PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666570

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666570

Automotive Human Machine Interface (HMI) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

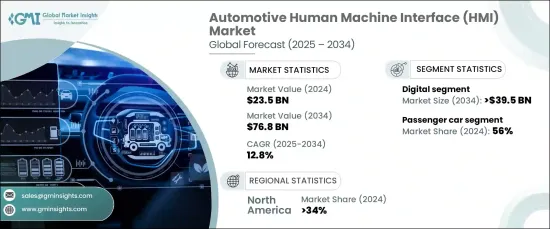

The Global Automotive Human Machine Interface Market was valued at USD 23.5 billion in 2024 and is anticipated to experience a robust CAGR of 12.8% between 2025 and 2034. The rapid adoption of electric and autonomous vehicles is a primary driver of this market's expansion. Electric vehicles increasingly depend on sophisticated HMI systems for functions such as energy management, navigation to charging stations, and efficient battery monitoring. Similarly, the rising prevalence of autonomous vehicles amplifies the need for advanced interfaces that enhance driver-vehicle communication. These interfaces are essential for managing features like adaptive cruise control, lane-keeping assistance, and automated navigation, ensuring drivers remain informed and engaged, even in semi-autonomous modes where human input might be necessary.

Consumers now prioritize comfort, convenience, and personalization in their vehicles, which is fueling the demand for innovative HMI technologies. With growing expectations for seamless and intuitive technology, automakers are moving beyond traditional buttons and knobs. Instead, they are focusing on solutions like voice recognition, touchscreens, gesture control, and augmented reality displays. These advancements enable a more interactive and user-friendly experience, aligning with modern lifestyles and preferences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.5 Billion |

| Forecast Value | $76.8 Billion |

| CAGR | 12.8% |

The market categorizes interfaces into physical, digital, and multimodal options. Digital interfaces accounted for more than 48% of the market share in 2024 and are projected to exceed USD 39.5 billion by 2034. Their popularity stems from their ability to deliver a highly customizable and intuitive user experience. Digital displays incorporate features like multifunctional dashboards and touchscreens, providing automakers with flexible options to integrate advanced functionalities. These systems simplify access to vehicle operations such as climate control, navigation, infotainment, and driver assistance, enhancing convenience and efficiency.

Based on vehicle type, the market is segmented into passenger cars, commercial vehicles, and off-highway vehicles. Passenger cars represented around 56% of the total market share in 2024, largely driven by increasing consumer demand for improved comfort, safety, and usability in everyday driving. The widespread presence of passenger vehicles globally significantly boosts the adoption of HMI technologies. Automakers are incorporating intuitive interfaces like voice recognition, touchscreens, and advanced driver assistance systems to cater to evolving consumer expectations and elevate the driving experience.

Regionally, North America held 34% of the global revenue share in 2024, driven by its leadership in automotive innovation and rising adoption of electric and autonomous vehicles. Similarly, Europe's thriving automotive industry and strong focus on connectivity and sustainability are accelerating the demand for cutting-edge HMI technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component manufacturer

- 3.2.2 Technology providers

- 3.2.3 Software developers

- 3.2.4 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growth of electric and autonomous vehicles

- 3.7.1.2 Consumer demand for enhanced user experience

- 3.7.1.3 Advancements in automotive technology

- 3.7.1.4 Increasing focus on driver and passenger safety

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High implementation costs

- 3.7.2.2 Complexity in integration

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Touch-based interfaces

- 5.3 Voice control systems

- 5.4 Gesture recognition

- 5.5 Augmented reality displays

- 5.6 Haptic feedback systems

Chapter 6 Market Estimates & Forecast, By Interface, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Physical

- 6.3 Digital

- 6.4 Multimodal

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Infotainment

- 7.3 Navigation

- 7.4 Driver assistance

- 7.5 Climate control

- 7.6 Vehicle diagnostics

- 7.7 Connectivity services

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Passenger car

- 8.2.1 Hatchback

- 8.2.2 SUV

- 8.2.3 Sedan

- 8.3 Commercial vehicle

- 8.3.1 LCV

- 8.3.2 HCV

- 8.4 Off-highway vehicle

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alpine Electronics

- 10.2 Bosch

- 10.3 Cerence

- 10.4 Clarion

- 10.5 Continental

- 10.6 Denso

- 10.7 Faurecia

- 10.8 Garmin

- 10.9 Harman

- 10.10 LG Electronics

- 10.11 LUXOFT

- 10.12 Marelli Holdings

- 10.13 Mitsubishi

- 10.14 Panasonic

- 10.15 Socionext

- 10.16 Synaptics

- 10.17 TATA ELXSI

- 10.18 Valeo

- 10.19 Visteon

- 10.20 Yazaki