PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665427

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665427

Watering Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

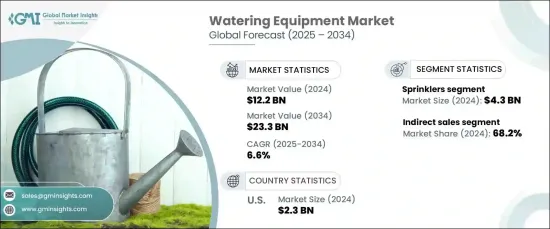

The Global Watering Equipment Market was valued at USD 12.2 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2034. The rising emphasis on water conservation and sustainability has significantly influenced the adoption of efficient watering solutions. As water scarcity concerns continue to escalate, there is growing demand for tools designed to optimize water usage while maintaining plant health. Advanced irrigation systems, including automated devices and moisture-sensitive technologies, have gained popularity due to their ability to minimize water waste. Increased awareness of environmental issues has encouraged consumers and organizations to seek eco-friendly watering methods, further driving market expansion.

Government initiatives and policies aimed at promoting water conservation have also played a pivotal role in this growth. Regulatory measures targeting water usage in farming, gardening, and landscaping are reshaping industry practices. Additionally, financial incentives such as subsidies and tax benefits are encouraging investment in advanced irrigation equipment across residential, commercial, and agricultural sectors. The combination of stricter regulations, heightened environmental consciousness, and innovative technologies positions water conservation as a central factor in market progress.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $23.3 Billion |

| CAGR | 6.6% |

The market is categorized by type, with products including watering cans, drip irrigation kits, sprinklers, hose nozzles, misters, and others such as pumps, pipes, and valves. Among these, sprinklers captured the largest share in 2024, generating USD 4.3 billion in revenue. This segment is expected to expand at a CAGR of 7% during the forecast period. Sprinklers are widely utilized across diverse applications, ensuring effective water distribution over large areas. Enhanced features like automation and sensors are making these systems increasingly efficient and appealing to a broad range of users.

By distribution channel, the market is segmented into direct and indirect sales. The indirect sales channel dominated the market in 2024, accounting for approximately 68.2% of the overall share, and is projected to grow at a CAGR of 6.9% through the forecast period. This segment encompasses retailers, wholesalers, and e-commerce platforms, enabling manufacturers to reach a diverse customer base. Retail stores and online platforms have become essential for catering to urban and tech-savvy buyers, offering extensive product options and detailed information. The rise of e-commerce has further strengthened this channel by providing convenience and competitive pricing.

In the United States, the watering equipment market contributed approximately USD 2.3 billion to the global market in 2024, with a CAGR of 6.8% expected during the forecast period. The country's strong demand for advanced irrigation systems reflects a growing focus on sustainable water management practices and technological advancements in the industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing focus on water conservation

- 3.6.1.2 Rising adoption of smart irrigation systems

- 3.6.1.3 Expansion of residential and commercial gardening activities

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial costs of advanced equipment

- 3.6.2.2 Vulnerability to fluctuations in water availability and climate conditions

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Consumer buying behavior analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Watering cans

- 5.3 Drip irrigation kits

- 5.4 Sprinklers

- 5.5 Hose nozzles

- 5.6 Misters

- 5.7 Others (pumps, pipes, valves)

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Metal

- 6.4 Rubber

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Agriculture

- 7.3 Residential gardening (home & garden)

- 7.4 Commercial landscaping (parks, gardens, public spaces)

- 7.5 Sports and golf fields

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Briggs & Stratton Corporation

- 10.2 Gilmour Manufacturing Company

- 10.3 Hunter Industries Incorporated

- 10.4 Irritrol Systems, Inc.

- 10.5 Jain Irrigation Systems Ltd.

- 10.6 John Deere & Company

- 10.7 K-Rain Manufacturing Corporation

- 10.8 Lindsay Corporation

- 10.9 Netafim Ltd.

- 10.10 Orbit Irrigation Products, Inc.

- 10.11 Rain Bird Corporation

- 10.12 The Scotts Miracle-Gro Company

- 10.13 The Toro Company

- 10.14 T-L Irrigation Company

- 10.15 Valmont Industries, Inc.