PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666668

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666668

Manual Lifting Light Tower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

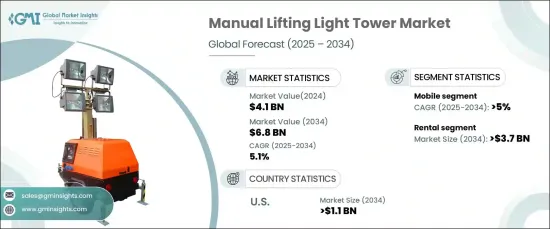

The Global Manual Lifting Light Tower Market was valued at USD 4.1 billion in 2024 and is expected to witness a CAGR of 5.1% from 2025 to 2034. The industry is expanding as construction, mining, and emergency response operations demand portable, cost-effective lighting solutions.

These towers provide simplicity and easy deployment in remote locations. Infrastructure development drives market growth, as evidenced by the U.S. Department of Transportation's allocation of USD 185 billion for infrastructure projects in 2023. The need for temporary lighting in disaster relief operations and outdoor events further propels market demand. LED lighting integration, improved durability, and enhanced fuel efficiency increase the adoption of manual lifting light towers globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $6.8 Billion |

| CAGR | 5.1% |

The rental segment is expected to surpass USD 3.7 billion by 2034, driven by increasing demand for flexible and cost-effective lighting solutions across various industries. Rental light towers are favored for short-term projects, such as construction, mining, and outdoor events, where temporary lighting is required without long-term investment. The rising number of infrastructure projects, particularly in emerging economies, fuels the demand for rental equipment. Additionally, the need for portable lighting in disaster relief and emergency response operations further contributes to market growth. The growing trend of equipment rental services, supported by lower maintenance costs and quick deployment, is another key factor driving the expansion of the rental market.

The mobile manual lifting light towers are expected to grow at a CAGR of over 5% through 2034. This growth is driven by the increasing demand for versatile and easily deployable lighting solutions in various industries, including construction, mining, and outdoor events. Mobile light towers offer enhanced flexibility, portability, and ease of transport, making them ideal for projects in remote or challenging environments. The rising trend of temporary lighting for emergency response, disaster relief, and large-scale outdoor events further fuels demand. Additionally, advancements in fuel efficiency, LED lighting technology, and durability contribute to the growing adoption of mobile manual lifting light towers.

The U.S. manual lifting light tower market is expected to surpass USD 1.1 billion by 2034, driven by increasing demand for portable and efficient lighting solutions across various sectors. Growing infrastructure development, construction, and outdoor events are key factors fueling this market expansion. Manual lifting light towers are favored for their affordability, ease of use, and quick deployment in areas with limited access to power. Additionally, the rising frequency of emergency response situations and natural disasters contributes to the growing demand for temporary lighting. Technological advancements in energy-efficient LED lighting, along with improvements in fuel efficiency and durability, further support the adoption of manual lifting light towers across the U.S. market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Channel, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Sales

- 5.3 Rental

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Stationary

- 6.3 Mobile

Chapter 7 Market Size and Forecast, By Lighting, 2021 – 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Metal halide

- 7.3 LED

- 7.4 Electric

- 7.5 Others

Chapter 8 Market Size and Forecast, By Power Source, 2021 – 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 Diesel

- 8.3 Solar

- 8.4 Direct

- 8.5 Others

Chapter 9 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & ‘000 Units)

- 9.1 Key trends

- 9.2 Construction

- 9.3 Infrastructure development

- 9.4 Oil & gas

- 9.5 Mining

- 9.6 Military & defense

- 9.7 Emergency & disaster relief

- 9.8 Others

Chapter 10 Market Size and Forecast, By Region, 2021 – 2034 (USD Million and ‘000 Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Qatar

- 10.5.4 South Africa

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

Chapter 11 Company Profiles

- 11.1 Allmand Bros

- 11.2 Aska Equipments

- 11.3 Atlas Copco

- 11.4 Caterpillar

- 11.5 Chicago Pneumatic

- 11.6 Colorado Standby

- 11.7 DMI

- 11.8 Doosan Portable Power

- 11.9 Generac Power Systems

- 11.10 HIMOINSA

- 11.11 Inmesol gensets

- 11.12 J C Bamford Excavators

- 11.13 LARSON Electronics

- 11.14 Light Boy

- 11.15 LTA Projects

- 11.16 Multiquip

- 11.17 Olikara Lighting Towers

- 11.18 Progress Solar Solutions

- 11.19 The Will Burt Company

- 11.20 Trime

- 11.21 United Rentals

- 11.22 Wacker Neuson

- 11.23 Youngman Richardson