PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665099

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665099

n-Heptane Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

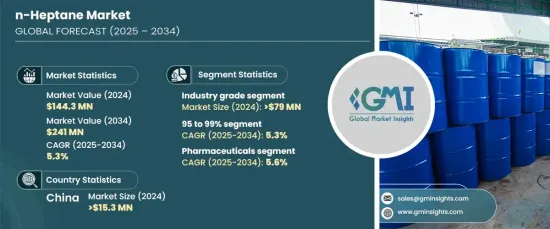

The Global N-Heptane Market reached a valuation of USD 144.3 million in 2024, and it is expected to experience robust growth with a CAGR of 5.3% from 2025 to 2034. This growth is being fueled by rising industrial demand, an expanding range of applications, and significant developments in various sectors, including automotive, pharmaceuticals, and chemicals. N-heptane's versatility and wide adoption as a solvent in chemical processes and fuel testing make it indispensable across numerous industries. With its growing demand in key economies, the market is positioned for steady expansion, particularly in countries with strong industrial infrastructures. Furthermore, the increasing focus on research and product innovations will contribute to the market development. As industries seek efficient and high-performance materials, n-heptane's applications will continue to evolve, further driving market growth.

In 2024, the industry-grade segment led the n-heptane market, reaching a valuation of USD 79 million, and it is expected to grow at a CAGR of 5.1% through 2034. This segment's dominance is attributed to its cost-effectiveness and suitability for a range of industrial processes. Often utilized in adhesives, coatings, and fuel testing, the industry-grade n-heptane offers reliable performance for non-critical applications. Additionally, it plays a key role in chemical synthesis and rubber manufacturing, especially in regions with a well-established industrial framework. Its broad usage across these sectors helps maintain its strong position in the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $144.3 Million |

| Forecast Value | $241 Million |

| CAGR | 5.3% |

The 95% to 99% purity segment dominated the market in 2024, generating USD 72.1 million in revenue, with a projected CAGR of 5.3% through 2034. N-heptane within this purity range is highly sought after due to its ability to meet the rigorous demands of industries requiring precise formulations. It is widely used in laboratories for analytical purposes and chemical synthesis, where high accuracy is paramount. Furthermore, its role in fuel performance testing and pharmaceutical formulations highlights its essential use in sectors that require high precision and exceptional quality.

China has emerged as a key player in the Asia-Pacific n-heptane market, contributing USD 15.3 million in 2024, with an expected growth rate of 6.3% during the forecast period. The country's robust chemical and automotive industries are the driving force behind this surge in demand. China's rapidly expanding industrial base, coupled with urbanization and improved infrastructure, strengthens its position in the global n-heptane market. With increasing applications in sectors like adhesives, coatings, and pharmaceuticals, China's market potential continues to grow.

The n-heptane market is poised for substantial growth, driven by industrial expansion, product advancements, and the increasing demand for high-quality solvents in various applications. As industries continue to prioritize performance, n-heptane's significance in manufacturing and research processes will continue to rise, solidifying its place in the global marketplace.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for high-purity solvents in laboratories and industrial applications

- 3.6.1.2 Rising energy demands fueling petrochemical testing

- 3.6.1.3 Expansion of the pharmaceutical and adhesive manufacturing industries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Stringent environmental regulations restricting the use of volatile organic compounds (VOCs)

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Grade, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Industry grade

- 5.3 Pharmaceutical grade

Chapter 6 Market Estimates & Forecast, By Purity, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 <95%

- 6.3 95 to 99%

- 6.4 ≥99%

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Pharmaceuticals

- 7.3 Paints & coatings

- 7.4 Electronics

- 7.5 Adhesives & sealants

- 7.6 Plastic & polymers

- 7.7 Chemical synthesis

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Chevron Phillips Chemical

- 9.2 Chuzhou Runda Solvents

- 9.3 DHC Solvent Chemie

- 9.4 Gadiv Petrochemical Industries

- 9.5 Haltermann Carless Deutschland

- 9.6 Hanwha Total Petrochemical

- 9.7 Henan Haofei Chemical

- 9.8 Liaoning Yufeng Chemical

- 9.9 Mehta Petro-Refineries

- 9.10 Royal Dutch Shell

- 9.11 Sankyo Chemical

- 9.12 Shenyang Huifeng Petrochemical

- 9.13 SK Global Chemical