PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666545

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666545

Ultra-Thin Glass Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

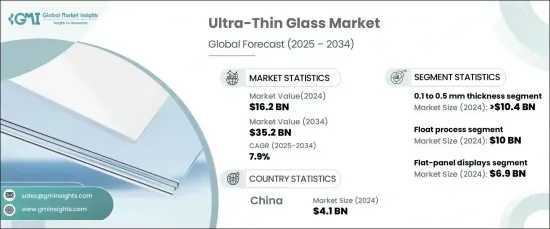

The Global Ultra-Thin Glass Market reached USD 16.2 billion in 2024 and is projected to grow at a robust CAGR of 7.9% during 2025-2034. This growth is driven by rising demand across consumer electronics, automotive, and energy sectors, where lightweight, flexible, and durable materials are essential.

The 0.1 to 0.5 mm thickness segment dominated the market, accounting for USD 10.4 billion in 2024, and is expected to maintain steady growth at a 7.7% CAGR during 2025-2034. Ultra-thin glass in this thickness range is witnessing high adoption due to its unique combination of strength, flexibility, and transparency. These properties make it highly suitable for applications requiring precision, such as flexible displays, wearable devices, and lightweight panels. In the automotive and energy sectors, ultra-thin glass is increasingly used to reduce weight, improve fuel efficiency, and enhance energy solutions, such as solar panels. Additionally, the growing demand for sustainable and high-performance materials is boosting its adoption, while advancements in eco-friendly production methods are creating new opportunities in the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.2 Billion |

| Forecast Value | $35.2 Billion |

| CAGR | 7.9% |

The float process, a key production method for ultra-thin glass, was valued at USD 10 billion in 2024 and is anticipated to grow at a CAGR of 7.8% throughout 2025- 2034. This process ensures the production of high-quality, uniform glass sheets with precise thickness, making it ideal for applications where consistency and performance are critical. The float process supports the development of thin, lightweight glass, which is increasingly used in industries requiring advanced materials, such as consumer electronics, automotive, and renewable energy. The process's ability to meet the demand for durable, high-clarity glass drives its continued significance in the market.

China leads the global ultra-thin glass market, contributing USD 4.1 billion in 2024, with a projected CAGR of 8.8% from 2025 to 2034. The country's market dominance is fueled by its strong consumer electronics sector, growing automotive industry, and increasing investment in renewable energy solutions. China's advancements in production technologies and focus on sustainability are further accelerating the market growth. As a global manufacturing hub, China is well-positioned to meet the rising demand for ultra-thin glass in flexible displays, lightweight components, and energy-efficient applications.

Overall, the ultra-thin glass market is set for significant expansion, driven by technological advancements, increasing demand for lightweight materials, and a strong push for energy-efficient and sustainable solutions across industries worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for consumer electronics

- 3.6.1.2 Growing penetration in solar panels

- 3.6.1.3 Rising use in medical devices and sensors due to its flexibility and strength

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Complex manufacturing process and fluctuating raw material prices

- 3.6.2.2 Competition from alternative materials such as plastics and ceramics

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Thickness, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Less than 0.1 mm

- 5.3 0.1 to 0.5 mm

- 5.4 0.5 to 1.2 mm

Chapter 6 Market Estimates & Forecast, By Production Process, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Downdraw process

- 6.3 Overflow- fusion process

- 6.4 Float process

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Semiconductors substrate

- 7.3 Flat-panel displays

- 7.4 Touch-control devices

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AGC Inc.

- 9.2 Central Glass Co. Ltd.

- 9.3 Changzhou Almaden Co. Ltd.

- 9.4 Corning Inc.

- 9.5 CSG Holdings Co. Ltd.

- 9.6 Emerge Glass

- 9.7 Luoyang Glass Co. Ltd.

- 9.8 Nippon Sheet Glass Co., Ltd.

- 9.9 Noval Glass Co. Ltd.

- 9.10 Schott AG

- 9.11 Taiwan Glass Ind

- 9.12 Xinyi Glass Holdings Ltd.