PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913320

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913320

Unmanned Traffic Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

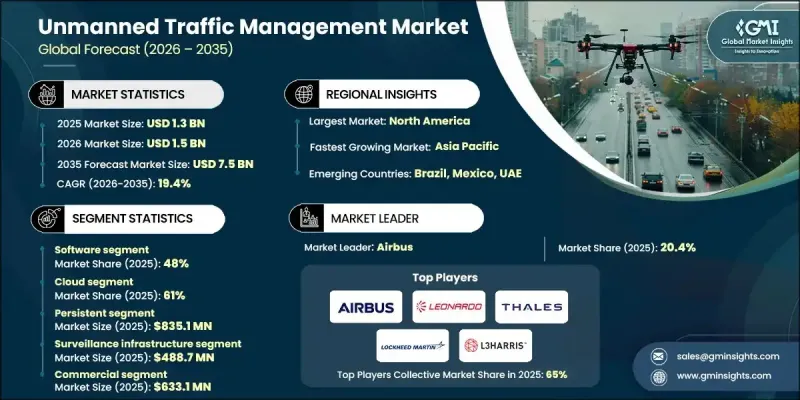

The Global Unmanned Traffic Management Market was valued at USD 1.3 billion in 2025 and is estimated to grow at a CAGR of 19.4% to reach USD 7.5 billion by 2035.

Market growth is fueled by a rapid increase in commercial and governmental drone operations, heightened demand for safe low-altitude airspace management, and evolving regulatory frameworks governing drone traffic. As organizations and authorities focus on integrating unmanned aerial vehicles (UAVs) into shared airspace safely, advanced UTM solutions are becoming essential to enable timely, secure, and traceable drone operations. The market's expansion is also supported by rising investments in technology that enhance drone monitoring, flight planning, and operational efficiency. Stakeholders across industries are prioritizing end-to-end, data-driven systems that provide real-time situational awareness, reduce airspace conflicts, and support scalable, long-term air traffic management strategies. These developments position UTM solutions as critical enablers of safe and efficient UAV operations worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.3 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 19.4% |

Technological innovations, including AI- and ML-driven flight path optimization, IoT-enabled real-time tracking, GPS and ADS-B monitoring, cloud-based UTM platforms, and automated drone coordination systems, are transforming traditional airspace management. These tools provide full visibility and control over UAV operations, from mission planning and real-time monitoring to conflict detection and regulatory compliance. The market continues to evolve as integrated digital platforms, automation, and analytics improve efficiency, reduce risks, and enhance operational safety.

The software segment held 48% share and is projected to grow at a CAGR of 20.1% through 2035. Software dominates due to its pivotal role in real-time drone tracking, airspace monitoring, flight path optimization, and comprehensive traffic management. Cloud-based UTM platforms, AI-powered analytics, IoT monitoring, and mobile-enabled applications help operators, regulators, and commercial users coordinate UAV operations efficiently, maintain airspace safety, and optimize performance.

The cloud segment accounted for 61% share in 2025 and is expected to grow at a CAGR of 18.8% through 2035. Cloud solutions dominate because of their scalability, real-time data access, and lower deployment costs. They enable operators and regulators to monitor drone traffic, optimize flight paths, detect potential conflicts, and manage airspace across multiple regions. Their flexibility and integration capabilities make cloud platforms ideal for large-scale UAV operations.

U.S. Unmanned Traffic Management Market held 78% share, generating USD 367.1 million in 2025. North America leads the global market due to its mature drone ecosystem, advanced airspace infrastructure, and early adoption of digital air traffic management technologies. The region benefits from widespread deployment of cloud-based platforms, AI-powered analytics, IoT-enabled tracking, and real-time monitoring.

