PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665037

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1665037

Automotive Seating Thermal Comfort System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

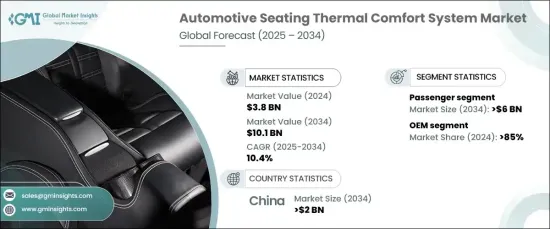

The Global Automotive Seating Thermal Comfort System Market was valued at USD 3.8 billion in 2024 and is forecasted to expand at a robust CAGR of 10.4% from 2025 to 2034. This growth is primarily driven by escalating consumer preferences for comfort and luxury features in modern vehicles. Once exclusive to high-end models, features like heated, ventilated, and cooled seats are now becoming standard in mid-range and economy cars. As drivers and passengers increasingly prioritize enhanced comfort during their journeys, automakers are integrating advanced thermal systems to meet these evolving expectations.

The rising demand for personalized comfort experiences aligns with the growing emphasis on innovative automotive technologies. Automakers are focusing on integrating smart sensors and energy-efficient systems that maintain optimal comfort while reducing energy consumption. These advancements not only enhance user satisfaction but also contribute to overall vehicle sustainability. Additionally, the market benefits from rising global automotive production, urbanization, and the increasing prevalence of long commutes, all of which drive demand for more comfortable seating solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 10.4% |

The growing popularity of electric and hybrid vehicles (EVs) has emerged as another pivotal driver for the automotive seating thermal comfort system market. Unlike traditional vehicles powered by internal combustion engines, EVs lack engine-generated waste heat, making dedicated seat heating and cooling systems essential for maintaining cabin comfort. To meet the energy efficiency standards required by EVs, manufacturers are developing innovative thermal technologies that deliver superior comfort with minimal power consumption. This shift underscores the importance of advanced seating solutions in the broader EV ecosystem, as automakers aim to enhance cabin experiences without compromising energy efficiency.

In terms of vehicle type, the market is segmented into passenger and commercial vehicles. Passenger vehicles commanded 70% of the market share in 2024 and are expected to generate USD 6 billion by 2034. This dominance is attributed to the high production volumes of passenger cars globally and the rising consumer demand for premium features across various price segments. As mid-range and premium passenger vehicles increasingly include features such as heated and cooled seats, the segment is poised to maintain its leadership in the coming years.

By sales channel, the market is divided into original equipment manufacturer (OEM) and aftermarket segments. In 2024, OEMs captured 85% of the market share, leveraging their ability to seamlessly integrate thermal comfort systems into vehicle designs. Strong partnerships with suppliers allow OEMs to deliver advanced solutions at competitive prices while ensuring reliability and compatibility across models.

China dominated the automotive seating thermal comfort system market in 2024, representing 60% of the global share, and is projected to generate USD 2 billion by 2034. The country's unmatched automotive production capacity and competitive manufacturing infrastructure drive this growth. As China continues to lead in EV production and adoption, the demand for sophisticated thermal comfort systems grows in parallel. Its robust supply chain and cost-effective production capabilities further cement China's position as a pivotal player in the global market.

Report Content

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 OEM Automotive seating thermal comfort system manufacturers

- 3.2.2 Aftermarket providers

- 3.2.3 Distributors

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Pricing analysis

- 3.5 Patent landscape

- 3.6 Cost Breakdown of automotive seating thermal comfort systems

- 3.7 Technology & innovation landscape

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing demand for comfort and luxury features in vehicles

- 3.10.1.2 Rising adoption of electric and hybrid vehicles (EVs)

- 3.10.1.3 Advancements in smart technologies for temperature control and energy efficiency

- 3.10.1.4 Expanding vehicle production in emerging economies

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High cost of advanced thermal comfort systems limiting adoption in economy vehicles

- 3.10.2.2 Complexity and cost of retrofitting thermal comfort systems in the aftermarket

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Leather

- 5.3 Fabric

- 5.4 Synthetic materials

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Process, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Seat heating

- 6.3 Seat cooling

- 6.4 Seat ventilation

- 6.5 Integrated systems

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2032 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Heavy commercial vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2032 ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Adient

- 10.2 BorgWarner

- 10.3 Brose Fahrzeugteile

- 10.4 Continental

- 10.5 Denso

- 10.6 Faurecia

- 10.7 Gentherm

- 10.8 Grammer

- 10.9 Hyundai Transys

- 10.10 Johnson Controls International

- 10.11 Lear

- 10.12 Magna International

- 10.13 NHK Spring

- 10.14 RECARO Automotive

- 10.15 Rochling

- 10.16 Tachi-S

- 10.17 Toyota Boshoku

- 10.18 TS TECH

- 10.19 Yanfeng Automotive Interiors

- 10.20 Zentex Industries