PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664854

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664854

Peak Shaving Diesel Fueled Power Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

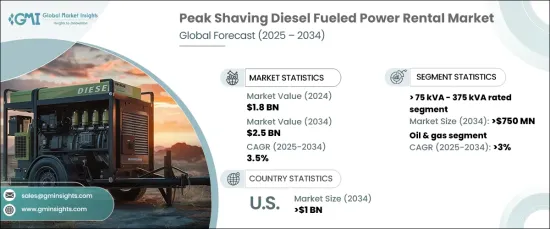

The Global Peak Shaving Diesel Fueled Power Rental Market was valued at USD 1.8 billion in 2024 and is projected to experience a steady growth rate of 3.5% CAGR from 2025 to 2034. A combination of increasing power outages, natural disasters, grid failures, and the growing need for energy-efficient solutions is expected to drive market expansion. Additionally, stricter environmental regulations are motivating the shift towards more sustainable power generation methods, creating favorable conditions for the growth of this market.

The demand for power units rated between 75 kVA and 375 kVA is anticipated to reach USD 750 million by 2034. This surge is primarily attributed to the rising frequency of extreme weather events and the critical need for dependable power in various industries. Technological innovations, such as quieter and more efficient power units, are expected to further boost market growth. Additionally, supportive regulatory frameworks and an increasing need for innovative energy solutions across diverse sectors will fuel the adoption of diesel-powered rental units.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 3.5% |

The oil and gas industry is projected to witness substantial growth within the peak shaving diesel power rental market, with a CAGR of 3% by 2034. The continuous demand for reliable power sources for exploration, extraction, and refining activities is a major driver. As oil and gas operations expand into remote or off-grid locations, the need for stable diesel-powered generators will intensify. The growing need for emergency backup systems to mitigate costly operational disruptions during power outages will also drive the market's expansion in this sector.

The U.S. peak shaving diesel fueled power rental market is expected to generate USD 1 billion by 2034. Technological advancements in engine systems that enhance performance, fuel efficiency, and reliability, alongside the rising importance of sectors such as construction, manufacturing, and oil and gas, will play a key role in market growth. The aging power grid and frequent grid failures will further elevate the demand for backup power solutions. Additionally, an increasing focus on improving power reliability while minimizing operational costs will accelerate the adoption of diesel-powered rental units.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 ≤ 75 kVA

- 5.3 > 75 kVA - 375 kVA

- 5.4 > 375 kVA - 750 kVA

- 5.5 > 750 kVA

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Telecom

- 6.3 Data center

- 6.4 Healthcare

- 6.5 Oil & gas

- 6.6 Electric utilities

- 6.7 Offshore

- 6.8 Manufacturing

- 6.9 Construction

- 6.10 Mining

- 6.11 Marine

- 6.12 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Aggreko

- 8.2 APR Energy

- 8.3 Ashtead Group

- 8.4 Atlas Copco

- 8.5 Byrne Equipment Rental

- 8.6 Caterpillar

- 8.7 Cummins

- 8.8 Generac Power Systems

- 8.9 Herc Rentals

- 8.10 HIMOINSA

- 8.11 Modern Hiring Service

- 8.12 Perennial Technologies

- 8.13 Power Express Gensets

- 8.14 Shenton Group

- 8.15 Sudhir Power

- 8.16 United Rentals