PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913398

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913398

Automotive Tire Inflator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

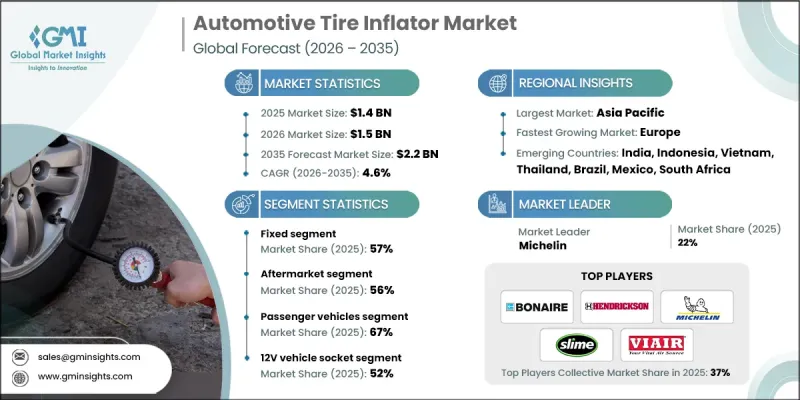

The Global Automotive Tire Inflator Market was valued at USD 1.4 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 2.2 billion by 2035.

Automotive tire inflators play an essential role in maintaining correct tire pressure, which directly supports vehicle efficiency, driving safety, and overall performance. The market includes both stationary and portable solutions designed to operate through vehicle power outlets, rechargeable battery systems, or direct electrical connections. Product offerings range from basic air inflation units to digitally controlled systems equipped with automated pressure regulation and monitoring capabilities. Technological progress has reshaped the market, with digital interfaces, automated shut-off functions, and intelligent pressure control improving usability and accuracy. Growth trends reflect a contrast between mature markets, where replacement demand is dominant, and developing regions, where rising vehicle ownership continues to create new opportunities. Shifting consumer expectations, tighter safety standards, and the increasing digitization of retail channels are influencing purchasing behavior. Together, these factors continue to redefine product innovation, accessibility, and adoption across global automotive ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 4.6% |

The fixed inflator segment accounted for 57% share in 2025 and is projected to grow at a CAGR of 4.2% from 2026 to 2035. These systems are designed for continuous, high-capacity usage and are commonly installed in professional and industrial environments. Their ability to deliver consistent performance without power limitations and withstand heavy operational demands supports their leading market position.

The aftermarket segment held 56% share in 2025 and is expected to grow at the fastest CAGR of 4.8% through 2035. Strong consumer demand for replacement units and product upgrades, combined with the expansion of online sales channels, continues to drive growth. This segment serves users seeking improved functionality, portability, or additional inflators for multiple vehicles.

China Automotive Tire Inflator Market held a 38% share in 2025, generating USD 541.7 million. Regional leadership is supported by rising vehicle ownership, increasing consumer spending on automotive accessories, expanding retail networks, and growing awareness of vehicle care across emerging economies.

Key companies active in the Global Automotive Tire Inflator Market include Michelin, VIAIR, Slime, ITW Global Tire Repair, Kensun, Marmon Holdings, BONAIRE Industries, Hendrickson USA, TIRETEK, and Guangzhou Meitun Electronic Commerce. Companies operating in the Global Automotive Tire Inflator Market strengthen their competitive position through continuous product innovation and portfolio expansion. Manufacturers focus on integrating digital controls, smart sensors, and automated features to improve accuracy and ease of use. Expanding presence across online and offline distribution channels helps brands reach a wider customer base. Strategic pricing across basic and premium product lines supports diverse consumer needs. Firms also emphasize product durability and compliance with safety standards to build long-term trust. Partnerships with automotive retailers and investments in brand visibility further enhance market penetration.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Vehicles

- 2.2.4 Application

- 2.2.5 Power Source

- 2.2.6 Component

- 2.2.7 Sales Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising awareness about tire safety

- 3.2.1.3 Demand for portable and compact solutions

- 3.2.1.4 Rise in adventure and off-road activities

- 3.2.1.5 Rising vehicle ownership is increasing demand for tire inflators

- 3.2.1.6 Growth of e-commerce is improving product availability and market reach

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial cost of advanced models

- 3.2.2.2 Competition of alternative tire repair solutions

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for smart and digital tire inflators

- 3.2.3.2 Growing adoption of cordless and rechargeable inflators

- 3.2.3.3 Increasing vehicle sales in emerging markets

- 3.2.3.4 OEM fitment in vehicles without spare tires

- 3.2.3.5 Expansion of e-commerce and direct-to-consumer channels

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Production statistics

- 3.8.1 Production hubs

- 3.8.2 Consumption hubs

- 3.8.3 Export and import

- 3.9 Pricing analysis

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Future outlook & investment opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Fixed

- 5.3 Portable

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUVS

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

- 6.4 Two-wheelers

- 6.5 Electric vehicles

- 6.6 Off-Road Vehicles (ATV/UTV)

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.2.1 Fixed

- 7.2.2 Portable

- 7.3 Aftermarket

- 7.3.1 Fixed

- 7.3.2 Portable

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Household

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 ECU

- 9.3 Compressor

- 9.4 Pressure sensor

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Power Source, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 12V Vehicle Socket

- 10.3 Rechargeable Battery (Li-ion)

- 10.4 Direct AC Power

- 10.5 Other

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Singapore

- 11.4.7 Thailand

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Berkshire Hathaway

- 12.1.2 BLACK+DECKER

- 12.1.3 CRAFTSMAN

- 12.1.4 ITW Global Tire Repair

- 12.1.5 Marmon Holdings

- 12.1.6 MAT Industries

- 12.1.7 Michelin

- 12.1.8 Slime

- 12.1.9 STEMCO Products

- 12.1.10 VIAIR

- 12.2 Regional Players

- 12.2.1 Airtec

- 12.2.2 BONAIRE Industries

- 12.2.3 Coido

- 12.2.4 Guangzhou Meitun Electronic Commerce

- 12.2.5 Hendrickson USA

- 12.2.6 Kensun

- 12.2.7 Nova Gas Techniques

- 12.2.8 Pressure Systems International

- 12.2.9 PressureGuard

- 12.2.10 TIRETEK

- 12.3 Emerging Players

- 12.3.1 Alpha Catalyst Consulting

- 12.3.2 Alto Ride

- 12.3.3 Kstar New Energy

- 12.3.4 Stealth Electric Outboards

- 12.3.5 TEMO