PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665181

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665181

Gas Fueled Peak Shaving Power Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

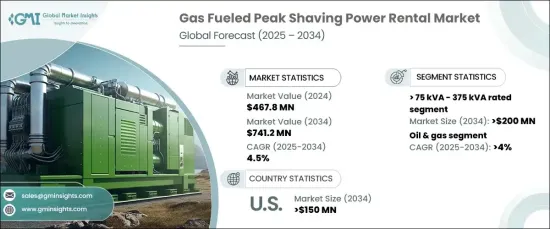

The Global Gas Fueled Peak Shaving Power Rental Market, valued at USD 467.8 million in 2024, is projected to experience steady growth with a CAGR of 4.5% from 2025 to 2034. The market is primarily driven by stricter environmental regulations and an increasing demand for efficient and reliable power solutions. As more infrastructure projects emerge worldwide, there is a rising need for flexible power systems capable of addressing peak load demands, further fueling market growth. Temporary power solutions, particularly those capable of efficiently managing peak electricity loads, have become essential across various industries. Additionally, the shift towards sustainability and carbon reduction initiatives is prompting industries to adopt cleaner fuel alternatives, such as natural gas, to align with global environmental goals. Innovations in power generation technologies and the growing preference for on-demand rental systems are reshaping the market, making gas-fueled power rentals a preferred choice for numerous commercial and industrial applications.

A significant segment within this market is the demand for gas-fueled peak shaving power rental systems rated between 75 kVA and 375 kVA, which is expected to generate USD 200 million by 2034. Weather-related disruptions like storms and cyclones have made reliable power systems more critical than ever for maintaining operational continuity. To meet these demands, technological advancements focused on reducing noise emissions and enhancing the quiet operation of rental units are gaining traction, improving market acceptance. These innovations, combined with favorable regulatory frameworks, are encouraging industries to adopt gas-powered rental solutions for temporary energy needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $467.8 Million |

| Forecast Value | $741.2 Million |

| CAGR | 4.5% |

In the oil and gas sector, the peak shaving power rental market is expected to grow at a rate of 4% through 2034. The increasing need for temporary power, particularly in remote drilling and production activities, is driving adoption. Efforts to minimize carbon emissions and a growing preference for natural gas-based fuels are also contributing to this trend. Moreover, technological improvements, including more efficient gas engines and enhanced remote monitoring capabilities, are improving fuel efficiency, reducing operational costs, and offering real-time tracking for better performance management.

The U.S. gas-fueled peak shaving power rental market is projected to generate USD 150 million by 2034. With a growing demand for electricity during peak hours and a strong focus on cost-effective energy management solutions, the market is expected to gain significant traction. As federal and state regulations push for cleaner energy alternatives, the adoption of gas-fueled rental systems is expected to rise. Furthermore, investments in grid modernization and renewable energy integration are intensifying the need for flexible power systems capable of ensuring grid stability and operational resilience. This trend will drive the demand for efficient, dependable gas-fueled power rentals across various sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 ≤ 75 kVA

- 5.3 > 75 kVA - 375 kVA

- 5.4 > 375 kVA - 750 kVA

- 5.5 > 750 kVA

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Telecom

- 6.3 Data center

- 6.4 Healthcare

- 6.5 Oil & gas

- 6.6 Electric utilities

- 6.7 Offshore

- 6.8 Manufacturing

- 6.9 Construction

- 6.10 Mining

- 6.11 Marine

- 6.12 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Aggreko

- 8.2 Al Faris

- 8.3 Atlas Copco

- 8.4 BPC Power Rentals

- 8.5 Bredenoord

- 8.6 Caterpillar

- 8.7 Cummins

- 8.8 GEN-TECH

- 8.9 Global Power Supply

- 8.10 Modern Hiring Service

- 8.11 Pon Energy Rental

- 8.12 PowerLink

- 8.13 Prime Power Rentals

- 8.14 Teksan

- 8.15 Unicel Autotech