PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665403

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665403

Smart Tailgate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

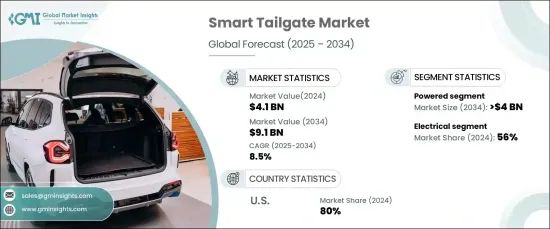

The Global Smart Tailgate Market, valued at USD 4.1 billion in 2024, is projected to grow at a CAGR of 8.5% from 2025 to 2034. This expansion is largely driven by the increasing demand for advanced in-vehicle automation and convenience features. Automotive manufacturers are continuously enhancing vehicle interfaces to incorporate innovative technologies. Smart tailgate systems with automated opening and closing functions offer hands-free access, making them particularly useful for users managing heavy loads. The emphasis on user-friendly, tech-forward solutions aligns with consumer preferences for greater convenience in modern vehicles.

Additionally, the rising popularity of larger vehicles, such as SUVs and crossovers, has significantly boosted the adoption of smart tailgates. Safety and security enhancements also propel market growth, as these systems reduce the risk of injury or damage by integrating sensors to detect obstacles. The ongoing evolution of vehicle safety features highlights the importance of these technologies in improving functionality and user satisfaction.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $9.1 Billion |

| CAGR | 8.5% |

The market, segmented by offering into manual, powered, and hands-free options, saw the powered segment dominate with over 50% of the market share in 2024. By 2034, this segment is anticipated to surpass USD 4 billion, reflecting the growing consumer appetite for convenient, high-tech vehicle features. The integration of powered smart tailgates into vehicles demonstrates automakers' efforts to meet evolving expectations and enhance their competitive edge.

Mechanisms for smart tailgates include electrical, hydraulic, and pneumatic systems. Electrical systems held a 56% market share in 2024, driven by consumer demand for easily operable and energy-efficient solutions. These systems simplify tailgate control with features like button-operated opening and closing. The seamless, cordless operation improves efficiency and accessibility while aligning with the growing preference for smart, eco-friendly vehicles. The incorporation of advanced technologies like keyless entry and remote control further enhances user convenience and reinforces the appeal of electrical smart tailgate systems.

In North America, the United States dominated the regional smart tailgate market with an impressive 80% share in 2024. The rise in outdoor recreational activities, including camping and road trips, has led to increased demand for vehicles equipped with advanced features. Consumers prioritize convenience and safety when purchasing vehicles, making smart tailgates a valuable addition. These systems facilitate effortless access to the trunk, catering to the needs of individuals on the go. The shift towards outdoor-oriented lifestyles and longer road trips continues to drive the penetration of smart tailgate systems across the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 Distribution channel

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing vehicle comfort features

- 3.9.1.2 Rising consumer convenience expectations

- 3.9.1.3 Technological advancements in vehicles

- 3.9.1.4 Growing automotive luxury segment

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High manufacturing costs

- 3.9.2.2 Technical complexity

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Manual

- 5.3 Powered

- 5.4 Hands-Free

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Hatchback

- 6.3 Sedan

- 6.4 SUVs

Chapter 7 Market Estimates & Forecast, By Mechanism, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Electrical

- 7.3 Hydraulic

- 7.4 Pneumatic

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Aisin Seiki

- 9.2 Aptiv

- 9.3 Bosch

- 9.4 Brose

- 9.5 Continental

- 9.6 Ficosa

- 9.7 Hella

- 9.8 Huf Holding

- 9.9 Johnson

- 9.10 Kiekert

- 9.11 Lear

- 9.12 Magna

- 9.13 Mitsuba

- 9.14 Stabilus

- 9.15 Zhejiang