PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913304

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913304

Automotive Operating System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

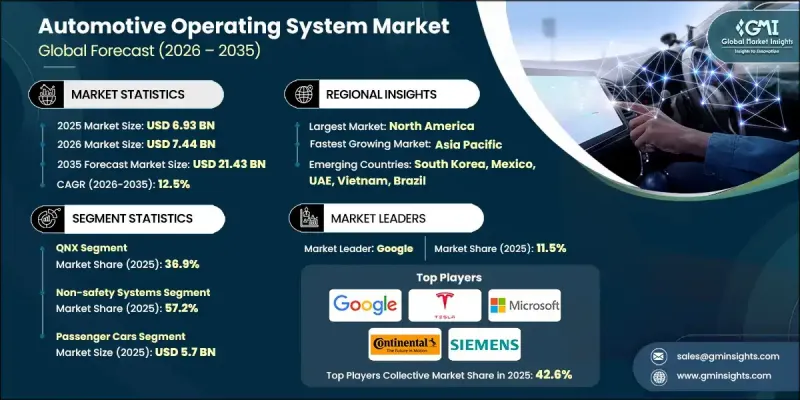

The Global Automotive Operating System Market was valued at USD 6.93 billion in 2025 and is estimated to grow at a CAGR of 12.5% to reach USD 21.43 billion by 2035.

Market expansion reflects the rapid shift of vehicles toward software-defined architectures and the increasing role of digital platforms in vehicle functionality. Governments across multiple regions are accelerating regulatory frameworks that encourage the integration of advanced driver assistance technologies, which directly elevates demand for robust automotive operating systems. At the same time, rising vehicle sales combined with growing adoption of digital displays are strengthening system-level software requirements. Modern vehicles increasingly rely on integrated operating systems to support connectivity, automation, user interfaces, and real-time processing. Automotive manufacturers are prioritizing secure, scalable, and efficient software environments to manage growing system complexity. Wireless update capabilities are now a baseline expectation, enabling seamless delivery of both software and firmware updates while enhancing cybersecurity and performance optimization. This transformation allows manufacturers to resolve issues remotely, deploy enhancements faster, and introduce new revenue models without physical servicing. As vehicles evolve into connected digital platforms, operating systems have become a central pillar supporting innovation, compliance, and long-term competitiveness across the global automotive ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.93 Billion |

| Forecast Value | $21.43 Billion |

| CAGR | 12.5% |

The QNX segment accounted for 36.9% share in 2025 and maintained a leading position due to its strong penetration across global vehicle platforms. Competing platforms are gaining momentum as innovation accelerates, contributing positively to overall market expansion.

The non-safety systems segment held 57.2% share in 2025 and is expected to grow at a CAGR of 11.9% between 2026 and 2035. Fewer regulatory constraints and faster development cycles are enabling rapid adoption across this segment.

U.S. Automotive Operating System Market reached USD 1.86 billion in 2025. Automakers in the country are rapidly transitioning toward centralized software architectures that support over-the-air updates and cross-domain integration, driving demand for flexible and scalable operating systems.

Key companies active in the Global Automotive Operating System Market include BlackBerry, NVIDIA, Google, Apple, Microsoft, BMW, Mercedes-Benz, Siemens, Continental, and Tesla. Companies operating in the Automotive Operating System Market are strengthening their competitive position through platform innovation, ecosystem partnerships, and long-term collaborations with vehicle manufacturers. Investment in cybersecurity, real-time processing, and scalable architectures is helping vendors address increasing software complexity. Many players are focusing on modular system designs that enable faster deployment across vehicle models. Strategic alliances with semiconductor firms and cloud providers are improving system performance and integration capabilities. Continuous enhancement of update management, lifecycle support, and developer tools is expanding adoption.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Operating System

- 2.2.3 Auto system

- 2.2.4 Vehicle

- 2.2.5 Propulsion

- 2.2.6 Application

- 2.2.7 Sales Channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid electrification of vehicles

- 3.2.1.2 Growing adoption of software-defined vehicles (SDVs)

- 3.2.1.3 Rising integration of Advanced Driver Assistance Systems (ADAS)

- 3.2.1.4 Increasing demand for in-vehicle infotainment and connectivity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High complexity of software integration and validation

