PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833638

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833638

Sleep Apnea Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

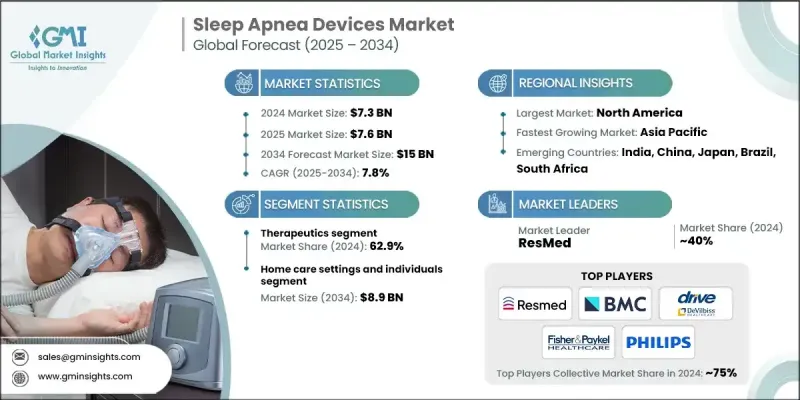

The Global Sleep Apnea Devices Market was valued at USD 7.3 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 15 billion by 2034.

This growth is being driven by the rising number of sleep apnea cases worldwide, increased awareness around sleep disorders, and growing demand for advanced, portable treatment solutions. Sleep apnea devices are used both for diagnosing and managing sleep-disordered breathing, helping to keep the airway open and monitor patients' sleep health effectively. With more individuals recognizing symptoms such as persistent snoring, fatigue during the day, and difficulty focusing, medical consultations and sleep disorder diagnoses are becoming more common. Innovations in sleep testing methods, including lab-based polysomnography and home testing kits, are further contributing to this surge in diagnosis rates. As more patients are formally diagnosed, demand for devices like CPAP, BiPAP, and other sleep apnea treatment technologies continues to rise. These devices are instrumental in reducing the health risks of untreated sleep apnea, offering improved patient care and boosting overall quality of life.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $15 Billion |

| CAGR | 7.8% |

In 2024, the diagnostics segment held a 37.1% share. This growth stems from heightened attention to early sleep disorder detection and greater access to compact and AI-powered diagnostic tools. As these technologies become more sophisticated and affordable, screening for sleep apnea is becoming quicker and more convenient for both patients and providers. The evolution of home-based testing and real-time data analysis continues to enhance diagnostic capabilities and market expansion.

The home care settings and individuals segment held a share of 56.9% in 2024 and is expected to generate USD 8.9 billion by 2034, fueled by the rising demand for cost-effective, long-term treatment solutions outside of clinical settings. Managing sleep apnea at home helps cut down on frequent clinic visits and hospitalization expenses. Expanded insurance coverage for home-based care and the availability of budget-friendly treatment options are helping make home sleep therapy more accessible to a wide population base, encouraging more people to manage their condition independently and affordably.

North America Sleep Apnea Devices Market held a 37.6% share in 2024, supported by robust healthcare infrastructure, a well-established reimbursement ecosystem, and high public awareness around sleep-related health issues. The region continues to see strong early adoption of both therapeutic and diagnostic sleep apnea technologies. Integration of remote monitoring platforms and connected health solutions is further advancing patient care in the region. Major industry players such as Drive DeVilbiss, BMC, ResMed, Teleflex, Fisher & Paykel, and Philips have cemented their position in North America by offering comprehensive portfolios that include CPAP, BiPAP, and remote sleep testing solutions.

Key companies active in the Global Sleep Apnea Devices Market Include Cadwell, DynaFlex, Asahi KASEI, Glidewell, Apnea Sciences, SomnoMed, NIHON KOHDEN, Natus, WEINMANN, and others. To strengthen their position in the global sleep apnea devices market, companies are deploying several core strategies. These include consistent investment in research and development to enhance device accuracy, portability, and patient comfort. Firms are introducing connected technologies that support real-time data monitoring and telehealth compatibility. In addition, partnerships with sleep clinics, home care providers, and insurance networks are helping expand distribution. Marketing initiatives focus on increasing public awareness and encouraging early diagnosis. Moreover, companies are entering new markets through regulatory approvals and building scalable production to meet rising global demand, particularly in home care settings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of sleep apnea and related comorbidities

- 3.2.1.2 Growing demand for portable, high-performance sleep apnea solutions

- 3.2.1.3 Surging awareness of sleep apnea and sleep disorders

- 3.2.1.4 Rising aging population amplifying demand

- 3.2.1.5 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of adherence to sleep apnea treatment

- 3.2.2.2 Product recalls and safety concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 AI and digital health integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Reimbursement scenario

- 3.8 Evolving role of sleep apnea implants within sleep apnea treatment devices

- 3.9 Pipeline analysis

- 3.10 Investment landscape

- 3.11 Start-up scenario

- 3.12 Pricing analysis, 2024

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia Pacific

- 4.3.4 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Therapeutics

- 5.2.1 Airway clearance systems

- 5.2.2 Positive airway pressure (PAP) devices

- 5.2.2.1 Continuous positive airway pressure (CPAP) devices

- 5.2.2.2 Bilevel positive airway pressure (BiPAP) devices

- 5.2.2.3 Automatic positive airway pressure (APAP) devices

- 5.2.3 Adaptive servo-ventilation (ASV) devices

- 5.2.4 Oral appliances

- 5.2.4.1 Mandibular advancement devices

- 5.2.4.2 Tongue-retaining devices

- 5.2.4.3 Rapid maxillary expansion

- 5.2.4.4 Mouth guards

- 5.2.5 Other therapeutics

- 5.3 Diagnostics

- 5.3.1 Polysomnography (PSG) device

- 5.3.1.1 Ambulatory PSG devices

- 5.3.1.2 Clinical PSG devices

- 5.3.2 Actigraphy systems

- 5.3.3 Pulse oximeters

- 5.3.4 Home sleep testing (HST) devices

- 5.3.4.1 Type 2

- 5.3.4.2 Type 3

- 5.3.4.3 Type 4

- 5.3.5 Respiratory polygraph

- 5.3.1 Polysomnography (PSG) device

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Home care settings and individuals

- 6.3 Sleep laboratories and hospitals

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Asahi KASEI

- 8.2 BMC

- 8.3 Cadwell

- 8.4 Drive DeVilbiss

- 8.5 FISHER & PAYKEL

- 8.6 natus

- 8.7 NIHON KOHDEN

- 8.8 Philips

- 8.9 ResMed

- 8.10 Teleflex

- 8.11 WEINMANN

- 8.12 Glidewell

- 8.13 DynaFlex

- 8.14 SomnoMed

- 8.15 Apnea Sciences