PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665205

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665205

Automotive Intelligent Antenna Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

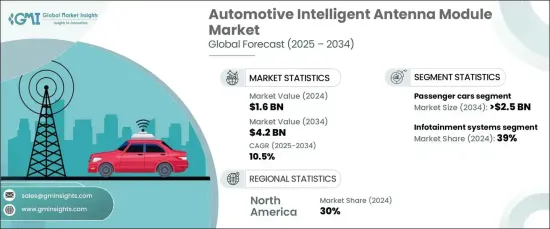

The Global Automotive Intelligent Antenna Module Market, valued at USD 1.6 billion in 2024, is forecasted to grow at a robust CAGR of 10.5% between 2025 and 2034. This remarkable growth aligns with the increasing deployment of autonomous vehicles and advanced driver assistance systems (ADAS). As these technologies become integral to modern mobility solutions, intelligent antenna modules emerge as a critical component, facilitating seamless communication and robust data transfer capabilities required for next-generation vehicles.

The growing demand for in-car connectivity and infotainment solutions further propels the market. Today's consumers expect vehicles to operate as connected hubs equipped with features like real-time navigation, voice-controlled functionalities, and effortless smartphone integration via Bluetooth and Wi-Fi. Intelligent antenna modules are the backbone of these advanced systems, ensuring uninterrupted connectivity and meeting the expectations of tech-savvy drivers. The ongoing shift toward smart, connected vehicles underscores the role of these modules in delivering superior in-car experiences, keeping pace with evolving consumer preferences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 10.5% |

The market is segmented by vehicle type into passenger cars and commercial vehicles. In 2024, passenger cars dominated the market with a 65% share and are projected to generate USD 2.5 billion by 2034. Passenger vehicles increasingly rely on intelligent antenna modules for enhanced connectivity, offering smart navigation, media streaming, and real-time traffic updates. Rising consumer demand for personalized and immersive in-car experiences continues to fuel the adoption of these modules in passenger cars, solidifying their role as a key feature in modern vehicles.

By application, the market includes vehicle-to-vehicle (V2V), telematics, infotainment systems, ADAS, and vehicle-to-infrastructure (V2I) communication. In 2024, infotainment systems accounted for 39% of the market share, driven by the growing integration of voice assistants and cloud-based features. Intelligent antenna modules provide the reliable connectivity required for hands-free operations, seamless media streaming, and continuous updates, making them indispensable for advanced infotainment solutions.

The North American market accounted for 30% of the global share in 2024, underpinned by advancements in autonomous vehicle technology. The region leads in the testing and deployment of self-driving cars, amplifying the demand for intelligent antenna modules. These modules enable critical vehicle-to-everything (V2X) communication, GPS, radar systems, and seamless data transfer, ensuring the safety, efficiency, and reliability of autonomous systems in North America. The continued innovation in this region positions it as a leader in the adoption of intelligent antenna technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Tier 1 suppliers

- 3.1.2 Telecommunications providers

- 3.1.3 Tech companies and software providers

- 3.1.4 Automotive connectivity & infrastructure provider

- 3.1.5 Distributors

- 3.1.6 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of connected and autonomous vehicles

- 3.9.1.2 Deployment of 5G networks and V2X communication technologies

- 3.9.1.3 Increasing consumer demand for infotainment and telematics features

- 3.9.1.4 Stringent regulations promoting vehicle safety and connectivity

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High costs and complexity of integration

- 3.9.2.2 Signal interference and network reliability issues

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Module, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 5G

- 5.3 V2X communication

- 5.4 Multiband

- 5.5 MIMO

- 5.6 Wi-Fi/Bluetooth

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Antennas

- 6.3 Signal processors

- 6.4 Control units

- 6.5 Radio Frequency (RF) Units

- 6.6 Filters

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Telematics

- 7.3 Infotainment systems

- 7.4 ADAS

- 7.5 Vehicle-to-Vehicle (V2V)

- 7.6 Vehicle-to-Infrastructure (V2I)

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 ICE

- 8.3 Electric

- 8.3.1 Battery Electric Vehicles (BEV)

- 8.3.2 Plug-in Hybrid Electric Vehicles (PHEV)

- 8.3.3 Hybrid Electric Vehicles (HEV)

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Passenger cars

- 9.2.1 Sedans

- 9.2.2 Hatchbacks

- 9.2.3 SUVs

- 9.2.4 Others

- 9.3 Commercial vehicles

- 9.3.1 Light Commercial Vehicles (LCVs)

- 9.3.2 Heavy Commercial Vehicles (HCVs)

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Antenova

- 12.2 Aptiv

- 12.3 Autotalks

- 12.4 Continental

- 12.5 Denso

- 12.6 Ficosa

- 12.7 Harman International

- 12.8 Harxon

- 12.9 Hella GmbH

- 12.10 Hirschmann Car Communication

- 12.11 Laird Connectivity

- 12.12 Magna

- 12.13 Mikros Technologies

- 12.14 Pulse Electronics

- 12.15 Robert Bosch

- 12.16 Taoglas

- 12.17 TE Connectivity

- 12.18 Texas Instruments

- 12.19 Valeo