PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665285

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665285

Space Logistics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

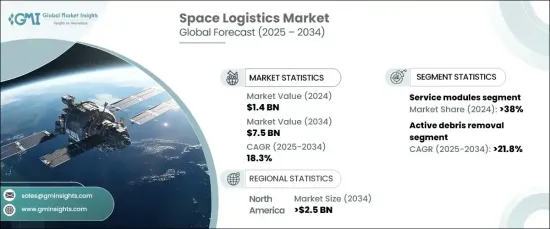

The Global Space Logistics Market, valued at USD 1.4 billion in 2024, is set to experience robust growth with a projected compound annual growth rate (CAGR) of 18.3% from 2025 to 2034. This growth is largely driven by the increasing demand for satellite deployment, in-orbit servicing, and space exploration programs. Innovations in reusable launch technologies, coupled with the rising deployment of satellite constellations for communication and Earth observation, have significantly boosted the need for efficient transportation and operational support in space. Furthermore, the rise of commercial ventures, such as space tourism and mining, along with ambitious government-led missions to the Moon and Mars, are catalyzing technological advancements and opening up new growth opportunities.

The space logistics market is segmented into various types, including service modules, Mission Extension Pods (MEPs), cargo modules, robotic arms and manipulators, and space tugs. In 2024, the service modules segment held a substantial 38% market share and is expected to see significant growth. These modules have become essential for maintaining satellite operations by providing critical functions such as propulsion, power, and communication systems. As the deployment of satellite constellations expands, service modules are playing a key role in extending satellite lifespans and supporting orbital sustainability, driving their rapid adoption across the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 billion |

| Forecast Value | $7.5 billion |

| CAGR | 18.3% |

The market is also segmented by operation, with key areas including life extension, last-mile delivery, active debris removal, space situational awareness, and on-orbit assembly and manufacturing. The active debris removal segment is forecasted to grow at an impressive CAGR of 21.8% through 2034. This growth is fueled by advancements in autonomous robotics and artificial intelligence (AI) technologies, which enhance space debris management systems. Cutting-edge tools such as robotic arms, nets, and harpoons are being developed to capture unused satellites and debris, while AI-powered algorithms improve navigation and operational precision in complex orbital environments.

North America space logistics market is projected to reach USD 2.5 billion by 2034. The U.S. market, in particular, is experiencing significant growth due to the increasing demand for satellite deployment and advancements in space infrastructure. The adoption of reusable launch vehicles has played a critical role in reducing operational costs and increasing launch frequencies, making space logistics operations more efficient and cost-effective.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increased satellite launch demand

- 3.6.1.2 Advancements in space transportation and infrastructure

- 3.6.1.3 Growing reusable launch systems and spacecraft

- 3.6.1.4 Rising demand for complex payload deployment in space

- 3.6.1.5 Shift toward space as a service and flexible models for deploying and managing satellite fleets

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs of space operations

- 3.6.2.2 Space traffic management and debris mitigation

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Mission extension pods (MEPs)

- 5.3 Cargo modules

- 5.4 Service modules

- 5.5 Robotic arms and manipulators

- 5.6 Space tugs

Chapter 6 Market Estimates & Forecast, By Operation, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Last mile delivery

- 6.3 Space situational awareness

- 6.4 Life-extension

- 6.5 Active debris removal

- 6.6 On-orbit assembly and manufacturing

Chapter 7 Market Estimates & Forecast, By Orbit, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Near earth orbit

- 7.3 Lower earth orbit

- 7.4 Geostationary orbit

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Government and defense

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Arianespace

- 10.2 Astroscale

- 10.3 Atomos Space

- 10.4 Blue Origin

- 10.5 ClearSpace

- 10.6 D-Orbit

- 10.7 Exolaunch

- 10.8 Japan Aerospace Exploration Agency

- 10.9 Lockheed Martin

- 10.10 Maxar Technologies

- 10.11 Northrop Grumman

- 10.12 Rocket Lab

- 10.13 SpaceX

- 10.14 Thales Alenia Space