PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665102

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665102

Hereditary Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

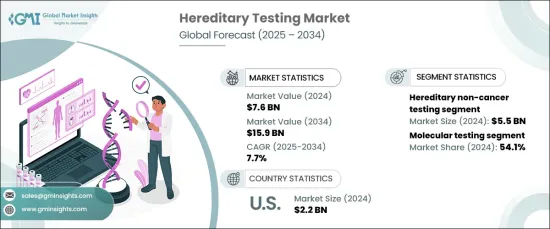

The Global Hereditary Testing Market, valued at USD 7.6 billion in 2024, is projected to grow at a robust CAGR of 7.7% from 2025 to 2034. Hereditary testing, often referred to as genetic testing, analyzes an individual's DNA to detect gene, chromosome, or protein mutations inherited from parents. This revolutionary technology plays an increasingly pivotal role in identifying genetic conditions, enabling early diagnoses, assessing risk factors, and tailoring personalized treatment plans for individuals. The market's rapid growth can be attributed to advancements in genomic research and technology, which have made genetic testing more affordable and accessible to a wider population. With greater integration into everyday healthcare practices and supported by favorable government policies and increasing health awareness, the demand for hereditary testing is at an all-time high.

As personalized medicine gains momentum, hereditary testing is positioned as a cornerstone of precision healthcare, helping doctors customize treatments based on genetic information. This trend has led to the growing use of genetic tests in diverse areas like prenatal screening, disease prediction, and cancer risk evaluation. These applications are transforming modern healthcare, emphasizing the need for genetic testing to facilitate early interventions and improve long-term health outcomes. Additionally, growing awareness of genetic conditions, combined with improved accessibility due to insurance support and reimbursement policies, has contributed significantly to the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $15.9 Billion |

| CAGR | 7.7% |

By disease type, the market is divided into hereditary cancer testing and hereditary non-cancer testing. In 2024, hereditary non-cancer testing dominated the market, generating USD 5.5 billion in revenue. This surge in demand is driven by increased awareness of genetic disorders and the growing importance of early detection. Patients and healthcare providers alike are placing more emphasis on proactive genetic screening and counseling, leading to a shift toward preventive healthcare strategies.

Technologically, the market is categorized into cytogenetic, biochemical, and molecular testing, with molecular testing holding the largest market share at 54.1% in 2024. This segment is expected to experience substantial growth during the forecast period, thanks to innovations like multiplex PCR assays that have improved testing accuracy and efficiency. These advanced technologies enable the simultaneous detection of multiple genetic variants, reducing both costs and turnaround times. Additionally, the integration of artificial intelligence and machine learning in molecular testing platforms is streamlining data interpretation, enhancing genetic variant classification, and further driving market growth.

In the U.S. alone, the hereditary testing market reached USD 2.2 billion in 2024 and is expected to maintain its upward trajectory. The rising prevalence of genetic disorders and hereditary cancers in the country is fueling the demand for genetic testing services. Enhanced insurance coverage and favorable reimbursement policies are making genetic testing more accessible, accelerating adoption. With ongoing advancements in genomic research and a growing focus on personalized medicine, the hereditary testing market is poised for continued growth, playing a crucial role in improving health outcomes worldwide.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of hereditary diseases

- 3.2.1.2 Advancements in genomic technologies

- 3.2.1.3 Rising demand for personalized medicine

- 3.2.1.4 Increasing adoption of non-invasive prenatal testing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced genetic tests

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Key news and initiatives

- 3.8 Gap analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hereditary cancer testing

- 5.2.1 Lung cancer

- 5.2.2 Breast cancer

- 5.2.3 Colorectal cancer

- 5.2.4 Cervical cancer

- 5.2.5 Ovarian cancer

- 5.2.6 Prostate cancer

- 5.2.7 Stomach/gastric cancer

- 5.2.8 Melanoma

- 5.2.9 Sarcoma

- 5.2.10 Uterine cancer

- 5.2.11 Pancreatic cancer

- 5.2.12 Other hereditary cancers

- 5.3 Hereditary non-cancer testing

- 5.3.1 Genetic tests

- 5.3.1.1 Cardiac diseases

- 5.3.1.2 Rare diseases

- 5.3.1.3 Other diseases

- 5.3.2 Preimplantation genetic diagnosis & screening

- 5.3.3 Non-invasive prenatal testing (NIPT) & carrier screening tests

- 5.3.4 Newborn genetic screening

- 5.3.1 Genetic tests

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cytogenetic

- 6.3 Biochemical

- 6.4 Molecular testing

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Agilent Technologies

- 8.2 Centogene

- 8.3 CooperSurgical

- 8.4 F. Hoffmann-La Roche

- 8.5 Fulgent Genetics

- 8.6 Illumina

- 8.7 Invitae Corporation

- 8.8 Laboratory Corporation of America Holdings

- 8.9 MedGenome

- 8.10 Myriad Genetics

- 8.11 Natera

- 8.12 Quest Diagnostics

- 8.13 Sophia Genetics

- 8.14 Thermo Fisher Scientific

- 8.15 Twist Bioscience