PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665339

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665339

Mattress and Mattress Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

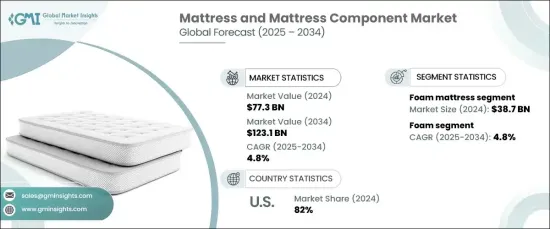

The Global Mattress And Mattress Component Market reached a valuation of USD 77.3 billion in 2024 and is expected to grow at a steady CAGR of 4.8% between 2025 and 2034. This growth is driven by shifting consumer preferences, advancements in mattress technology, a growing focus on health and wellness, and an increasing demand for innovative sleep solutions.

As consumers place greater emphasis on health and well-being, the importance of quality sleep has taken center stage. This trend has fueled the demand for mattresses that offer superior comfort, support, and pressure relief. Advanced materials such as memory foam, gel-infused foam, hybrid systems, and adjustable bases are gaining traction among buyers. Additionally, mattresses tailored to address specific health concerns, such as back pain and joint discomfort, are driving interest in therapeutic solutions designed to enhance sleep quality and overall wellness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $77.3 Billion |

| Forecast Value | $123.1 Billion |

| CAGR | 4.8% |

The market categorizes its products into foam, hybrid, innerspring, latex, and other mattress types. Foam mattresses, in particular, dominated the segment with a valuation of USD 38.7 billion in 2024 and are projected to grow at a 4.8% CAGR through 2034. These mattresses are widely recognized for their ability to conform to body shapes, providing exceptional pressure relief. This adaptability makes foam mattresses highly appealing to consumers looking to improve sleep quality or alleviate chronic pain and musculoskeletal issues.

In the mattress components category, the market is segmented into foam, innerspring, latex, fillings, and others. The foam component segment accounted for a significant 50% market share in 2024 and is expected to expand at a 4.8% CAGR during the forecast period. Foam materials, especially memory foam, are celebrated for their superior contouring capabilities and support, making them a top choice for individuals with specific sleep needs or health-related requirements.

In the United States, the mattress and mattress component market claimed an impressive 82% share in 2024. A growing focus on sustainability is reshaping consumer choices in this region, driven by heightened environmental awareness. Eco-conscious buyers are increasingly opting for mattresses crafted from sustainable materials such as organic cotton, natural latex, and eco-friendly memory foam. Non-toxic, biodegradable, and organic options are gaining popularity as shoppers aim to minimize environmental impact while creating healthier, toxin-free living spaces.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing commercial sector

- 3.6.1.2 Changing lifestyle and increasing consumer spending

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Raw material analysis

- 3.9 Consumer buying behavior analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Million Units)

- 5.1 Key trends

- 5.2 Foam mattress

- 5.3 Hybrid mattress

- 5.4 Innerspring mattress

- 5.5 Latex mattress

- 5.6 Others (waterbed, airbed, etc.)

Chapter 6 Market Estimates & Forecast, By Component Type, 2021-2034 (USD Million) (Million Units)

- 6.1 Key trends

- 6.2 Foam

- 6.3 Innerspring

- 6.4 Latex

- 6.5 Fillings

- 6.6 Others (ticking, etc.)

Chapter 7 Market Estimates & Forecast, By Size, 2021-2034 (USD Million) (Million Units)

- 7.1 Key trends

- 7.2 Small (up to 3 quarts)

- 7.3 Medium (3 to 7 quarts)

- 7.4 Large (above 7 quarts)

Chapter 8 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Million) (Million Units)

- 8.1 Key trends

- 8.2 Single size

- 8.3 Twin size

- 8.4 Full or double size

- 8.5 King size

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Million Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Supermarkets

- 10.3.2 Specialty stores

- 10.3.3 Others (individual stores, etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Ashley Furniture Industries

- 12.2 DreamCloud

- 12.3 Hästens

- 12.4 Helix Sleep

- 12.5 IKEA

- 12.6 Kingsdown

- 12.7 Leggett & Platt

- 12.8 Purple Innovation

- 12.9 Relyon

- 12.10 Saatva

- 12.11 Serta Simmons Bedding

- 12.12 Simmons Bedding Company

- 12.13 Sleep Number Corporation

- 12.14 Stearns & Foster

- 12.15 Tempur Sealy International