sports segment accounted for 36% of the market share in 2024, driven by the growing interest in high-adrenaline activities like motocross, off-road racing, and rock crawling. Consumers engaged in these activities are demanding specialized vehicles like ATVs and UTVs that offer superior performance in extreme conditions. As a result, manufacturers are responding with cutting-edge vehicle designs featuring advanced suspension systems, greater power, and improved durability to meet the needs of sports enthusiasts.

The Texas off-road vehicles market alone captured 10% of the total market share in 2024. The state's varied terrain, including deserts, forests, and mountainous areas, provides the perfect setting for off-road activities like trail riding, rock crawling, and dune bashing. The region's year-round favorable weather conditions and strong cultural affinity for off-roading have significantly contributed to the growing demand for off-road vehicles in this area. As the U.S. off-road vehicle market continues to expand, innovations in vehicle performance, comfort, and adaptability ensure that these vehicles remain a staple for both leisure and utility purposes across the country.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacture

- 3.1.4 Distributors

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rapid investment in R&D and new product development in U.S.

- 3.9.1.2 Proliferation of the electric-off road vehicles industry

- 3.9.1.3 Growing consumer inclination towards off-road recreational activities in California

- 3.9.1.4 High growth of the tourism industry

- 3.9.1.5 Increasing presence of off-roading sports events

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Safety concerns related to off-road vehicles

- 3.9.2.2 Environmental impact of off-roading activities

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 UTV

- 5.3 ATV

- 5.4 Snowmobile

- 5.5 Off-road motorcycle

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Utility

- 7.3 Sports

- 7.4 Recreation

- 7.5 Military

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Alabama

- 8.3 Alaska

- 8.4 Arizona

- 8.5 Arkansas

- 8.6 California

- 8.7 Colorado

- 8.8 Florida

- 8.9 Georgia

- 8.10 Idaho

- 8.11 Illinois

- 8.12 Indiana

- 8.13 Iowa

- 8.14 Kansas

- 8.15 Kentucky

- 8.16 Louisiana

- 8.17 Maine

- 8.18 Michigan

- 8.19 Minnesota

- 8.20 Mississippi

- 8.21 Missouri

- 8.22 Montana

- 8.23 Nebraska

- 8.24 Nevada

- 8.25 New Mexico

- 8.26 North Carolina

- 8.27 North Dakota

- 8.28 Ohio

- 8.29 Oklahoma

- 8.30 Oregon

- 8.31 Pennsylvania

- 8.32 South Carolina

- 8.33 South Dakota

- 8.34 Tennessee

- 8.35 Texas

- 8.36 Utah

- 8.37 Virginia

- 8.38 Washington

- 8.39 West Virginia

- 8.40 Wisconsin

- 8.41 Wyoming

Chapter 9 Company Profiles

- 9.1 American Landmaster

- 9.2 Artic Cat

- 9.3 BMS Motorsports

- 9.4 BRP

- 9.5 CFMOTO

- 9.6 DRR

- 9.7 Hisun

- 9.8 Honda

- 9.9 INTIMIDATOR

- 9.10 Kawasaki

- 9.11 KYMCO

- 9.12 Polaris

- 9.13 Suzuki

- 9.14 Taiga

- 9.15 Tracker

- 9.16 Vanderhall

- 9.17 Volcon

- 9.18 Yamaha