PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665098

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665098

EV Low Voltage Drive System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

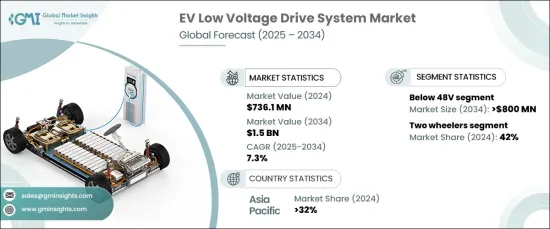

The Global EV Low Voltage Drive System Market was valued at USD 736.1 million in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2034. This robust growth can be attributed to several key factors, notably the ongoing advancements in power electronics. Technological innovations have greatly enhanced the efficiency of critical components such as inverters, motor controllers, and battery management systems (BMS), making them more compact, cost-effective, and powerful. These improvements have resulted in better vehicle performance, increased energy efficiency, and longer driving ranges-qualities that consumers increasingly prioritize when choosing electric vehicles (EVs).

Additionally, as low-voltage drive systems become more affordable, manufacturers can offer more sustainable and energy-efficient options, further driving market expansion. EV adoption has become a priority in several regions due to stricter environmental regulations and the growing demand for green transportation solutions. As energy efficiency becomes a major focal point for consumers, the market for low-voltage drive systems in electric vehicles continues to grow, presenting new opportunities for stakeholders in the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $736.1 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 7.3% |

The market is segmented by voltage into three categories: below 48V, 48V to 60V, and above 60V. In 2024, the below 48V segment held a dominant 57% market share and is expected to generate USD 800 million by 2034. This segment is favored for its cost-effectiveness, making it ideal for smaller electric vehicles such as two-wheelers and mild hybrid vehicles. The widespread use of 48V systems in electric two-wheelers, including e-scooters and e-bikes, plays a pivotal role in maintaining the segment's market leadership, especially in cost-sensitive urban transport solutions.

Looking at vehicle types, the market is divided into passenger cars, commercial vehicles, two-wheelers, and off-highway vehicles. In 2024, the two-wheeler segment held a strong 42% share, a trend driven by the growing demand for eco-friendly, affordable, and efficient transportation solutions. The rise of urbanization, particularly in emerging economies, has led to an increased preference for electric two-wheelers, which are seen as a practical alternative to traditional internal combustion engine vehicles. These vehicles not only contribute to environmental sustainability but also help reduce traffic congestion and pollution in densely populated cities.

Asia-Pacific is the leading region in the EV low voltage drive system market, accounting for 32% of the market share in 2024. The region's dominance in EV production and adoption is largely due to the strong growth of electric two-wheelers and smaller electric vehicles. Government incentives promoting electric mobility, coupled with a growing commitment to sustainability, have further fueled the expansion of EV infrastructure. The shift toward electric two-wheelers, in particular, has been a significant driver of growth in this region, making it a key player in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturer

- 3.2.3 Logistics and distribution providers

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising adoption of EVs

- 3.8.1.2 Technological advancements in power electronics

- 3.8.1.3 Growing focus on sustainability and environmental concerns

- 3.8.1.4 Cost efficiency and economic benefits

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Lack of consumer awareness

- 3.8.2.2 Competition from high-voltage systems

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Voltage, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Below 48V

- 5.3 48V to 60V

- 5.4 Above 60V

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicle

- 6.3.1 LCV

- 6.3.2 HCV

- 6.4 Two wheeler

- 6.5 Off highway vehicle

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Inverter

- 7.3 Battery management system

- 7.4 DC-DC converters

- 7.5 Voltage regulators

- 7.6 Power electronics

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Battery electric vehicles (BEV)

- 8.3 Plug-in hybrid electric vehicles (PHEV)

- 8.4 Hybrid electric vehicles (HEV)

- 8.5 Fuel cell electric vehicles (FCEV)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Allegro Microsystems

- 10.3 Analog Devices

- 10.4 Borgwarner

- 10.5 Continental

- 10.6 Delphi Technologies

- 10.7 Eaton

- 10.8 Infineon

- 10.9 Lear

- 10.10 Mahle

- 10.11 Microchip Technology

- 10.12 nanoFlowcell

- 10.13 Renesas Electronics

- 10.14 Semiconductor Components

- 10.15 Sensata Technologies

- 10.16 Valeo

- 10.17 ZF Friedrichshafen