PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665371

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665371

Juicers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

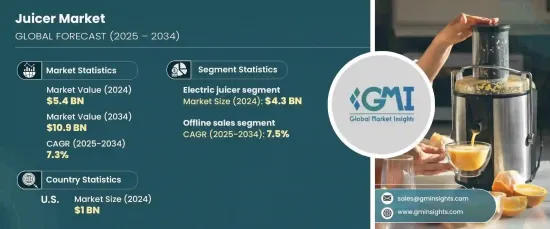

The Global Juicer Market was valued at USD 5.4 billion in 2024 and is poised to expand at a robust CAGR of 7.3% from 2025 to 2034. This remarkable growth is driven by the rising health consciousness among consumers who are increasingly opting for fresh, nutrient-rich beverages over processed alternatives. Juicing has emerged as a convenient way to incorporate essential vitamins, minerals, and antioxidants into daily diets, supporting goals like detoxification and weight management. Urban dwellers and millennials, in particular, are leading the shift toward healthier lifestyles, fueling the demand for modern juicing solutions.

The growing prevalence of lifestyle diseases such as obesity, diabetes, and cardiovascular issues has further amplified interest in juicers. Fresh juices are becoming a staple in preventive health routines, contributing to the rising popularity of advanced juicing appliances. Cold-pressed juices, renowned for their superior nutrient retention, are in high demand, driving innovations in juicer technology. Health-focused marketing campaigns, coupled with user-friendly designs, are accelerating market expansion, while the influence of social media and wellness advocates continues to attract a broader audience to the juicing trend.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 Billion |

| Forecast Value | $10.9 Billion |

| CAGR | 7.3% |

The market is segmented by product type into manual and electric juicers, with the electric segment dominating in 2024, generating USD 4.3 billion in revenue. This segment is projected to grow at a CAGR of 7.5% during the forecast period, driven by the efficiency and convenience offered by electric models. Centrifugal juicers, known for their speed and masticating variants, celebrated for nutrient preservation, are gaining traction among health-conscious buyers. Technological advancements such as quieter motors, compact designs, and adjustable speed settings are enhancing the user experience and boosting adoption rates.

Distribution channels play a pivotal role in market dynamics, with offline sales commanding a significant 68.2% share in 2024. This segment is expected to grow at a CAGR of 7.5% through 2034. Physical retail outlets, including supermarkets and specialty stores, remain critical for product sales by offering hands-on testing and demonstrations, which are particularly valuable for premium products. This personalized shopping experience continues to attract buyers, even as e-commerce gains momentum.

The U.S. juicer market contributed USD 1 billion in revenue in 2024 and is anticipated to grow at a CAGR of 7.4% over the forecast period. Increasing health awareness, especially among millennials and Gen Z consumers, is driving the demand for natural, fresh juices. Both online and offline channels are thriving, with retail stores maintaining a strong foothold due to their ability to provide demonstrations and personalized product insights. Manufacturers are focusing on developing innovative, compact, and quiet juicer models to cater to urban consumers, intensifying competition among brands prioritizing quality, technology, and affordability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising health and wellness trends

- 3.6.1.2 Increasing demand for convenient home appliances

- 3.6.1.3 Advancements in juicer technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of premium juicers

- 3.6.2.2 Environmental concerns over electronic waste

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Consumer buying behavior analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual juicer

- 5.3 Electric juicer

- 5.3.1 Centrifugal juicer

- 5.3.2 Masticating juicer

- 5.3.3 Triturating juicer

- 5.3.4 Others (steam, slow juicers)

Chapter 6 Market Estimates & Forecast, By Installation, 2021 – 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Portable

- 6.3 Fixed

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 – 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Small (300-500 ml)

- 7.3 Medium (500-800 ml)

- 7.4 Large (1-1.5 liters)

- 7.5 Extra Large (2 liters and above)

Chapter 8 Market Estimates & Forecast, By Price Range, 2021 – 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company website

- 10.3 Offline

- 10.3.1 Hypermarket/supermarkets

- 10.3.2 Specialty stores

- 10.3.3 Other retail stores

Chapter 11 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 AB Electrolux

- 12.2 Breville Group Ltd.

- 12.3 Conair LLC

- 12.4 De'Longhi S.p.A.

- 12.5 Focus Products Group International, LLC

- 12.6 Hamilton Beach Brands Holding Co.

- 12.7 Hurom Co., Ltd.

- 12.8 Koninklijke Philips N.V.

- 12.9 NUC Electronics Co., Ltd.

- 12.10 Panasonic Holdings Corporation

- 12.11 Smeg S.p.A.

- 12.12 Stanley Black & Decker, Inc.

- 12.13 Sunbeam Products, Inc.

- 12.14 Tribest Corporation

- 12.15 Whirlpool Corporation