PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666638

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666638

Very Low Sulphur Fuel Oil (VLSFO) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

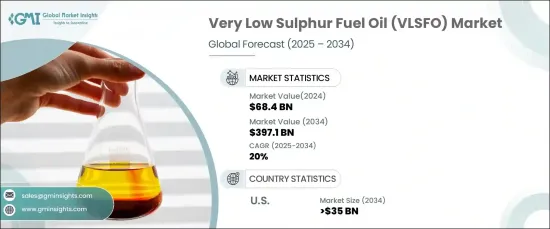

The Global Very Low Sulphur Fuel Oil Market, valued at USD 68.4 billion in 2024, is poised for significant expansion, with an expected CAGR of 20% from 2025 to 2034. This market surge is largely driven by the stringent sulphur emission regulations enforced by the International Maritime Organization (IMO) since 2020. These regulations require shipping companies worldwide to transition to VLSFO, a cleaner marine fuel alternative that complies with the new sulphur content standards. This shift is not only pushing the demand for low-sulphur fuels but also prompting refineries to enhance their production capabilities to meet these evolving standards, further fueling market growth.

Beyond regulatory drivers, the maritime sector is growing rapidly, with rising environmental awareness also contributing to the increased demand for VLSFO. Sustainable shipping practices are now more than ever a central focus, with the aim to reduce carbon emissions and protect marine ecosystems. The shift toward eco-friendly fuels aligns perfectly with these objectives. As more bunkering facilities become available and vessel traffic intensifies in key regions like Europe and Asia-Pacific, the VLSFO market is seeing widespread adoption across these regions. Companies are investing in innovative technologies to optimize operational efficiency while ensuring compliance with environmental regulations, thus ensuring continued market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $68.4 Billion |

| Forecast Value | $397.1 Billion |

| CAGR | 20% |

The trend toward retrofitting existing vessels with low-sulphur propulsion technologies is boosting the VLSFO demand even further. As seaborne passenger traffic continues to grow and regional ports develop, the market's trajectory remains positive. In addition, government investments in expanding naval fleets, particularly in the defense sector with military vessels such as aircraft carriers and submarines, will likely increase the demand for VLSFO in these segments as well.

In the U.S., the Very Low sulphur Fuel Oil (VLSFO) market is projected to reach USD 35 billion by 2034. The increasing demand for low-sulphur fuels is being driven by tighter sulphur emission regulations and the proximity of refineries that can meet the new standards. Additionally, local regulations are fostering the adoption of cleaner fuels, while the need to reduce pollution from seaborne activities is further pushing the demand for VLSFO. The growing focus on operational reliability, in line with the rising demand for vessels that offer luxury and dependability, continues to fuel the market's growth. With ongoing economic stability and a stronger focus on eco-friendly shipping, the U.S. VLSFO market is expected to continue flourishing in the coming decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 North America

- 5.2.1 U.S

- 5.2.2 Canada

- 5.3 Europe

- 5.3.1 Spain

- 5.3.2 Russia

- 5.3.3 UK

- 5.3.4 Italy

- 5.3.5 France

- 5.3.6 Germany

- 5.3.7 Belgium

- 5.3.8 Netherlands

- 5.4 Asia Pacific

- 5.4.1 China

- 5.4.2 Japan

- 5.4.3 South Korea

- 5.4.4 India

- 5.4.5 Australia

- 5.4.6 Singapore

- 5.5 Middle East & Africa

- 5.5.1 UAE

- 5.5.2 Saudi Arabia

- 5.5.3 Turkey

- 5.5.4 South Africa

- 5.6 Latin America

- 5.6.1 Brazil

- 5.6.2 Mexico

- 5.6.3 Argentina

Chapter 6 Company Profiles

- 6.1 BP

- 6.2 Chevron

- 6.3 Exxon Mobil

- 6.4 Hindustan Petroleum

- 6.5 Indian Oil

- 6.6 Marathon Petroleum

- 6.7 Mediterranean Fuels

- 6.8 Phillips 66

- 6.9 Rosneft

- 6.10 Saudi Aramco

- 6.11 Shell

- 6.12 Sinopec

- 6.13 TotalEnergies

- 6.14 Viva Energy

- 6.15 Vitol