PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666645

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666645

Electric Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

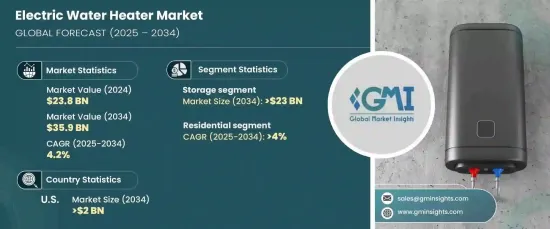

The Global Electric Water Heater Market was valued at USD 23.8 billion in 2024 and is expected to grow at 4.2% CAGR from 2025 to 2034. Electric water heaters use electrical energy to heat water for a variety of domestic and commercial purposes, such as bathing, cleaning, and cooking. These devices typically use electrical resistance elements to directly heat water, making them a common choice for modern households and businesses.

Several factors are driving the growth of the electric water heater market. Competitive pricing, along with a wide range of capacity options, is appealing to consumers. Additionally, as more individuals and businesses shift toward energy-efficient systems, the demand for electric water heaters is increasing. The growing trend to electrify heating systems and the integration of renewable energy sources into residential and commercial infrastructure is also boosting the adoption of electric water heaters. Furthermore, stricter energy efficiency regulations and incentives for upgrading from traditional, less efficient water heaters are reshaping the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.8 Billion |

| Forecast Value | $35.9 Billion |

| CAGR | 4.2% |

Government policies focused on reducing carbon emissions, along with increased investments in infrastructure development, are further promoting the use of electric water heaters. The demand for high-capacity water heaters is on the rise due to the ongoing renovation and modernization of older buildings. Manufacturers are also responding to the market by offering customized solutions for various commercial and industrial applications, which is enhancing business growth.

The market is divided into two main product types: instant and storage water heaters. The storage water heater segment is expected to generate USD 23 billion by 2034. Smart features that improve energy efficiency and reduce utility costs are a significant driver for storage water heaters. The increasing number of multi-family and single-family homes, along with the growing demand for on-demand hot water in institutions like hotels, restaurants, and hospitals, is further fueling the demand for these units.

The electric water heater market is also segmented by application, with residential and commercial being the primary categories. The residential segment is forecasted to grow at a CAGR of 4% through 2034 as homeowners increasingly seek Energy Star-certified models to reduce energy bills. Additionally, the rise in smart water heater technologies, such as Wi-Fi connectivity and mobile app controls, is boosting product demand, allowing homeowners to manage their water heaters remotely.

U.S. electric water heater market is projected to reach USD 2 billion by 2034. The growing emphasis on energy efficiency, environmental sustainability, and technological advancements in water heaters are contributing to this growth. As stricter energy efficiency standards are enforced, more consumers are opting for advanced electric models, some of which integrate with renewable energy systems like solar panels, further reducing energy costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

- 4.4 Company market share

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Instant

- 5.3 Storage

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Below 30 liters

- 6.3 30 – 100 liters

- 6.4 100 – 250 liters

- 6.5 250 – 400 liters

- 6.6 >400 liters

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 College/University

- 7.3.2 Offices

- 7.3.3 Government/Building

- 7.3.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Austria

- 8.3.6 Spain

- 8.3.7 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 Oman

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Chile

- 8.6.4 Mexico

Chapter 9 Company Profiles

- 9.1 A. O. Smith

- 9.2 Ariston Holding N.V.

- 9.3 American Standard Water Heaters

- 9.4 Bosch Thermotechnology Corp.

- 9.5 Bradford White Corporation

- 9.6 FERROLI

- 9.7 GE Appliances

- 9.8 Groupe Atlantic

- 9.9 Haier

- 9.10 Havells India

- 9.11 Hubbell Heaters

- 9.12 LINUO RITTER INTERNATIONAL

- 9.13 Nihon Itomic Co., Ltd.

- 9.14 Noritz Corporation

- 9.15 Parker Boiler Company

- 9.16 Racold

- 9.17 Rheem Manufacturing Company

- 9.18 Rinnai Corporation

- 9.19 State Industries

- 9.20 STIEBEL ELTRON

- 9.21 Vaillant

- 9.22 Viessmann

- 9.23 Westinghouse Electric Corporation

- 9.24 Whirlpool Corporation

- 9.25 Watts

- 9.26 Zenith Water Heaters