PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665058

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665058

Food and Beverages Packaging Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032

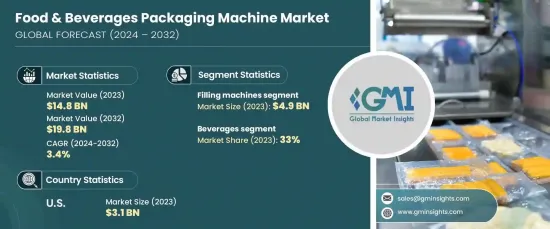

The Global Food And Beverages Packaging Machine Market reached USD 14.8 billion in 2023 and is projected to experience a steady growth rate of 3.4% CAGR from 2024 to 2032. This growth is driven by the increasing demand for sustainable packaging solutions. As consumers lean toward eco-friendly alternatives, manufacturers are under pressure to adopt recyclable and biodegradable materials, fueling the need for machinery designed to process these new materials. This shift toward sustainability is spurring innovation and technological advancements within the industry, making packaging machines more efficient and versatile.

In terms of product type, the market is divided into sealing machines, filling machines, labeling machines, pouch packaging machines, wrapping machines, and other categories. Filling machines alone generated USD 4.9 billion in revenue in 2023 and are expected to grow at a rate of 3.7% CAGR over the forecast period. These machines are essential for increasing production speed and improving efficiency while reducing the reliance on manual labor. Their ability to handle high-volume production requirements in the food and beverage industry while minimizing operational costs makes them a key player in the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $14.8 Billion |

| Forecast Value | $19.8 Billion |

| CAGR | 3.4% |

The market's applications span across beverages, processed food, bakery products, confectionery, meat, poultry and seafood, fruits and vegetables, and more. In 2023, the beverages segment held a substantial 33% market share and is projected to grow at a 3.8% CAGR through 2032. This growth is primarily fueled by the rising demand for ready-to-drink products, including bottled water, soft drinks, and health-focused beverages. As consumers increasingly prioritize convenience and portability, the need for packaging machinery capable of handling a variety of container types and high production volumes has become more critical.

In the U.S., the food and beverages packaging machine market was valued at USD 3.1 billion in 2023 and is expected to grow at a CAGR of 3.5% from 2024 to 2032. The country's diverse consumer base and the growing demand for packaged foods and beverages, including ready-to-eat meals and health drinks, are driving investments in advanced packaging technologies. U.S. manufacturers are increasingly turning to high-capacity machinery that can handle various packaging formats like bottles, pouches, and cartons, which is essential for meeting the needs of both consumers and producers in the sector. The U.S. remains a leading force in driving technological advancements and fueling the growth of the global packaging machine industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for processed foods

- 3.6.1.2 Automation and technological advancements

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial cost

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2032 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Filling machines

- 5.3 Sealing machines

- 5.4 Labeling machines

- 5.5 Wrapping machines

- 5.6 Pouch packaging machines

- 5.7 Others (case packing machines, etc)

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021-2032 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Flexible packaging

- 6.3 Rigid packaging

- 6.4 Semi-rigid packaging

Chapter 7 Market Estimates & Forecast, By Automation, 2021-2032 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual packaging machines

- 7.3 Semi-automatic packaging machines

- 7.4 Automatic packaging machines

Chapter 8 Market Estimates & Forecast, By Application, 2021-2032 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Beverages

- 8.3 Processed food

- 8.4 Bakery products

- 8.5 Confectionery

- 8.6 Meat, poultry, and seafood

- 8.7 Fruits & vegetables

- 8.8 Others (health foods & nutritional products, etc)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2032 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2032 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Bosch Packaging Technology

- 11.2 Coesia S.p.A.

- 11.3 FLSmidth A/S

- 11.4 GEA Group AG

- 11.5 IMA Group S.p.A.

- 11.6 Krones AG

- 11.7 Marel hf.

- 11.8 Mitsubishi Heavy Industries, Ltd.

- 11.9 Multivac Sepp Haggenmüller SE & Co. KG

- 11.10 Nestlé S.A.

- 11.11 ProMach, Inc.

- 11.12 Schubert GmbH

- 11.13 Shibaura Machine Co., Ltd.

- 11.14 Sidel Group S.A.S.

- 11.15 Tetra Pak International S.A.