PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665193

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665193

Ocular Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

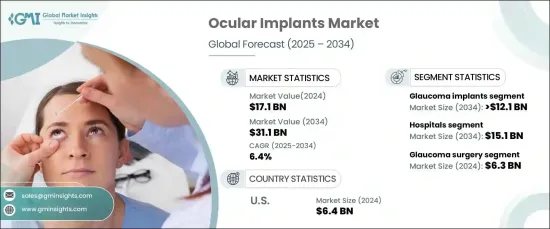

The Global Ocular Implants Market, valued at USD 17.1 billion in 2024, is set for robust growth at a CAGR of 6.4% from 2025 to 2034. This impressive expansion is fueled by multiple factors, including the increasing demand for aesthetic enhancements, the rising popularity of minimally invasive procedures, escalating healthcare spending, and a growing aging population in need of advanced eye care solutions. Additionally, the surge in chronic eye diseases, such as glaucoma and cataracts, along with rising awareness about vision correction treatments, is further driving the adoption of ocular implants. Technological innovations in implant materials and designs also contribute to the market's growth, ensuring better patient outcomes and increased safety.

The market is categorized into glaucoma implants, intraocular lenses, orbital implants, ocular prostheses, and other related products. Among these, the glaucoma implants segment stands out, expected to achieve a CAGR of 6.2% and reach USD 12.1 billion by 2034. This growth is primarily driven by the rising prevalence of glaucoma, especially among older populations, highlighting the increasing demand for effective solutions to manage intraocular pressure (IOP). As a result, glaucoma implants are becoming a critical component in improving the quality of life for patients, offering better IOP control and fewer complications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.1 Billion |

| Forecast Value | $31.1 Billion |

| CAGR | 6.4% |

Focusing on applications, the ocular implants market is segmented into age-related macular degeneration, glaucoma surgery, drug delivery, oculoplasty, and aesthetic purposes. The glaucoma surgery segment, valued at USD 6.3 billion in 2024, is expected to grow at a CAGR of 6.7% by 2034. The demand for glaucoma implants is driven by advancements in implant design, which include smaller, more effective, and minimally invasive options. These innovations enhance safety, biocompatibility, and overall treatment effectiveness, making them more popular among both patients and healthcare providers.

The U.S. ocular implants market, valued at USD 6.4 billion in 2024, is projected to grow at a CAGR of 6.1% during 2025-2034. The country has a large and aging population dealing with various age-related eye conditions, including cataracts, glaucoma, diabetic retinopathy, and macular degeneration. As the elderly population continues to grow and the incidence of chronic eye diseases rises, the demand for advanced ocular implants to address vision correction and manage high intraocular pressure continues to increase. This surge in demand is driving significant growth in the U.S. market, with healthcare advancements playing a crucial role in meeting the evolving needs of patients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of eye disorders

- 3.2.1.2 Innovations in intraocular lens design

- 3.2.1.3 Surge in ophthalmic surgeries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of implants and procedures

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Value chain analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Glaucoma implants

- 5.3 Intraocular lenses

- 5.4 Orbital implants

- 5.5 Ocular prosthesis

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Glaucoma surgery

- 6.3 Oculoplasty

- 6.4 Drug delivery

- 6.5 Age-related macular degeneration

- 6.6 Aesthetic purpose

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ophthalmic clinics

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 Alcon

- 9.3 Bausch Health

- 9.4 Glaukos Corporation

- 9.5 Gulden Ophthalmics

- 9.6 HOYA Corporation

- 9.7 HumanOptics Holding

- 9.8 Johnson & Johnson

- 9.9 Lenstec

- 9.10 MORCHER

- 9.11 NIDEK

- 9.12 Orbtex

- 9.13 Rayner Group

- 9.14 STAAR Surgical

- 9.15 ZEISS Group