PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665342

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665342

Modular Packaging Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

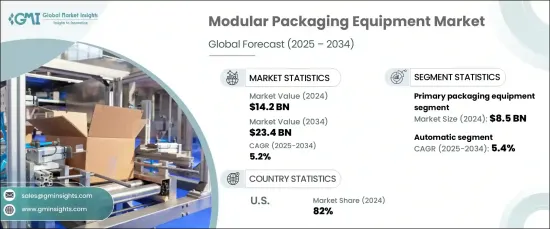

The Global Modular Packaging Equipment Market reached USD 14.2 billion in 2024 and is expected to experience robust growth at a CAGR of 5.2% from 2025 to 2034. A major driver behind this expansion is the increasing shift toward e-commerce and direct-to-consumer (DTC) business models. As more businesses embrace online platforms, the need for flexible, scalable packaging solutions has surged. Modular packaging systems are stepping up to meet this demand, providing adaptable solutions for varying product sizes, personalized packaging needs, and optimized shipping configurations, which are crucial in today's fast-paced business environment.

The market is divided into primary and secondary packaging equipment types. The primary packaging equipment segment generated USD 8.5 billion in 2024 and is anticipated to grow at a CAGR of 5.3% through 2034. The rising demand for innovative and customized packaging solutions is fueling the growth of this segment. Manufacturers are increasingly adopting flexible primary packaging systems to accommodate diverse product formats and ever-evolving consumer preferences. These systems offer enhanced efficiency, adaptability, and the ability to meet the dynamic demands of the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.2 Billion |

| Forecast Value | $23.4 Billion |

| CAGR | 5.2% |

In terms of automation, the market is segmented into manual, semi-automatic, and automatic systems. The automatic packaging equipment segment accounted for 45% of the market share in 2024 and is projected to grow at a CAGR of 5.4% throughout the forecast period. Industries with high-volume production, such as pharmaceuticals, food and beverages, and consumer electronics, are rapidly adopting automated modular systems. These systems enable faster processing, reduce the need for manual intervention, and support large-scale operations, all while maintaining the precision and consistency required for efficient manufacturing.

The U.S. modular packaging equipment market held a dominant share of 82% in 2024. The rapid expansion of e-commerce in the region has further amplified the need for versatile packaging systems that can handle a wide range of product types and diverse shipping requirements. Increasing consumer demands for faster, more secure, and cost-effective packaging solutions have propelled the growth of modular packaging systems. These systems not only streamline production processes but also optimize material usage, promoting sustainable and efficient packaging practices across industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing e-commerce industry

- 3.6.1.2 Growing food and beverage industry

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Technological overview

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Primary packaging equipment

- 5.2.1 Filling machines

- 5.2.2 Sealing machines

- 5.2.3 Labeling machines

- 5.2.4 Coding and marking equipment

- 5.3 Secondary packaging equipment

- 5.3.1 Cartoning machines

- 5.3.2 Case packing systems

- 5.3.3 Shrink wrapping machines

- 5.3.4 Palletizing equipment

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual modular equipment

- 6.3 Semi-automatic systems

- 6.4 Automatic systems

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Food and beverage

- 7.3 Pharmaceuticals

- 7.4 Cosmetics and personal care

- 7.5 Chemical and agrochemical

- 7.6 Electronics

- 7.7 Others (automotive, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Bosch Packaging Technology

- 10.2 Coesia

- 10.3 Combi Packaging Systems

- 10.4 IMA Group

- 10.5 Krones

- 10.6 Marchesini Group

- 10.7 Marel

- 10.8 Multivac

- 10.9 NJM Packaging

- 10.10 Packaging Automation

- 10.11 ProMach

- 10.12 Rockwell Automation

- 10.13 Sidel Group

- 10.14 Tetra Pak

- 10.15 Unipak Machinery