PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665045

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665045

EV Traction Inverter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

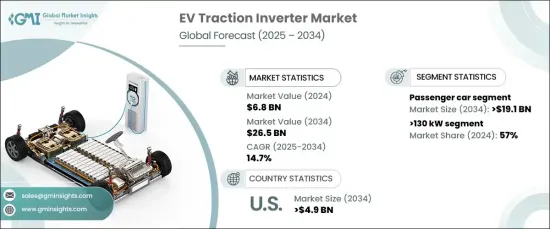

The Global EV Traction Inverter Market was valued at USD 6.8 billion in 2024 and is projected to expand at a robust CAGR of 14.7% from 2025 to 2034. The surging adoption of electric vehicles (EVs) worldwide is a key driver of this market growth, as governments promote EVs as a cleaner and more sustainable alternative to internal combustion engine (ICE) vehicles. These efforts aim to significantly reduce greenhouse gas emissions and tackle the pressing challenges of climate change.

Advancements in power electronics are revolutionizing traction inverter performance and efficiency. Breakthrough innovations, such as wide-bandgap semiconductors like silicon carbide and gallium nitride, are enabling greater energy efficiency, improved thermal management, and more compact designs. These technologies are critical for addressing the growing demand for extended driving ranges, faster charging times, and superior vehicle performance, making them indispensable in the rapidly evolving EV industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $26.5 Billion |

| CAGR | 14.7% |

By vehicle type, the market is divided into passenger cars and commercial vehicles. In 2024, the passenger car segment led the market, accounting for 73% of the total share, and is projected to generate USD 19.1 billion by 2034. This growth is propelled by the increasing use of EVs for personal transportation, spurred by heightened environmental consciousness, government incentives, and volatile fuel prices. Passenger cars are transitioning to electric mobility at a faster pace than commercial vehicles, thanks to their larger market base and higher production volumes.

Based on output power, the EV traction inverter market is categorized into <=130 kW and >130 kW segments. The >130 kW segment held 57% of the market share in 2024, driven by the rising preference for high-performance EVs and the electrification of heavy-duty commercial fleets. High-powered inverters are crucial for delivering exceptional torque, acceleration, and extended range, catering to the needs of premium EVs and demanding commercial applications. These advanced inverters are engineered to operate efficiently under high-performance conditions, ensuring reliability and optimal energy utilization.

The U.S. EV traction inverter market dominated with an 83% share in 2024 and is projected to reach USD 4.9 billion by 2034. The country's well-established EV manufacturing ecosystem and growing consumer demand are key factors fueling this expansion. Additionally, significant investments in EV production and the development of critical components, including traction inverters, are bolstering the market growth trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Technology providers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 OEMs

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing adoption of electric vehicles (EV)

- 3.7.1.2 Advancements in power electronics technology

- 3.7.1.3 Electrification of commercial vehicles

- 3.7.1.4 Increasing investments in charging infrastructure

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs of EV and components

- 3.7.2.2 Technical complexity and thermal management

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 BEV

- 5.3 HEV

- 5.4 PHEV

Chapter 6 Market Estimates & Forecast, By Output Power, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 <=130 kW

- 6.3 >130 kW

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 IGBT

- 7.3 MOSFET

Chapter 8 Market Estimates & Forecast, By Semiconductor Material, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 GaN

- 8.3 Si

- 8.4 SiC

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Passenger car

- 9.3 Commercial vehicle

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 BorgWarner Inc.

- 11.2 Continental AG

- 11.3 DENSO Corporation

- 11.4 Drive System Design Ltd

- 11.5 Eaton Corporation

- 11.6 Hitachi Astemo Ltd

- 11.7 Hyundai Mobis Co. Ltd.

- 11.8 Infineon Technologies AG

- 11.9 John Deere Electronic Solutions

- 11.10 Lear Corporation

- 11.11 LG Magna e-Powertrain

- 11.12 Marelli Corporation

- 11.13 Meidensha Corporation

- 11.14 Mitsubishi Electric Corporation

- 11.15 Robert Bosch GmbH

- 11.16 Tesla, Inc.

- 11.17 Toyota Industries Corporation

- 11.18 Valeo SA

- 11.19 Vitesco Technologies

- 11.20 ZF Friedrichshafen AG