PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892755

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892755

Used Car Financing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

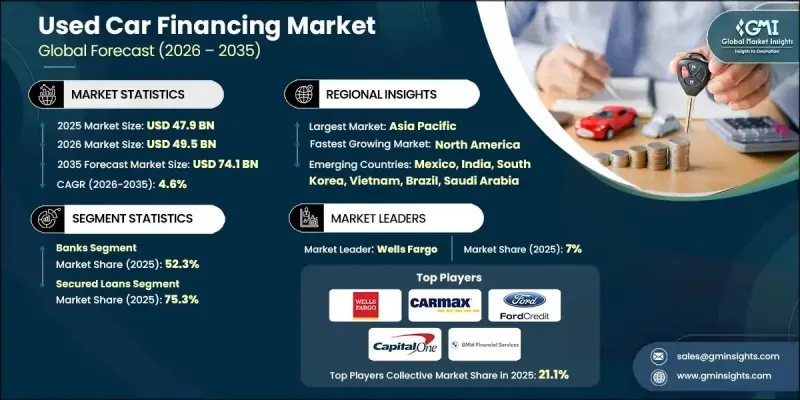

The Global Used Car Financing Market was valued at USD 47.9 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 74.1 billion by 2035.

Rising disposable income has fueled automotive demand, yet the high cost of new vehicles continues to make buyers hesitant. Used car sales have emerged as a practical alternative, enabling consumers to access vehicles at lower price points. Financing solutions, including EMIs, are bridging this gap, making car ownership more attainable and convenient. Lenders are offering flexible interest rates to accommodate varying loan tenures, with rates currently averaging around 4.79% for 12-36 months and 5.29% for 37-60 months, according to industry associations. The Asia-Pacific region accounts for roughly half of the market, driven by China's scale and India's rapid motorization alongside the growth of organized retail networks. North America and Europe remain mature markets but continue to present opportunities through digital financing platforms, innovative insurance solutions, and specialized financing for electric vehicles, supporting steady market expansion globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $47.9 Billion |

| Forecast Value | $74.1 Billion |

| CAGR | 4.6% |

The banks segment held a 52.3% share in 2024. Their dominance stems from low-cost deposit capabilities, wide branch and online networks, and expertise in low-risk lending. Borrowers typically secure 80-90% loan-to-value ratios over 36-72 months. Secured loans accounted for 75.3% of the market revenue, as collateralized loans reduce lender risk while offering borrowers favorable rates and longer tenures.

The secured loans segment held a 75.3% share in 2025. Secured loans are highly preferred because the vehicle itself serves as collateral, reducing risk for lenders. Borrowers with strong credit profiles can benefit from longer repayment terms and lower interest rates. From the lender's perspective, these loans provide assurance through the option to repossess the asset if needed, while borrowers gain access to favorable financing solutions. This risk-managed structure makes secured loans the cornerstone of the used car financing market.

U.S. Used Car Financing Market reached USD 8.3 billion in 2025. High new car prices have made used vehicles the preferred choice for many, sustaining demand for financing. Banks, credit unions, and captive finance companies actively serve consumers across credit categories, including prime, near-prime, and subprime borrowers.

Key players in the Used Car Financing Market include CarMax Auto Finance, Capital One Auto Finance, Ally Financial, Ford Motor Credit Company, Carvana, BMW Financial Services, JPMorgan Chase, GM Financial, Wells Fargo, and Toyota Financial Services. Companies in the Used Car Financing Market are leveraging flexible financing structures, including variable interest rates and customizable EMI plans, to attract a broader customer base. Many are investing in digital platforms and mobile applications to simplify loan applications, approvals, and repayments, increasing convenience for borrowers. Partnerships with dealerships, online marketplaces, and financial institutions allow lenders to expand distribution channels and tap into new regional markets. Risk assessment and credit scoring technologies are being enhanced to accommodate prime, near-prime, and subprime borrowers while minimizing defaults. Additionally, marketing initiatives emphasize affordability, convenience, and vehicle accessibility, strengthening brand presence.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Lender

- 2.2.3 Loan Type

- 2.2.4 Vehicle Class

- 2.2.5 Vehicle Type

- 2.2.6 Loan Duration

- 2.2.7 Vehicle Age

- 2.2.8 User

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising used vehicle prices expanding addressable market

- 3.2.1.2 Digital pre-qualification reducing friction & improving conversion

- 3.2.1.3 Extended loan terms improving affordability & access

- 3.2.1.4 Embedded finance partnerships expanding distribution

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Rising interest rates increasing borrowing costs