Key players in the Global Unmanned Traffic Management Market include Leonardo, L3Harris, Lockheed Martin, Airbus, Altitude Angel, PrecisionHawk, Frequentis, Thales, and Unifly. Companies in the Global Unmanned Traffic Management Market are strengthening their presence by investing heavily in software and cloud-based solutions that enhance real-time airspace monitoring and automated conflict resolution. They are forming strategic partnerships with drone operators, regulators, and technology providers to create integrated platforms for end-to-end UAV management. Continuous R&D in AI, machine learning, and IoT-enabled systems is helping firms improve flight path optimization, situational awareness, and predictive analytics. Several companies are also expanding globally to serve high-growth regions, enhancing scalability, regulatory compliance, and customer engagement. Focusing on flexible, interoperable, and data-driven solutions enables firms to build long-term competitive advantages and capture larger market share.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Type

- 2.2.4 Deployment Model

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid Growth of Commercial Drone Operations

- 3.2.1.2 Regulatory Mandates & Safety Requirements

- 3.2.1.3 Technological Advancements

- 3.2.1.4 Urban Air Mobility & BVLOS Expansion

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fragmented Global Regulations

- 3.2.2.2 High Initial Costs

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with Smart Cities & IoT Networks

- 3.2.3.2 Expansion into Emerging Markets

- 3.2.3.3 Government and Defense UAV Adoption

- 3.2.3.4 Advanced Analytics and AI-Driven Optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. FAA Remote ID Rules

- 3.4.1.2 U.S. National Airspace System (NAS) Guidelines

- 3.4.2 Europe

- 3.4.2.1 Germany BMVI & DFS Regulations

- 3.4.2.2 France DGAC & ANAF Guidelines

- 3.4.2.3 United Kingdom CAA & UAS Regulations

- 3.4.2.4 Italy ENAC Guidelines

- 3.4.3 Asia Pacific

- 3.4.3.1 China CAAC & UAS Regulations

- 3.4.3.2 Japan JCAB Drone Guidelines

- 3.4.3.3 South Korea MOLIT & Drone Regulations

- 3.4.3.4 India DGCA Drone Rules & UIN System

- 3.4.4 Latin America

- 3.4.4.1 Brazil ANAC & DECEA Guidelines

- 3.4.4.2 Mexico DGAC UAV Regulations

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE GCAA Drone Regulations

- 3.4.5.2 Saudi Arabia GACA Drone Guidelines

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

- 3.13 UTM system architecture & airspace models

- 3.13.1 Centralized vs federated UTM architectures

- 3.13.2 Tactical vs strategic deconfliction

- 3.13.3 Integration with manned ATM systems

- 3.14 Interoperability & standards framework

- 3.15 UTM business & monetization models

- 3.16 Stakeholder ecosystem & governance model

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Hardware

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Type, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Persistent

- 6.3 Non-persistent

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 On premises

- 7.3 Cloud

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 Surveillance infrastructure

- 8.3 Communication infrastructure

- 8.4 Navigation infrastructure

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035 ($ Bn)

- 9.1 Key trends

- 9.2 Commercial

- 9.3 Government

- 9.4 Private

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 Airbus

- 11.1.2 Altitude Angel

- 11.1.3 Frequentis

- 11.1.4 Honeywell International

- 11.1.5. L3 Harris

- 11.1.6 Leonardo

- 11.1.7 Lockheed Martin

- 11.1.8 PrecisionHawk

- 11.1.9 Thales

- 11.1.10 Unifly

- 11.2 Regional Player

- 11.2.1 AirMap

- 11.2.2 Airspace Link

- 11.2.3 ANRA Technologies

- 11.2.4 Dedrone

- 11.2.5 DroneDeploy

- 11.2.6 Flytrex

- 11.2.7 Kittyhawk

- 11.2.8 SkyGrid

- 11.2.9 Terra Drone

- 11.2.10 uAvionix

- 11.3 Emerging Players

- 11.3.1 Airborne Robotics

- 11.3.2 Drone Harmony

- 11.3.3 Simulyze

- 11.3.4 UAV Navigation

Volocopter UT