PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665287

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665287

Space Last-Mile Delivery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

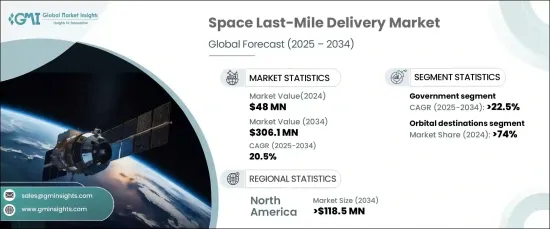

The Global Space Last-Mile Delivery Market was valued at USD 48 million in 2024 and is set to experience impressive growth, with a projected compound annual growth rate (CAGR) of 20.5% from 2025 to 2034. This growth is being driven by an increasing demand for cutting-edge in-orbit logistics solutions and precise satellite deployment. Innovations in orbital transfer vehicles and advanced propulsion systems enable more efficient payload placement and repositioning, making satellite networks, space exploration, and commercial operations more effective than ever. With the growing commercialization of space and advancements in reusable technologies, these services are becoming more cost-effective and accessible to a broader range of industries.

The space last-mile delivery market is primarily divided into two categories: orbital targets and planetary or surface destinations. The orbital destinations segment held a dominant 74% market share in 2024 and is expected to see robust growth in the coming years. The expanding deployment of satellite constellations for global broadband coverage, Earth observation, and communication services is significantly boosting the demand for orbital delivery solutions. Organizations are placing greater emphasis on achieving precise orbital placement to optimize satellite performance, driving increased reliance on last-mile delivery systems and orbital transfer technologies to meet the evolving needs of space missions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $48 million |

| Forecast Value | $306.1 million |

| CAGR | 20.5% |

In terms of end users, the market is segmented into commercial and government sectors. The government segment is expected to experience the highest growth, with a projected CAGR of 22.5% through 2034. Governments worldwide are ramping up investments in last-mile delivery infrastructure to deploy critical defense satellites for surveillance, communications, and missile detection. The need for exact orbital positioning is fueling greater interest in orbital transfer vehicles and in-orbit servicing capabilities, which in turn enhances national security and optimizes satellite network efficiency.

North America is anticipated to lead the space last-mile delivery market, reaching USD 118.5 million by 2034. The United States is at the forefront of this growth, driven by its technological expertise in space exploration and commercialization. The escalating deployment of satellite constellations for Earth observation and communication is further intensifying the demand for advanced in-orbit logistics systems. Companies are focusing on developing reusable transfer vehicles and autonomous delivery technologies, which enhance mission flexibility and reduce costs, making space operations more efficient and affordable.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing number of satellite deployment

- 3.6.1.2 Rise of commercial space ventures and the growing private sector involvement in space exploration

- 3.6.1.3 Increasing ride-sharing and secondary payload launches

- 3.6.1.4 Growing focus on sustainability and mitigating space debris

- 3.6.1.5 Increasing governmental investments and space programs

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High development and operational costs

- 3.6.2.2 Technological limitations and reliability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Destination, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Orbital destinations

- 5.2.1 Low earth orbit (LEO)

- 5.2.2 Medium earth orbit (MEO)

- 5.2.3 Geostationary orbit (GEO)

- 5.2.4 High earth orbit (Beyond GEO)

- 5.3 Planetary/surface destinations

- 5.3.1 Lunar surface

- 5.3.2 Martian surface

- 5.3.3 Asteroids surface

Chapter 6 Market Estimates & Forecast, By Delivery Payload, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Scientific equipment

- 6.3 Infrastructure components

- 6.3.1 Space station modules

- 6.3.2 Satellite components

- 6.4 Consumables

- 6.5 Propellants/fuel

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Delivery Technology, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Autonomous systems

- 7.3 Manned delivery

- 7.4 Hybrid systems

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Government

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AAC Clyde Space

- 10.2 Aliena

- 10.3 Astro Digital

- 10.4 D-Orbit

- 10.5 Exotrail

- 10.6 Impulse Space

- 10.7 Momentus Space

- 10.8 Orbit Fab

- 10.9 Rocket Lab

- 10.10 SEOPS (Space Exploration and Orbital Solutions)

- 10.11 Spaceflight Industries

- 10.12 SpaceLink

- 10.13 TransAstra