PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665222

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665222

Direct View LED Display Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

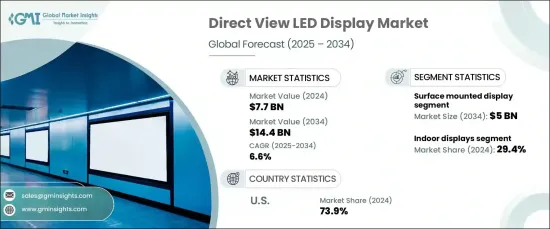

The Global Direct View LED Display Market reached USD 7.7 billion in 2024 and is anticipated to grow at a robust CAGR of 6.6% from 2025 to 2034. The increasing demand for high-resolution, energy-efficient displays is fueling this growth across commercial, entertainment, and retail sectors. Renowned for their ability to deliver vibrant visuals, seamless performance, and exceptional durability, DVLED displays are becoming the go-to solution for a wide range of indoor and outdoor applications.

In 2024, indoor displays emerged as the market leader, capturing a 29.4% share. Their sharp resolution, precise color accuracy, and aesthetic appeal make them highly sought after for applications in corporate environments, retail spaces, and entertainment venues. Designed with finer pixel pitches and optimized brightness levels ranging from 500 to 1,500 units, indoor DVLED systems offer unmatched visual clarity, meeting the demands of these high-profile sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $14.4 Billion |

| CAGR | 6.6% |

On the technology front, surface-mounted displays are projected to generate USD 5 billion by 2034, driven by their compact design and superior durability. Leveraging Surface Mounted Device (SMD) technology, these displays feature LED chips directly integrated into circuit boards, enhancing brightness, color consistency, and overall performance. This advanced technology is ideal for both indoor and outdoor installations, including dynamic digital signage and large-format displays.

The U.S. market led the global DVLED landscape in 2024, holding an impressive 73.9% share. This dominance is largely attributed to the growing adoption of DVLED displays across retail, entertainment, and commercial sectors. Retailers are increasingly leveraging these displays for dynamic in-store signage, creating engaging customer experiences while enhancing visual appeal. In urban areas, outdoor advertising is undergoing a digital transformation as static billboards give way to eye-catching digital alternatives. The entertainment industry is also embracing DVLED technology to create immersive experiences in sports arenas, concert venues, and event spaces.

As the demand for visually striking, energy-efficient display solutions continues to rise, the DVLED market is set to flourish. Technological advancements in pixel density and the integration of smart features are driving innovation and expanding adoption. With applications spanning diverse sectors, the direct view LED display market is poised for significant growth and transformative impact over the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for high-quality visual experiences

- 3.6.1.2 Declining costs and technological advancements

- 3.6.1.3 Growing adoption in outdoor advertising and digital signage

- 3.6.1.4 Rising popularity of interactive displays

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment and maintenance costs

- 3.6.2.2 Technical challenges and complex integration

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Display Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Indoor displays

- 5.3 Outdoor displays

- 5.4 Stadium screens

- 5.5 Digital signage

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Surface mounted display

- 6.3 Chip on board display

- 6.4 MicroLED display

- 6.5 Quantum dot display

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Advertising

- 7.3 Sports

- 7.4 Transportation

- 7.5 Retail

- 7.6 Broadcasting

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Government

- 8.3 Commercial

- 8.4 Educational

- 8.5 Residential

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Absen

- 10.2 AOTO Electronics

- 10.3 Barco NV

- 10.4 Christie Digital Systems

- 10.5 Daktronics

- 10.6 Delta Electronics

- 10.7 INFiLED

- 10.8 Ledman Optoelectronic

- 10.9 Leyard Optoelectronic

- 10.10 LG Electronics

- 10.11 Lighthouse Technologies

- 10.12 NEC Display Solutions

- 10.13 Planar Systems

- 10.14 ROE Visual

- 10.15 Samsung Electronics

- 10.16 Shenzhen Absen Optoelectronic

- 10.17 Shenzhen Liantronics

- 10.18 SiliconCore Technology

- 10.19 Unilumin Group

- 10.20 Yaham Optoelectronics