PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665183

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665183

Antihypertensive Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

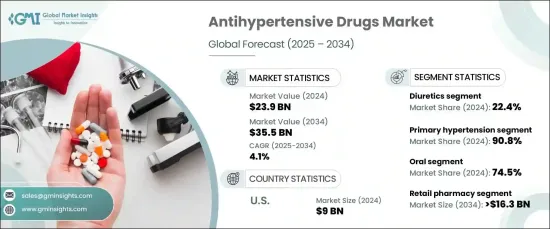

The Global Antihypertensive Drugs Market, valued at USD 23.9 billion in 2024, is set to expand at a compound annual growth rate (CAGR) of 4.1% from 2025 to 2034. This growth is largely driven by the increasing prevalence of hypertension worldwide, a condition often referred to as the "silent killer" due to its asymptomatic nature and severe health risks.

As populations age and lifestyle factors such as poor diet, stress, and lack of exercise persist, hypertension rates continue to rise, fueling the demand for effective treatments. Continuous advancements in drug formulations, coupled with the integration of digital health technologies like remote monitoring and personalized medication plans, are reshaping treatment landscapes. Furthermore, heightened awareness of the complications associated with unmanaged hypertension, such as heart disease and stroke, is encouraging early diagnosis and proactive treatment adoption, ensuring a sustained demand for antihypertensive drugs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.9 Billion |

| Forecast Value | $35.5 Billion |

| CAGR | 4.1% |

The market is categorized by therapy type into diuretics, ACE inhibitors, angiotensin receptor blockers, beta blockers, calcium channel blockers, renin inhibitors, alpha-blockers, vasodilators, and other treatments. In 2024, the diuretics segment commanded the largest share at 22.4%, thanks to the widespread use of thiazide diuretics, which are recognized for their effectiveness in reducing blood pressure. This segment also includes loop and potassium-sparing diuretics, catering to diverse treatment requirements. Beta blockers, another key category, are further segmented into beta-1 selective and intrinsic sympathomimetic variants, offering personalized solutions based on individual patient needs.

By drug type, the market divides into treatments for primary and secondary hypertension. Primary hypertension treatments dominated with a commanding 90.8% market share in 2024, reflecting the high global prevalence of this condition. Primary hypertension, often linked to lifestyle and genetic factors, underscores the growing need for effective, long-term treatment options.

The United States remains a dominant player in the antihypertensive drugs market, generating USD 9 billion in revenue in 2024. This leadership is attributed to the high incidence of hypertension, coupled with robust healthcare infrastructure and significant investment in research and development. Regulatory approvals for innovative therapies are enabling patients to access cutting-edge medications, further driving market growth. The focus on early diagnosis campaigns and advanced treatment protocols is also accelerating adoption rates across the country.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of hypertension

- 3.2.1.2 Advances in hypertensive drug development and formulations

- 3.2.1.3 Growing awareness about the risks of hypertension

- 3.2.1.4 Integration of digital health solutions in treatment strategies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Poor medication adherence during antihypertensive treatments

- 3.2.2.2 Presence of stringent regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Patent analysis

- 3.7 Gap analysis

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Therapy, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diuretics

- 5.2.1 Thiazide diuretics

- 5.2.2 Loop diuretics

- 5.2.3 Potassium-sparing diuretics

- 5.3 ACE inhibitors

- 5.4 Angiotensin receptor blockers

- 5.5 Beta blockers

- 5.5.1 Beta-1 selective

- 5.5.2 Intrinsic sympathomimetic

- 5.6 Calcium channel blockers

- 5.7 Renin inhibitors

- 5.8 Alpha-blockers

- 5.9 Vasodilators

- 5.10 Other therapies

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Primary hypertension

- 6.3 Secondary hypertension

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectables

- 7.4 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Retail pharmacy

- 8.3 Hospital pharmacy

- 8.4 Online pharmacy

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 AstraZeneca

- 10.3 Bayer AG

- 10.4 Boehringer Ingelheim International GmbH

- 10.5 Daiichi Sankyo Company

- 10.6 Johnson & Johnson Services

- 10.7 Lupin

- 10.8 Merck & Co

- 10.9 Noden Pharma DAC

- 10.10 Novartis AG

- 10.11 Pfizer

- 10.12 Sanofi

- 10.13 Sun Pharmaceutical Industries

- 10.14 Takeda Pharmaceutical

- 10.15 Torrent Pharmaceuticals