- 3.2.2.2 Vehicle price normalization risk compressing margins

- 3.2.3 Market opportunities

- 3.2.3.1 Embedded finance partnerships

- 3.2.3.2 EV used car financing emerging niche

- 3.2.3.3 Small business & fleet financing growth

- 3.2.3.4 Credit union-bank partnership models

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology roadmaps & evolution

- 3.7.4 Technology adoption lifecycle analysis

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Patent analysis

- 3.10 Investment & Funding Analysis

- 3.10.1 Venture capital in auto fintech

- 3.10.2 Private equity activity in subprime lending

- 3.10.3 Bank investment in digital capabilities

- 3.10.4 Securitization market trends

- 3.11 Pricing & interest rate analysis

- 3.11.1 Interest rate benchmarking

- 3.11.2 Historical interest rate trends

- 3.11.3 Dealer markup economics

- 3.11.4 Add-on product pricing

- 3.11.5 Fee structure analysis

- 3.11.6 Total cost of credit analysis

- 3.12 Macroeconomic & market cycle sensitivity

- 3.12.1 Macroeconomic drivers of used car financing demand

- 3.12.2 Vehicle market dynamics

- 3.12.3 Credit cycle dynamics

- 3.12.4 Recession & economic downturn sensitivity

- 3.12.5 Expansion & recovery dynamics

- 3.12.6 Vehicle ownership rates

- 3.13 Consumer credit score distribution analysis

- 3.13.1 Credit score trends over time

- 3.13.2 Credit score distribution by demographics

- 3.13.3 Credit score impact on loan terms

- 3.13.4 Credit score improvement & rehabilitation

- 3.14 Customer behavior analysis

- 3.14.1 Vehicle purchase decision process

- 3.14.2 Financing channel selection

- 3.14.3 Loan term selection behavior

- 3.14.4 Down payment behavior

- 3.14.5 Add-on product purchase behavior

- 3.14.6 Payment behavior & performance

- 3.15 Risk assessment & mitigation framework

- 3.15.1 Credit risk

- 3.15.2 Collateral risk

- 3.15.3 Operational risk

- 3.15.4 Compliance & regulatory risk

- 3.15.5 Market & economic risk

- 3.16 Sustainability & ESG trends

- 3.16.1 Environmental considerations

- 3.16.2 Social considerations

- 3.16.3 Governance considerations

- 3.16.4 ESG integration in lending practices

- 3.16.5 Investor & lender ESG commitments

- 3.17 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Vendor selection criteria

Chapter 5 Market Estimates & Forecast, By Lender, 2022 - 2035 ($Mn)

- 5.1 Key trends

- 5.2 Banks

- 5.2.1 Private

- 5.2.2 Public

- 5.3 NBFCs

- 5.4 OEM captive finance companies

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Loan Type, 2022 - 2035 ($Mn)

- 6.1 Key trends

- 6.2 Secured Loans

- 6.3 Unsecured Loans

- 6.4 Lease Financing

Chapter 7 Market Estimates & Forecast, By Vehicle Class, 2022 - 2035 ($Mn)

- 7.1 Key trends

- 7.2 Economy Cars

- 7.3 Mid-range

- 7.4 Luxury Cars

Chapter 8 Market Estimates & Forecast, By Vehicle Type, 2022 - 2035 ($Mn)

- 8.1 Key trends

- 8.2 Sedan

- 8.3 Hatchbacks

- 8.4 SUVs

Chapter 9 Market Estimates & Forecast, By Loan Duration, 2022 - 2035 ($Mn)

- 9.1 Key trends

- 9.2 Short-term (12-36 months)

- 9.3 Medium-term (37-60 months)

- 9.4 Long-term (Above 60 months)

Chapter 10 Market Estimates & Forecast, By Vehicle Age, 2022 - 2035 ($Mn)

- 10.1 Key trends

- 10.2 Newer (Upto 3 years)

- 10.3 Older (Above 3 years)

Chapter 11 Market Estimates & Forecast, By Use, 2022 - 2035 ($Mn)

- 11.1 Key trends

- 11.2 Individuals/consumers

- 11.3 Businesses/commercial

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.3.8 Benelux

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 ANZ

- 12.4.6 Singapore

- 12.4.7 Malaysia

- 12.4.8 Indonesia

- 12.4.9 Vietnam

- 12.4.10 Thailand

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Colombia

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global companies

- 13.1.1 Ally Financial

- 13.1.2 Capital One Financial Corporation

- 13.1.3 JPMorgan Chase

- 13.1.4 Bank of America

- 13.1.5 Wells Fargo

- 13.1.6 Santander Consumer

- 13.1.7 TD Auto Finance

- 13.1.8 GM Financial

- 13.1.9 Ford Motor Credit Company

- 13.1.10 Toyota Financial Services

- 13.1.11 Honda Financial Services

- 13.1.12 Volkswagen Credit

- 13.1.13 BMW Financial Services

- 13.1.14 Mercedes-Benz Financial Services

- 13.2 Regional companies

- 13.2.1 Navy Federal Credit Union

- 13.2.2 First Tech Federal Credit Union

- 13.2.3 Truist Financial

- 13.2.4 KeyBank

- 13.2.5 Huntington National Bank

- 13.2.6 PenFed Credit Union

- 13.3 Emerging companies

- 13.3.1 Carvana

- 13.3.2 LendingClub

- 13.3.3 Upstart Holdings

- 13.3.4 AutoFi

- 13.3.5 Exeter Finance