PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665110

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665110

Food Packaging Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

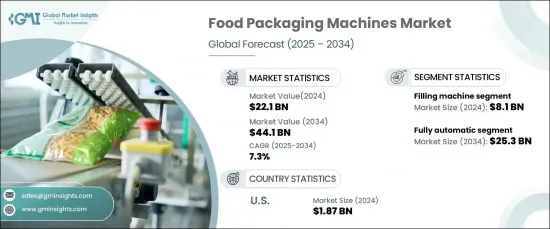

The Global Food Packaging Machines Market, valued at USD 22.1 billion in 2024, is set to see substantial growth, with a CAGR of 7.3% projected from 2025 to 2034. The market plays a vital role in the food processing industry by providing essential solutions that ensure the efficient and safe packaging of a wide array of food products. As consumer demand for fresh, convenient, and long-lasting food items continues to rise, food manufacturers are increasingly relying on advanced packaging machines to meet these needs. This growing demand for packaged food, coupled with the emphasis on product safety, preservation, and shelf life, is driving the market forward.

Technological advancements are further fueling the market's expansion, with automated machines gaining traction due to their ability to optimize production processes, improve consistency, and reduce operational costs. As convenience foods, ready-to-eat meals, and beverages grow in popularity, the need for innovative packaging solutions becomes more pronounced. Moreover, environmental concerns are influencing packaging design, pushing manufacturers to adopt sustainable materials and eco-friendly processes, creating additional opportunities for growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.1 Billion |

| Forecast Value | $44.1 Billion |

| CAGR | 7.3% |

The market is segmented by the type of machines used, including filling machines, sealing machines, wrapping machines, labeling machines, cartooning machines, and other types of packaging equipment. Among these, filling machines dominate the market, accounting for USD 8.1 billion in revenue in 2024. These machines are indispensable for packaging a wide variety of food products, especially liquids, powders, and solids. As demand for packaged beverages, dairy products, and ready-to-eat meals continues to increase, the filling machine segment is expected to see steady growth in the years ahead.

Automation is a critical driver of the market, with manual, semi-automatic, and fully automatic machines each holding a share of the market. Fully automatic machines are the leaders, making up 52% of the market in 2024. By 2034, this segment is expected to be worth USD 25.3 billion, as fully automated machines offer numerous advantages. They increase operational efficiency, ensure scalability, and reduce costs, making them particularly beneficial in high-volume production environments. As manufacturers continue to prioritize operational efficiency and product quality, fully automatic machines are becoming the preferred option in the food packaging industry.

In the U.S., the food packaging machines market was valued at USD 1.87 billion in 2024, with a projected growth rate of 8% CAGR from 2025 to 2034. The U.S. continues to be a leader in developing innovative packaging technologies, particularly in automation and smart packaging. These advancements enable manufacturers to streamline production, minimize waste, and ensure that food products maintain the highest quality standards. As U.S. companies push the boundaries of innovation, they are poised to drive both national and global market growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising consumer demand for convenience and ready-to-eat foods

- 3.6.1.2 Technological advancements in packaging machinery

- 3.6.1.3 Rising focus on sustainability and eco-friendly packaging

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial capital investment and operational costs

- 3.6.2.2 Complexity in adapting to diverse packaging formats

- 3.6.1 Growth drivers

- 3.7 Technological overview

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Filling machine

- 5.3 Sealing machine

- 5.4 Wrapping machine

- 5.5 Labelling machine

- 5.6 Cartoning machine

- 5.7 Others (palletizing machine, etc.)

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Food Type, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Bakery and confectionary food

- 7.3 Dairy products

- 7.4 Frozen food

- 7.5 Fruits and vegetables

- 7.6 Meat, poultry and seafood

- 7.7 Snacks

- 7.8 Others (ready-to-eat meals, etc.)

Chapter 8 Market Estimates & Forecast, By Packaging Format, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.1.1 Bags

- 8.1.2 Bottles

- 8.1.3 Cans

- 8.1.4 Cartons

- 8.1.5 Pouches

- 8.1.6 Others (baskets, jars, trays, etc.)

Chapter 9 Market Estimates & Forecast, By Packaging Material, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.1.1 Glass

- 9.1.2 Metal

- 9.1.3 Paperboard

- 9.1.4 Plastic

- 9.1.5 Others (biodegradable material, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 APACKS (Automated Packaging Systems)

- 12.2 Barry-Wehmiller Companies

- 12.3 Coesia

- 12.4 Douglas Machine

- 12.5 EconoCorp

- 12.6 GEA Group

- 12.7 Industria Macchine Automatiche

- 12.8 Jacob White Packaging Ltd.

- 12.9 KHS Group

- 12.10 Krones AG

- 12.11 ProMach

- 12.12 Sealed Air Corporation

- 12.13 Serac Group

- 12.14 Sidel Group

- 12.15 Tetra Pak International