PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665059

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665059

Human Immunodeficiency Virus Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

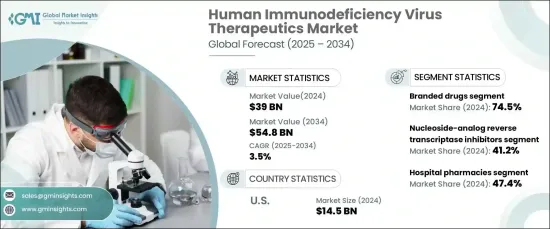

The Global Human Immunodeficiency Virus Therapeutics Market reached a valuation of USD 39 billion in 2024 and is projected to experience steady growth at a CAGR of 3.5% from 2025 to 2034. The market expansion is largely driven by the rising rates of HIV infections, significant advancements in treatment options, supportive government initiatives, and favorable regulatory approvals. These factors combined are playing a crucial role in fostering the market's ongoing growth trajectory.

The market is primarily segmented by drug type into branded and generic drugs. In 2024, branded drugs led the market with a substantial share of 74.5%, attributed to their proven efficacy, long-standing clinical reliability, and trusted performance in HIV treatment. Fixed-dose combinations have been gaining widespread popularity, as they offer simplified dosing regimens that enhance patient adherence to treatment plans. Their key role in combination therapies, particularly for effectively suppressing viral loads, continues to drive demand in the market, ensuring consistent market growth in the years to come.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $39 Billion |

| Forecast Value | $54.8 Billion |

| CAGR | 3.5% |

The market's distribution channels further highlight the reach and accessibility of HIV therapeutics. The primary distribution segments include drug stores and retail pharmacies, online pharmacies, and hospital pharmacies. In 2024, hospital pharmacies held the largest share of the market, with a notable 47.4%. Hospital pharmacies are well-equipped to offer a broader selection of specialized HIV medications, including advanced antiretroviral therapies and injectable treatments that require careful administration. Their ability to provide cutting-edge treatments, including combination regimens, under the supervision of healthcare professionals makes them the preferred choice for patients who require specialized care and attention.

In the United States, the HIV therapeutics market generated USD 14.5 billion in 2024. The country benefits from a highly developed healthcare infrastructure that ensures widespread access to advanced HIV treatments, including clinical trials and long-acting injectable therapies. The widespread availability of health insurance programs, such as Medicaid and Medicare, further guarantees that patients can afford the life-saving therapies they need. Moreover, the extensive network of retail pharmacies, hospital facilities, and online platforms helps facilitate seamless distribution and availability of HIV therapeutics, ensuring that patients can easily access the treatments they require.

The global Human Immunodeficiency Virus (HIV) therapeutics market reached a valuation of USD 39 billion in 2024 and is projected to experience steady growth at a CAGR of 3.5% from 2025 to 2034. The market expansion is largely driven by the rising rates of HIV infections, significant advancements in treatment options, supportive government initiatives, and favorable regulatory approvals. These factors combined are playing a crucial role in fostering the market's ongoing growth trajectory.

The market is primarily segmented by drug type into branded and generic drugs. In 2024, branded drugs led the market with a substantial share of 74.5%, attributed to their proven efficacy, long-standing clinical reliability, and trusted performance in HIV treatment. Fixed-dose combinations have been gaining widespread popularity, as they offer simplified dosing regimens that enhance patient adherence to treatment plans. Their key role in combination therapies, particularly for effectively suppressing viral loads, continues to drive demand in the market, ensuring consistent market growth in the years to come.

The market's distribution channels further highlight the reach and accessibility of HIV therapeutics. The primary distribution segments include drug stores and retail pharmacies, online pharmacies, and hospital pharmacies. In 2024, hospital pharmacies held the largest share of the market, with a notable 47.4%. Hospital pharmacies are well-equipped to offer a broader selection of specialized HIV medications, including advanced antiretroviral therapies and injectable treatments that require careful administration. Their ability to provide cutting-edge treatments, including combination regimens, under the supervision of healthcare professionals makes them the preferred choice for patients who require specialized care and attention.

In the United States, the HIV therapeutics market generated USD 14.5 billion in 2024. The country benefits from a highly developed healthcare infrastructure that ensures widespread access to advanced HIV treatments, including clinical trials and long-acting injectable therapies. The widespread availability of health insurance programs, such as Medicaid and Medicare, further guarantees that patients can afford the life-saving therapies they need. Moreover, the extensive network of retail pharmacies, hospital facilities, and on

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 High incidence of HIV infections

- 3.2.1.2 Advances in therapeutic treatment options

- 3.2.1.3 Growing support through government initiatives and health programs

- 3.2.1.4 Favorable regulatory approvals

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Concerns related to patient adherence and treatment continuity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Patent analysis

- 3.7 Technological landscape

- 3.8 Future market trends

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Branded drugs

- 5.3 Generic drugs

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Nucleoside-analog reverse transcriptase inhibitors

- 6.3 Integrase inhibitors

- 6.4 Non-nucleoside reverse transcriptase inhibitors

- 6.5 Protease inhibitors

- 6.6 Entry and fusion inhibitors

- 6.7 Coreceptor antagonists

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Drugs stores and retail pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 Aurobindo Pharma

- 9.3 Boehringer Ingelheim International GmbH

- 9.4 Bristol-Myers Squibb Company

- 9.5 Cipla

- 9.6 Dr. Reddy's Laboratories

- 9.7 F. Hoffmann-La Roche

- 9.8 Gilead Sciences

- 9.9 Hetero Drugs

- 9.10 Johnson & Johnson

- 9.11 Merck & Co

- 9.12 Mylan N.V. (Viatris)

- 9.13 Sun Pharmaceutical Industries

- 9.14 Teva Pharmaceutical Industries

- 9.15 ViiV Healthcare