PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665331

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665331

Coagulation Analyzers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

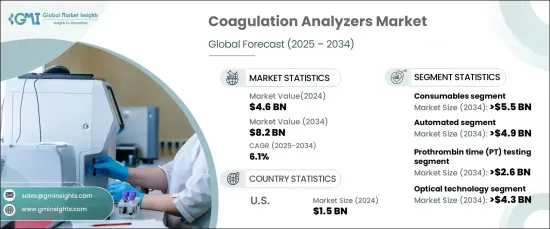

The Global Coagulation Analyzers Market reached USD 4.6 billion in 2024 and is poised to grow at a robust CAGR of 6.1% from 2025 to 2034. This growth is fueled by a rising prevalence of blood disorders such as hemophilia and thrombosis, alongside an increase in cardiovascular complications driven by sedentary lifestyles, aging populations, and obesity. As awareness of preventive healthcare expands and early diagnostic testing gains traction, the adoption of coagulation analyzers across healthcare facilities is accelerating.

The market is segmented by product type into consumables and instruments, with consumables expected to dominate. Projected to grow at a CAGR of 6.3%, the consumables segment is anticipated to generate USD 5.5 billion by 2034. The consistent demand for reagents, calibrators, and other essential consumables underpins this growth, as diagnostic centers and laboratories rely heavily on these products for routine and specialized coagulation testing. Advancements in reagent technology are enhancing compatibility with automated systems, driving efficiency and precision in high-throughput testing environments, further fueling demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $8.2 Billion |

| CAGR | 6.1% |

By test type, the market encompasses prothrombin time (PT) testing, activated partial thromboplastin time (aPTT) testing, D-dimer testing, fibrinogen testing, and other tests. PT testing is forecasted to achieve a CAGR of 6.6%, reaching USD 2.6 billion by 2034. This test is vital for diagnosing clotting disorders, monitoring anticoagulant therapies, assessing liver function, and detecting bleeding abnormalities. Its critical role in both routine and advanced diagnostic procedures underscores its significant contribution to market growth.

In the United States, the coagulation analyzers market reached USD 1.5 billion in 2024 and is projected to grow at a steady CAGR of 5.3% through 2034. The U.S. leads the North American market, benefiting from advanced healthcare infrastructure, substantial healthcare spending, and a high prevalence of chronic conditions like atrial fibrillation. The demand for coagulation tests, particularly PT and aPTT, continues to rise as effective monitoring of anticoagulant therapies becomes increasingly essential. Moreover, the integration of fully automated systems in clinical laboratories is enhancing workflow efficiency, meeting the needs of high-volume testing, and reinforcing the country's market dominance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular and blood-related disorders

- 3.2.1.2 Growing demand for point-of-care diagnostic devices

- 3.2.1.3 Technological advancements in coagulation analyzers

- 3.2.1.4 Rising awareness about early disease diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory requirements for device approval

- 3.2.2.2 Lack of skilled professionals for operating advanced analyzers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Mode, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Automated

- 6.3 Semi-automated

- 6.4 Manual

Chapter 7 Market Estimates and Forecast, By Test Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Prothrombin time (PT) testing

- 7.3 Activated partial thromboplastin time (aPTT) testing

- 7.4 D-dimer testing

- 7.5 Fibrinogen testing

- 7.6 Other test types

Chapter 8 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Optical technology

- 8.3 Electrochemical technology

- 8.4 Mechanical technology

- 8.5 Other technologies

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic laboratories

- 9.4 Academic and research institutes

- 9.5 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott

- 11.2 DiaSys

- 11.3 Erba Mannheim

- 11.4 HELENA LABORATORIES

- 11.5 HemoSonics

- 11.6 HORIBA

- 11.7 iLine

- 11.8 mindray

- 11.9 RANDOX

- 11.10 Roche

- 11.11 SEKISUI

- 11.12 SIEMENS Healthineers

- 11.13 Stago

- 11.14 sysmex

- 11.15 werfen