PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665414

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665414

Inspection Drone in Oil and Gas Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

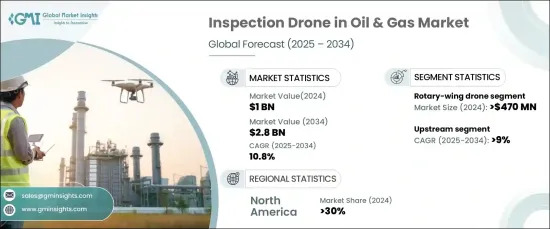

The Global Inspection Drone In Oil And Gas Market was valued at USD 1 billion in 2024 and is projected to grow at a CAGR of 10.8% from 2025 to 2034. This growth is fueled by the rising demand for efficient monitoring solutions and the rapid advancements in drone technology. Companies are prioritizing the development of innovative inspection systems to improve operations, reduce risks, and enhance safety. The increasing use of drones to conduct routine checks, assess infrastructure, and monitor operations has significantly transformed traditional inspection practices in the sector. Stricter regulatory requirements for safety and environmental compliance are also driving the adoption of drone technologies, which offer a faster and more reliable alternative to conventional methods. Additionally, incorporating AI and machine learning into drone systems is revolutionizing data analysis, enabling real-time insights and streamlined decision-making processes. The focus on automation and operational efficiency continues to shape the market's trajectory.

The market is segmented by drone type into rotary-wing, fixed-wing, and hybrid drones. Rotary-wing drones held a substantial market share in 2024, exceeding USD 470 million in value. These drones are widely preferred due to their ability to hover and maneuver in confined spaces, making them ideal for inspecting stationary assets like pipelines and offshore platforms. Their use enhances safety and efficiency while reducing the time and cost associated with traditional inspection methods. As companies increasingly integrate AI-enabled technologies, the demand for rotary-wing drones is expected to grow further, offering improved decision-making capabilities based on real-time data.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 10.8% |

The market is also categorized by operation type into upstream, midstream, and downstream segments. The upstream segment is forecasted to witness a robust CAGR of over 9% between 2025 and 2034. This growth is attributed to the rising need for advanced monitoring of exploration sites, drilling operations, and pipelines, especially in remote and challenging locations. Drones are becoming an indispensable tool for upstream operations by enhancing safety, minimizing inspection times, and optimizing operational costs. Increased investments in exploration activities and a focus on sustainability further amplify the demand for inspection drones in this segment.

North America led the global market in 2024, capturing over 30% of the revenue share. The United States, in particular, has seen significant growth due to its emphasis on operational efficiency and compliance with stringent safety regulations. The integration of advanced technologies like AI and machine learning into drone systems is enabling real-time data analysis, helping companies streamline processes, identify potential issues quickly, and reduce downtime. The region's strong focus on innovation and efficiency continues to bolster market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Manufacturer

- 3.2.3 Distributors

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Used cases

- 3.7.1 Used case 1

- 3.7.1.1 Benefits

- 3.7.1.2 ROI

- 3.7.2 Used case 2

- 3.7.2.1 Benefits

- 3.7.2.2 ROI

- 3.7.1 Used case 1

- 3.8 Case study

- 3.8.1 Case study 1

- 3.8.1.1 Consumer name

- 3.8.1.2 Challenge

- 3.8.1.3 Solution

- 3.8.1.4 Impact

- 3.8.2 Case study 2

- 3.8.2.1 Consumer name

- 3.8.2.2 Challenge

- 3.8.2.3 Solution

- 3.8.2.4 Impact

- 3.8.1 Case study 1

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand for real-time monitoring

- 3.9.1.2 Technological advancements in drone capabilities

- 3.9.1.3 Rising demand for asset management solutions

- 3.9.1.4 Enhanced safety protocols for remote inspections

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Challenges in data integration and analysis

- 3.9.2.2 High costs associated with implementing advanced drone systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Drone, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Fixed-wing drone

- 5.3 Rotary-wing drone

- 5.4 Hybrid drone

Chapter 6 Market Estimates & Forecast, By Payload, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Cameras

- 6.3 LiDAR

- 6.4 Gas detectors

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Upstream

- 7.3 Midstream

- 7.4 Downstream

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Pipeline inspection

- 8.3 Flare stack inspection

- 8.4 Tank inspection

- 8.5 Environmental monitoring

- 8.6 Well site inspection

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 National Oil Companies (NOCs)

- 9.3 Independent Oil Companies (IOCs)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 3D Robotics

- 11.2 Airobotics

- 11.3 Autel Robotics

- 11.4 Cyberhawk

- 11.5 DJI Enterprise

- 11.6 DroneBase

- 11.7 DroneDeploy

- 11.8 FLIR Systems

- 11.9 Flyability

- 11.10 GRIFF Aviation

- 11.11 IdeaForge

- 11.12 InspecTech Aero Services

- 11.13 Kespry

- 11.14 Percepto

- 11.15 PrecisionHawk

- 11.16 Quantum Systems

- 11.17 senseFly

- 11.18 Sky-Futures (ICR Group)

- 11.19 Terra Drone

- 11.20 Vantage Robotics