PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913362

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913362

Electric Vehicle Range Extender Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

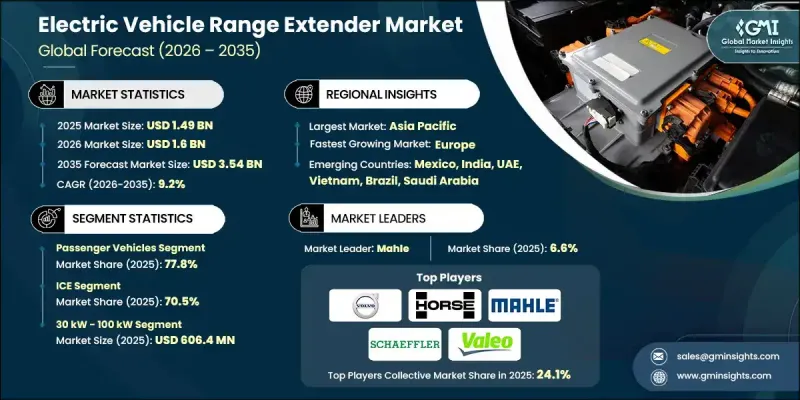

The Global Electric Vehicle Range Extender Market was valued at USD 1.49 billion in 2025 and is estimated to grow at a CAGR of 9.2% to reach USD 3.54 billion by 2035.

The accelerating shift toward electric mobility worldwide continues to support market expansion, as rising EV sales directly increase demand for technologies that address driving range concerns. Range extenders are gaining relevance in regions where public charging networks remain underdeveloped. Ongoing technological progress has improved the cost efficiency and performance of modern range extender systems, making them more viable for large-scale adoption. These systems help improve vehicle efficiency, reduce environmental impact, and extend driving distance, which strengthens the appeal of electric mobility for both private and commercial use. At the same time, innovation within the battery sector is creating competitive pressure, as higher battery energy density and faster charging capabilities reduce dependence on auxiliary power systems. Despite these challenges, range extenders continue to support market growth by addressing long-distance travel limitations and enabling wider EV acceptance across diverse use cases.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.49 Billion |

| Forecast Value | $3.54 Billion |

| CAGR | 9.2% |

The passenger vehicles segment accounted for 77.8% share in 2025. Consumers increasingly prioritize extended driving range for everyday urban and suburban usage, as reduced charging frequency improves convenience and confidence in EV ownership. Range extender integration has helped ease earlier adoption barriers related to range anxiety, allowing electric passenger vehicles to gain stronger global traction.

The internal combustion engine-based solutions segment held 70.5% share in 2025 and is forecast to grow at a CAGR of 9.6% from 2026 to 2035. Manufacturers continue to favor these systems due to their technical maturity, established supply chains, and lower development and manufacturing costs compared to newer power generation alternatives.

U.S. Electric Vehicle Range Extender Market garnered USD 309.7 million in 2025. State-level incentives, tax benefits, and regulatory support for electric vehicles continue to encourage domestic production and investment, strengthening market growth across the country.

Key companies active in the Global Electric Vehicle Range Extender Market include ZF Group, Hyundai Mobis, Mahle, Mazda, AVL, Li Auto, Schaeffler, AB Volvo, Valeo, and Horse Powertrain. Companies operating in the Electric Vehicle Range Extender Market focus on technology optimization, cost reduction, and strategic partnerships to reinforce their market position. Many players invest heavily in research and development to improve efficiency, durability, and system integration. Collaboration with vehicle manufacturers allows suppliers to align product design with evolving EV platforms. Firms also prioritize scalable manufacturing to meet rising demand while maintaining competitive pricing. Geographic expansion remains a key strategy, with companies strengthening regional production and distribution networks. In addition, players emphasize compliance with emission regulations and alignment with government incentive programs.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Range extender

- 2.2.3 Power Output

- 2.2.4 Component

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.2.7 Sales Channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer range anxiety

- 3.2.1.2 Growth in electric commercial and fleet vehicles

- 3.2.1.3 Expansion of EV adoption in emerging markets

- 3.2.1.4 Limited charging infrastructure in rural and highway areas

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Rapid expansion of fast-charging infrastructure

