PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664890

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664890

Semi-Automatic Labelling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032

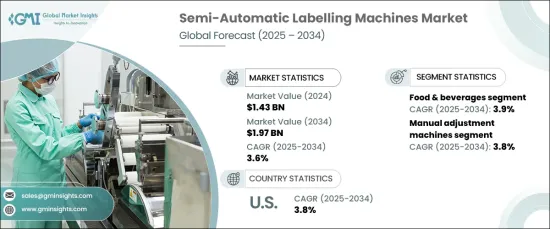

The Global Semi-Automatic Labelling Machines Market reached USD 1.43 billion in 2023 and is projected to expand at a CAGR of 3.6% between 2024 and 2032. The market growth is driven by the cost-effectiveness, adaptability of semi-automatic labelling machines to diverse industries, and essential role in meeting regulatory and consumer demands. With strong opportunities in the food and beverage sector and robust growth prospects in the U.S., this market is well-positioned for a promising future.

The market is segmented into manual adjustment machines and programmable machines, with the manual adjustment machines segment generating USD 843 million in revenue in 2023. This segment is expected to grow at a robust CAGR of 3.8% during the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $1.43 Billion |

| Forecast Value | $1.97 Billion |

| CAGR | 3.6% |

Manual adjustment machines are particularly appealing to startups, small manufacturers, and SME with budget constraints. These machines are ideal for businesses with low to medium production volumes, such as artisanal brands and niche product manufacturers, where the high cost of fully automated systems is not economically viable. Their affordability and efficiency make them a popular choice in these segments.

Based on end-use, the market is categorized into chemicals, consumer goods, electronics, food & beverages, pharmaceuticals, and others. Among these, the food & beverages segment captured a significant 34% market share in 2023 and is anticipated to grow at a CAGR of 3.9% between 2024 and 2032.

As urbanization accelerates and lifestyles become increasingly fast-paced, the demand for packaged food products-ranging from ready-to-eat meals to snacks and beverages-continues to rise. This growth underscores the importance of efficient labelling systems that meet regulatory, branding, and logistical requirements. In this sector, compliance with stringent labelling regulations is crucial, requiring detailed nutritional information, ingredient lists, expiration dates, and barcodes to be clearly displayed. Semi-automatic labelling machines excel in meeting these standards while streamlining production processes.

The U.S. semi-automatic labelling machines market accounted for USD 301 million in revenue in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2032. This growth is driven by a burgeoning preference for convenience foods, health-conscious options, and premium product offerings. The rising demand for packaged food and beverages, such as snacks, bottled drinks, and ready-to-eat meals, has further fueled the adoption of semi-automatic labelling machines. These machines are instrumental in adhering to regulatory standards set by the FDA and USDA, which mandate accurate labelling of nutritional information, ingredients, and health claims. By ensuring precise and consistent label placement, semi-automatic labelling machines help businesses maintain compliance while enhancing product presentation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for packaged goods

- 3.6.1.2 Rising regulatory compliance

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2032 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual adjustment machines

- 5.3 Programmable machines

Chapter 6 Market Estimates & Forecast, By Speed, 2021-2032 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Below 20 labels/min

- 6.3 20 - 30 labels/min

- 6.4 Above 30 labels/min

Chapter 7 Market Estimates & Forecast, By Application, 2021-2032 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Bottles and containers

- 7.3 Boxes and cartons

- 7.4 Cylindrical products

- 7.5 Others (Flat and Irregular Surfaces, Etc)

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2032 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Chemicals

- 8.3 Consumer goods

- 8.4 Electronics

- 8.5 Food & beverages

- 8.6 Pharmaceutical

- 8.7 Others (Logistics & E-commerce, Etc)

Chapter 9 Market Estimates & Forecast, By Region, 2021-2032 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Accutek Packaging Equipment Company

- 10.2 Adeneli Packaging Corp.

- 10.3 All-Fill Inc.

- 10.4 APACKS

- 10.5 BW Packaging (Barry-Wehmiller)

- 10.6 Herma GmbH

- 10.7 Kraus Maschinenbau GmbH

- 10.8 Marchesini Group

- 10.9 Shanghai BaZhou Industrial Co., Ltd.

- 10.10 Shree Bhagwati Equipments

- 10.11 Tronics

- 10.12 WINSKYS

- 10.13 Worldpack Automation Systems

- 10.14 Zhejiang Haizhou Packing Machinery Co., Ltd.

- 10.15 Zhengzhou Henuo Machinery Co., Ltd.