- 3.2.2.2 Concerns related to vehicle cybersecurity and data privacy

- 3.2.3 Market opportunities

- 3.2.3.1 Monetization of software features through subscription models

- 3.2.3.2 Increasing adoption of Vehicle-to-Everything (V2X) communication

- 3.2.3.3 Expansion of automotive OS use in commercial and fleet vehicles

- 3.2.3.4 Growth of smart mobility and shared transportation platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 ISO 26262 (ASIL D)

- 3.4.1.2 NHTSA Cybersecurity Best Practices

- 3.4.1.3 SAE J3061

- 3.4.1.4 FMVSS (Federal Motor Vehicle Safety Standards)

- 3.4.2 Europe

- 3.4.2.1 UN Regulation No. 155 (R155)

- 3.4.2.2 Automotive SPICE (ASPICE)

- 3.4.2.3 EU General Safety Regulation (GSR)

- 3.4.3 Asia Pacific

- 3.4.3.1 JASO (Japan Automotive Standards Organization)

- 3.4.3.2 MLIT Regulations (Japan)

- 3.4.3.3 AIS-189/AIS-190 (India)

- 3.4.4 Latin America

- 3.4.4.1 CONTRAN Resolutions

- 3.4.4.2 NOM-194-SE-2021

- 3.4.4.3 UNECE WP.29 Alignment

- 3.4.5 Middle East & Africa

- 3.4.5.1 GSO (Gulf Standardization Organization) Standards

- 3.4.5.2 UAE National EV Policy

- 3.4.5.3 Saudi SASO Regulations

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Sustainability and environmental impact

- 3.9.1 Environmental impact assessment

- 3.9.2 Social impact & community benefits

- 3.9.3 Governance & corporate responsibility

- 3.9.4 Sustainable finance & investment trends

- 3.10 Cost breakdown analysis

- 3.10.1 Hardware platform and compute cost for OS

- 3.10.2 OS development and integration cost

- 3.10.3 Cybersecurity and functional safety compliance cost

- 3.10.4 Over-the-air update infrastructure and cloud service cost

- 3.10.5 Licensing, subscription, and third-party software ecosystem cost

- 3.10.6 Maintenance, bug-fixing, and feature update lifecycle cost

- 3.11 Case studies

- 3.12 Future outlook & opportunities

- 3.13 Execution gaps in SDV delivery

- 3.13.1 Mismatches in software customization and plug-and-play capabilities

- 3.13.2 Company strategies for bridging the gaps

- 3.13.3 Use cases

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Operating System, 2022 - 2035 ($Mn)

- 5.1 Key trends

- 5.2 Android

- 5.3 Linux

- 5.4 QNX

- 5.5 Windows

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Auto System, 2022 - 2035 ($Mn)

- 6.1 Key trends

- 6.2 Non-safety system

- 6.3 Safety-critical System

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchbacks

- 7.2.2 Sedans

- 7.2.3 SUVs

- 7.3 Commercial vehicles

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Mn)

- 8.1 Key trends

- 8.2 ICE

- 8.3 EV

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Mn)

- 9.1 Key trends

- 9.2 Infotainment system

- 9.3 ADAS & safety system

- 9.4 Autonomous driving

- 9.5 Communication system

- 9.6 Connected services

- 9.7 Telematics

- 9.8 Powertrain control

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Mn)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Singapore

- 11.4.7 Malaysia

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.4.10 Thailand

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global companies

- 12.1.1 Google

- 12.1.2 Microsoft

- 12.1.3 Tesla

- 12.1.4 NVIDIA

- 12.1.5 Hyundai

- 12.1.6 Mercedes-Benz

- 12.1.7 BlackBerry

- 12.1.8 Wind River

- 12.1.9 Green Hills Software

- 12.1.10 Apple

- 12.1.11 Huawei

- 12.1.12 Baidu

- 12.1.13 Alibaba

- 12.1.14 Red Hat

- 12.1.15 Volkswagen

- 12.2 Regional companies

- 12.2.1 Elektrobit

- 12.2.2 Continental

- 12.2.3 Robert Bosch

- 12.2.4 Siemens

- 12.2.5 Vector Informatik

- 12.2.6 ETAS

- 12.2.7 Panasonic Automotive

- 12.2.8 Denso

- 12.2.9 Toyota Motor

- 12.2.10 Aptiv

- 12.3 Emerging companies

- 12.3.1 Xpeng Motors

- 12.3.2 NIO

- 12.3.3 BYD

- 12.3.4 Geely Automobile

- 12.3.5 SAIC Motor