- 3.2.2.2 Increasing battery energy density and cost decline

- 3.2.3 Market opportunities

- 3.2.3.1 Range extenders for electric trucks and vans

- 3.2.3.2 Retrofitting solutions for existing EV platforms

- 3.2.3.3 Emerging markets with infrastructure gaps

- 3.2.3.4 Hydrogen and e-fuel-based range extender systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 CARB Advanced Clean Cars II (ACC II)

- 3.4.1.2 EPA Greenhouse Gas (GHG) Standards

- 3.4.1.3 IRA (Inflation Reduction Act) Tax Credits

- 3.4.2 Europe

- 3.4.2.1 Euro 7 Standards

- 3.4.2.2 Utility Factor (UF) Curve Adjustments

- 3.4.2.3 European Commission

- 3.4.2.4 International Council on Clean Transportation

- 3.4.3 Asia Pacific

- 3.4.3.1 China’s New Energy Vehicle Policy

- 3.4.3.2 India’s FAME-III (Draft)

- 3.4.3.3 Dual Credit System (CAFC & NEV)

- 3.4.4 Latin America

- 3.4.4.1 Brazil’s Mover Program

- 3.4.4.2 CONAMA (Conselho Nacional do Meio Ambiente)

- 3.4.5 Middle East & Africa

- 3.4.5.1 GSO (Gulf Standardization Organization) Standards

- 3.4.5.2 UAE National EV Policy

- 3.4.5.3 Saudi SASO Regulations

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Sustainability and environmental impact

- 3.10.1 Environmental impact assessment

- 3.10.2 Social impact & community benefits

- 3.10.3 Governance & corporate responsibility

- 3.10.4 Sustainable finance & investment trends

- 3.11 Regional infrastructure readiness assessment

- 3.11.1 Charging infrastructure maturity by region

- 3.11.2 Fuel availability for range extender systems

- 3.11.3 Urban versus intercity infrastructure gaps

- 3.11.4 Impact on range extender demand outlook

- 3.12 Cost breakdown analysis

- 3.12.1 Engine or energy generation unit cost

- 3.12.2 Generator and power electronics cost

- 3.12.3 Fuel system and emissions control cost

- 3.12.4 Thermal management and cooling system cost

- 3.12.5 Manufacturing and assembly cost

- 3.13 Case studies

- 3.14 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Range Extender, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 ICE

- 5.2.1 Diesel

- 5.2.2 Gasoline

- 5.2.3 Rotary

- 5.3 Alternate fuel cell

- 5.3.1 Natural gas

- 5.3.2 Hydrogen

- 5.3.3 Biofuel

Chapter 6 Market Estimates & Forecast, By Power Output, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Less than 30 kW

- 6.3 30 kW - 100 kW

- 6.4 Above 100 kW

Chapter 7 Market Estimates & Forecast, By Component, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Battery pack

- 7.3 Power converter

- 7.4 Electric motor

- 7.5 Generator

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 Passenger vehicles

- 8.2.1 Sedan

- 8.2.2 SUV

- 8.2.3 Hatchback

- 8.3 Commercial vehicles

- 8.3.1 LCV

- 8.3.2 MCV

- 8.3.3 HCV

- 8.4 Two-Wheelers & Three-Wheelers

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 Corporate/logistics fleet

- 9.3 Ridesharing/taxi/rental services

- 9.4 Personal vehicles

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Mn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Singapore

- 11.4.7 Malaysia

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.4.10 Thailand

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global companies

- 12.1.1 ZF Group

- 12.1.2 Stellantis

- 12.1.3 Hyundai Motor

- 12.1.4 Volvo

- 12.1.5 Mazda Motor

- 12.1.6 BYD

- 12.1.7 Li Auto

- 12.1.8 Huawei

- 12.1.9 Leapmotor

- 12.1.10 Magna

- 12.1.11 MAHLE Powertrain

- 12.1.12 Ballard

- 12.2 Regional companies

- 12.2.1 AVL

- 12.2.2 FEV Group

- 12.2.3 Plug Power

- 12.2.4 Scout Motors

- 12.2.5 Avatr Technologies

- 12.2.6 Deepal

- 12.2.7 Bosch Engineering

- 12.2.8 XPeng Motors

- 12.3 Emerging companies

- 12.3.1 Obrist Powertrain

- 12.3.2 Delta Motorsports

- 12.3.3 Ceres Power

- 12.3.4 Symbio

- 12.3.5 EP Tender