PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665077

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665077

Healthcare Electronic Data Interchange Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

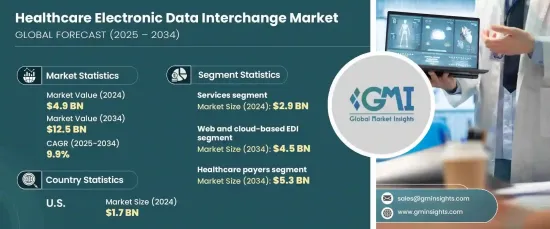

The Global Healthcare Electronic Data Interchange Market, valued at USD 4.9 billion in 2024, is set to experience remarkable growth with a projected CAGR of 9.9% between 2025 and 2034. This expansion is driven by the increasing adoption of automated EDI solutions, propelled by stringent regulatory mandates, growing demand for seamless interoperability, and the rising need to streamline administrative operations in healthcare systems.

As the healthcare industry embraces digital transformation, EDI platforms emerge as indispensable tools for secure, standardized, and efficient data exchange between payers, providers, and stakeholders. These platforms eliminate the inefficiencies of manual processes, ensuring compliance with evolving regulations and safeguarding sensitive patient information. Furthermore, advancements in cloud computing and AI-powered analytics have introduced sophisticated, cost-effective solutions, broadening the appeal of EDI systems to organizations of all sizes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $12.5 Billion |

| CAGR | 9.9% |

Government regulations and industry standards play a pivotal role in accelerating the adoption of healthcare EDI systems. Regulatory frameworks emphasize the necessity for secure data exchange, prompting healthcare organizations to modernize their workflows. Automated EDI solutions ensure seamless compliance with privacy and security standards while fostering efficient communication across the healthcare ecosystem. This push toward digitization is particularly significant as healthcare providers grapple with mounting pressures to optimize performance and reduce costs, further driving the market's expansion.

In terms of components, the healthcare EDI market is segmented into services and solutions, with services leading the charge in revenue generation. Services reached USD 2.9 billion in 2024, reflecting the industry's reliance on system integration, customization, training, and technical support. As organizations transition from legacy systems to modern EDI platforms, these services ensure a smooth and efficient integration process. The rising demand for professional services underscores the healthcare sector's focus on achieving interoperability and adhering to stringent compliance requirements. This trend is expected to gain momentum, aligning with healthcare providers' priorities for operational excellence.

The market also segments based on deployment type, including EDI value-added networks (VANs), direct (point-to-point) EDI, web and cloud-based EDI, and mobile EDI. Among these, web and cloud-based EDI solutions dominated in 2024, and this segment is forecasted to generate USD 4.5 billion by 2034. Cloud-based solutions offer unmatched scalability and cost-efficiency, allowing healthcare organizations to expand operations without heavy hardware investments. These systems are particularly attractive to small and medium-sized providers seeking access to advanced tools without the burden of maintaining on-premises infrastructure. The flexibility, reliability, and affordability of cloud-based EDI make it a cornerstone of the market's growth trajectory.

North America accounted for USD 1.7 billion of the healthcare EDI market in 2024, fueled by strict regulatory requirements mandating standardized transactions and robust healthcare spending in the United States. As the industry prioritizes data-driven innovations, investments in digital infrastructure and AI-driven analytics continue to drive the adoption of advanced EDI solutions, reshaping the global landscape of healthcare data exchange.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Regulatory support and compliance requirements

- 3.2.1.2 Rising demand for interoperability

- 3.2.1.3 Technological advancements

- 3.2.1.4 Cost reduction and efficiency

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation cost

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Innovation landscape

- 3.8 Gap analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Services

- 5.3 Solutions

Chapter 6 Market Estimates and Forecast, By Deployment Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Web and cloud-based EDI

- 6.3 EDI value added network (VAN)

- 6.4 Direct (point-to-point) EDI

- 6.5 Mobile EDI

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Healthcare payers

- 7.3 Healthcare providers

- 7.4 Pharmaceutical and medical device industries

- 7.5 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Boomi

- 9.2 Cleo

- 9.3 DataTrans Solutions

- 9.4 Effective Data

- 9.5 Epicor Software Corporation

- 9.6 GE Healthcare

- 9.7 MCKESSON CORPORATION

- 9.8 NXGN Management

- 9.9 OpenText

- 9.10 Optum

- 9.11 Oracle

- 9.12 OSP

- 9.13 SPS Commerce

- 9.14 SSI Group

- 9.15 TrueCommerce