PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664912

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664912

Automotive Child Presence Detection System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

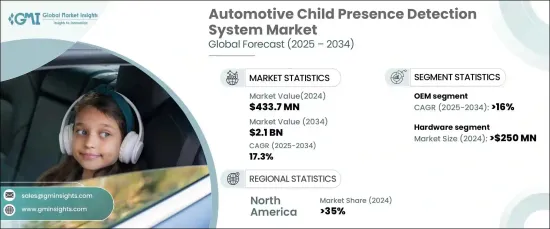

The Global Automotive Child Presence Detection System Market reached USD 433.7 million in 2024 and is expected to grow at a remarkable CAGR of 17.3% from 2025 to 2034. This growth is driven by heightened concerns about child safety, the increasing adoption of advanced vehicle safety technologies, and the enforcement of stricter regulations aimed at preventing child-related incidents in vehicles. As automakers and regulatory bodies emphasize the importance of safety, child presence detection systems are emerging as a vital component in modern vehicles, ensuring peace of mind for parents and caregivers while addressing pressing safety challenges. Enhanced consumer awareness, driven by public safety campaigns and rising technological capabilities, is further propelling the market forward.

The integration of Driver and Occupant Monitoring Systems (DOMS) is accelerating the adoption of these solutions. Technologies such as artificial intelligence-powered facial recognition, eye-tracking, and behavioral analysis are transforming in-cabin safety by closely monitoring driver attentiveness and occupant well-being. By incorporating child presence detection functionalities into DOMS, automakers are offering holistic safety packages that address critical issues like distracted driving, seat positioning, and the detection of unattended children. These integrated solutions underscore the growing focus on delivering smarter, safer vehicles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $433.7 Million |

| Forecast Value | $2.1 Billion |

| CAGR | 17.3% |

The market is segmented by components into hardware and software. In 2024, the hardware segment led the market, generating USD 250 million. This dominance is attributed to the widespread adoption of advanced sensors, radar modules, and camera-based systems designed to accurately detect unattended children in vehicles. These hardware components are not only reliable and cost-effective but also seamlessly integrated into modern automotive designs. Innovations in radar-based and ultra-wideband (UWB) systems have significantly enhanced detection precision while reducing false alarms, making these technologies a preferred choice for manufacturers.

By sales channels, the market is divided into original equipment manufacturers (OEMs) and aftermarket solutions. The OEM segment is expected to witness robust growth, with a projected CAGR of 16% from 2025 to 2034. Regulatory mandates requiring the inclusion of child presence detection systems in new vehicles are a major driver. Automakers are actively incorporating radar and AI-powered technologies into their safety features to ensure compliance with evolving standards and to meet growing consumer demand for enhanced safety measures.

North America accounted for 35% of the market share in 2024, supported by stringent safety regulations and government initiatives aimed at preventing child fatalities in vehicles. The widespread adoption of radar and ultrasonic detection systems, alongside partnerships between automakers and technology providers, is strengthening the region's position in the market. Increased public awareness and state-level legislative actions are further fueling growth in this region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Manufacturers

- 3.2.3 Distributors

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Case study

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising awareness of vehicular child safety risks

- 3.9.1.2 Technological advancements in sensing technologies

- 3.9.1.3 Growing integration of AI and machine learning

- 3.9.1.4 Increasing automotive safety standards globally

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Technological complexity

- 3.9.2.2 Variability in global safety regulations

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 Cameras

- 5.2.3 Ultrasonic systems

- 5.2.4 Radar systems

- 5.3 Software

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Electric vehicle

- 6.3 ICE

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Hatchback

- 7.3 Sedan

- 7.4 SUV

- 7.5 MUV

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aisin

- 10.2 Aker

- 10.3 Aptiv

- 10.4 Continental

- 10.5 Delphi

- 10.6 Denso

- 10.7 Faurecia

- 10.8 Hyundai Motor

- 10.9 Infineon

- 10.10 Magna

- 10.11 Murata Manufacturing

- 10.12 NXP Semiconductors

- 10.13 Robert Bosch

- 10.14 STMicroelectronics

- 10.15 TDK

- 10.16 Texas Instruments

- 10.17 UniMax Electronics

- 10.18 Valeo

- 10.19 Visteon

- 10.20 ZF Friedrichshafen