PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665068

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665068

Electric Vehicle Thermal Management System (EV TMS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

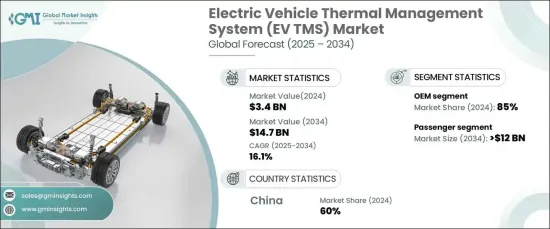

The Global Electric Vehicle Thermal Management System Market, valued at USD 3.4 billion in 2024, is projected to experience robust growth, with a CAGR of 16.1% from 2025 to 2034. This expansion is fueled by the accelerating global shift toward electric vehicles (EVs), driven by government policies such as subsidies, tax incentives, and stringent emissions regulations. As EVs rely heavily on batteries and power electronics, which are highly sensitive to temperature fluctuations, advanced thermal management systems are essential to ensure safety, optimize performance, and extend the lifespan of these critical components.

In terms of vehicle categories, the market is primarily divided into passenger vehicles and commercial vehicles. Passenger vehicles held a dominant 65% share of the market in 2024 and are expected to generate USD 12 billion by 2034. This dominance is attributed to the growing demand for electric cars and the increasing emphasis on improving energy efficiency, driving range, and overall vehicle performance. As the most prevalent type of EVs on the road, passenger vehicles are at the forefront of technological advancements in thermal management solutions, which enhance battery longevity and provide superior comfort for drivers and passengers alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $14.7 Billion |

| CAGR | 16.1% |

The EV TMS market is also segmented by sales channels, with the original equipment manufacturer (OEM) segment capturing a significant 85% share in 2024. OEMs play a pivotal role in integrating cutting-edge thermal management technologies during vehicle production. With rising EV adoption, these manufacturers are channeling substantial investments into research and development to deliver innovative, high-performance, and cost-efficient thermal solutions. Collaborations between OEMs and suppliers are further strengthening this segment by ensuring compliance with regulatory standards, optimizing battery efficiency, and improving overall vehicle performance, solidifying their leadership in the market.

China's EV TMS market accounted for an impressive 60% share in 2024 and is anticipated to reach USD 3 billion by 2034. This remarkable growth is driven by the nation's aggressive push for EV adoption, bolstered by supportive government policies and incentives. As a global leader in EV production and innovation, China continues to attract significant investments from automakers and suppliers, fueling advancements in research and development and cementing its position at the forefront of the EV revolution.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 EV TMS manufacturers

- 3.2.2 Aftermarket clutch providers

- 3.2.3 Distributors

- 3.2.4 OEMs

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Pricing analysis

- 3.5 Cost breakdown

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing adoption of electric vehicles (EVs)

- 3.9.1.2 Advancements in battery technologies

- 3.9.1.3 Rising focus on energy efficiency and vehicle range

- 3.9.1.4 Government incentives and stricter emission regulations

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High cost of advanced thermal management systems

- 3.9.2.2 Integration complexities in compact and lightweight vehicle designs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Active cooling

- 5.3 Passive cooling

- 5.4 Hybrid cooling

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Heat pumps

- 6.3 Electric pumps

- 6.4 Fans

- 6.5 Thermoelectric modules

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Battery Electric Vehicles (BEV)

- 8.3 Plug-in Hybrid Electric Vehicles (PHEV)

- 8.4 Hybrid Electric Vehicles (HEV)

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn,Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 BorgWarner

- 11.2 Bosch

- 11.3 Calsonic Kansei

- 11.4 Continental

- 11.5 Dana

- 11.6 Delphi Technologies

- 11.7 Denso

- 11.8 Gentherm

- 11.9 Grayson Thermal Systems

- 11.10 Hanon Systems

- 11.11 LG Chem

- 11.12 MAHLE

- 11.13 Modine Manufacturing Company

- 11.14 Renesas Electronics

- 11.15 Sanden Holdings

- 11.16 Schaeffler Group

- 11.17 Tesla

- 11.18 Thermo King

- 11.19 Valeo

- 11.20 Visteon