PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665404

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665404

Automotive Camera Monitoring System (CMS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

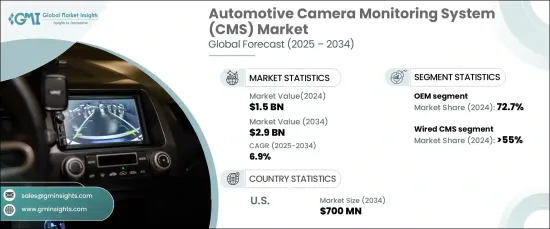

The Global Automotive Camera Monitoring System Market was valued at USD 1.5 billion in 2024 and is projected to expand at a CAGR of 6.9% from 2025 to 2034. This growth is largely driven by the increasing adoption of advanced driver-assistance systems (ADAS) across the automotive sector. These systems include features like automatic braking, adaptive cruise control, and lane-keeping assist, where camera monitoring systems play a vital role in functions such as blind-spot detection and collision avoidance. Government regulations focused on enhancing road safety further bolster the demand for these technologies. Stricter policies from global bodies are compelling automakers to incorporate camera-based systems into both new and existing vehicle models. The shift from traditional mirrors to camera-based systems aligns with these regulations, creating substantial growth opportunities for the market.

The market is categorized by technology into wired and wireless systems. Wired systems held over 55% of the market share in 2024 due to their reliability and stable performance in safety-critical applications. These systems are widely used in commercial vehicles, where real-time video feeds are essential. Their ability to offer consistent data transmission without interference makes them indispensable in applications involving heavy-duty vehicles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.9 Billion |

| CAGR | 6.9% |

Wireless systems, on the other hand, are witnessing a significant rise in popularity due to their ease of installation and aesthetic advantages. These systems are particularly favored in passenger vehicles and aftermarket solutions, as they eliminate the need for extensive wiring and contribute to a cleaner design. The increasing emphasis on connected vehicle technologies, including autonomous driving and vehicle-to-vehicle communication, is expected to drive further adoption of wireless systems. This trend is particularly notable in consumer vehicles and retrofit markets, where flexibility and advanced functionality are prioritized.

The distribution of camera monitoring systems is divided between original equipment manufacturers (OEMs) and the aftermarket. OEMs dominate the market with a 72.7% share as of 2024, primarily due to the integration of advanced safety systems in newly manufactured vehicles. Automakers are proactively incorporating camera monitoring systems to meet stringent safety standards and enhance vehicle performance, particularly in electric and autonomous models. The aftermarket is also gaining traction, driven by consumer demand for upgrades and compliance with evolving safety regulations. Retrofit solutions are becoming increasingly popular among vehicle owners seeking improved safety and functionality.

In the US, the market is expected to reach approximately USD 700 million by 2034, propelled by stringent safety standards and a growing focus on advanced vehicle technologies. Rising consumer interest in safety-enhanced vehicles and regulatory requirements are key factors supporting this growth trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 OEM Suppliers

- 3.2.2 Aftermarket suppliers

- 3.2.3 System integrators

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Price analysis

- 3.5 Cost breakdown analysis

- 3.6 Patent analysis

- 3.7 Technology & innovation landscape

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing adoption of Advanced Driver-Assistance Systems (ADAS)

- 3.10.1.2 Increased technological advancements

- 3.10.1.3 Growing consumers' expectations for advanced safety

- 3.10.1.4 Increasing regulatory pressure

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial costs

- 3.10.2.2 Consumer resistance to new technology

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Wireless

- 5.2.1 Wi-Fi

- 5.2.2 Bluetooth

- 5.2.3 Cellular

- 5.3 Wired

- 5.3.1 Coaxial

- 5.3.2 Ethernet

- 5.3.3 Fiber optic

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEMs

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Camera, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Digital

- 8.3 Analog

- 8.4 Infrared (IR)

- 8.5 Stereo

- 8.6 360-Degree

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Ambarella

- 10.2 Analog Devices

- 10.3 Aptiv

- 10.4 Bosch

- 10.5 Continental

- 10.6 Denso

- 10.7 Ficosa

- 10.8 Gentex

- 10.9 Hella

- 10.10 Hitachi Astemo

- 10.11 Hyundai Mobis

- 10.12 Kyocera

- 10.13 Magna

- 10.14 Mitsubishi Electric

- 10.15 Omnivision

- 10.16 Panasonic

- 10.17 SMR

- 10.18 Stoneridge

- 10.19 Texas Instruments

- 10.20 Valeo