PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666561

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666561

Calcium Aluminate Cement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

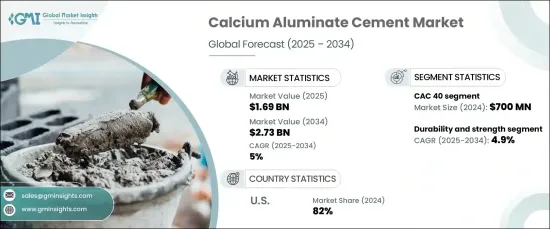

The Global Calcium Aluminate Cement Market was valued at USD 1.69 billion in 2024 and is projected to expand at a CAGR of 5% between 2025 and 2034. This robust growth stems from the unique properties of CAC, which make it indispensable in specialized construction applications. Known for its superior chemical resistance, high-heat endurance, and exceptional mechanical strength, CAC continues to gain traction across multiple industries, from wastewater management to high-performance infrastructure projects.

Calcium aluminate cement's remarkable resistance to chemical corrosion has positioned it as an essential material for environments prone to acidic or chemically aggressive conditions. Industries such as wastewater treatment, industrial flooring, sewage systems, and infrastructure projects in harsh environments rely heavily on CAC for its long-term durability and performance. The ongoing wave of industrialization and urbanization across the globe has further accelerated the adoption of CAC, with governments and private entities seeking durable materials that can withstand demanding conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.69 Billion |

| Forecast Value | $2.73 Billion |

| CAGR | 5% |

Another factor driving the market's expansion is the material's ability to perform under extreme conditions. Its high heat resistance and capacity to bear heavy loads and abrasion make it ideal for use in applications such as refractory linings, road repairs, and high-strength concrete production. As the demand for resilient and efficient construction materials continues to grow, CAC's versatility and reliability solidify its position in the global market.

The market is segmented by product type, with CAC 40, CAC 50, CAC 60, and CAC 70 being the primary categories. In 2024, the CAC 40 segment dominated the market, generating USD 700 million in revenue. It is anticipated to sustain a growth rate of 5% through 2034. CAC 40 is favored for its excellent balance of cost-effectiveness and durability, making it the preferred choice for applications such as road repairs, industrial flooring, and high-strength concrete production.

Functionality-wise, the market is divided into categories such as durability and strength, high-heat resistance, chemical resistance, and others. The durability and strength segment accounted for 50% of the market share in 2024 and is projected to grow at a CAGR of 4.9% over the next decade. With the increasing demand for materials capable of withstanding heavy wear and tear, CAC's unparalleled durability remains a critical driver of its adoption.

The United States dominated the North American calcium aluminate cement market in 2024, contributing 82% of the region's revenue. This demand is fueled by significant investments in infrastructure modernization, including the refurbishment of aging bridges, highways, and wastewater systems. Initiatives like the U.S. Infrastructure Investment and Jobs Act are expected to bolster CAC's growth further as government funding continues to prioritize infrastructure renewal. The need for long-lasting and high-performance materials ensures that CAC remains a cornerstone of construction and industrial applications in North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing construction activities

- 3.6.1.2 Growing product innovation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 CAC 40

- 5.3 CAC 50

- 5.4 CAC 60

- 5.5 CAC 70

- 5.6 Others (CAC 80, etc.)

Chapter 6 Market Estimates & Forecast, By Function, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Durability and strength

- 6.3 High-heat resistance

- 6.4 Chemical resistance

- 6.5 Others (corrosion resistance, etc.)

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Oil and gas

- 7.4 Refractory

- 7.5 Water and wastewater treatment

- 7.6 Others (mining, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Almatis

- 10.2 Buzzi Unicem

- 10.3 Calucem

- 10.4 Cementos Molins

- 10.5 Cementos Portland Valderrivas

- 10.6 Holcim Group

- 10.7 Imerys Aluminates

- 10.8 JK Cement

- 10.9 Kerneos

- 10.10 Rheinfelden Distler

- 10.11 Shree Cement

- 10.12 Siam Cement Group

- 10.13 Sinai Cement

- 10.14 Taiwan Cement Corporation

- 10.15 Union Cement Company