PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664847

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664847

P2P Rental Apps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

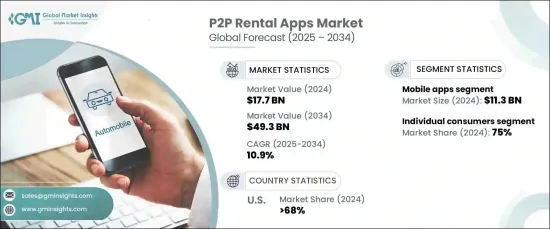

The Global P2P Rental Apps Market reached a valuation of USD 17.7 billion in 2024 and is expected to grow at a CAGR of 10.9% from 2025 to 2034. This robust expansion is primarily fueled by the rising popularity of the sharing economy and an increasing preference for on-demand services that offer flexibility and cost savings.

Consumers are gradually shifting from ownership to access-based models, favoring platforms that enable asset sharing between individuals. Advances in mobile technology, digital payments, and intuitive app interfaces have further streamlined this process, making it easier for people to rent or share items such as vehicles, tools, and recreational equipment. Younger generations, particularly millennials and Gen Z, are driving this trend due to their inclination toward sustainability and the convenience of temporary access to goods.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.7 Billion |

| Forecast Value | $49.3 Billion |

| CAGR | 10.9% |

Specialized rental categories, including luxury cars, recreational vehicles, and outdoor gear, are seeing heightened demand as consumers seek affordable alternatives to owning high-value items. Platforms catering to these niches are gaining user engagement and loyalty, with marketing campaigns and social media outreach playing a pivotal role in expanding adoption. This focus on diverse rental categories aligns with consumers' desire for tailored solutions, contributing to the growth of the P2P rental ecosystem.

The market is divided by platform type into mobile apps and web-based platforms. In 2024, mobile applications dominated the sector, generating USD 11.3 billion in revenue. Mobile apps remain the preferred choice due to their accessibility and integration with smartphone functionalities like geolocation, secure payments, and instant notifications. These features enhance the overall user experience, enabling real-time communication and smooth transactions. Moreover, app-exclusive deals and promotional campaigns are attracting more users, solidifying mobile platforms as the cornerstone of P2P rentals.

When segmented by end users, individual consumers represented 75% of the market share in 2023. These users are drawn to P2P platforms for their affordability, variety, and ease of use. The rise of gig work and flexible lifestyles has driven demand for short-term rentals, allowing consumers to access assets without long-term commitments. User-friendly designs and social media influence has further accelerated adoption, making these platforms a go-to option for personal and professional needs alike.

In North America, the United States accounted for over 68% of the regional market share in 2024. The country's tech-savvy population, widespread smartphone adoption, and thriving sharing economy have cemented its position as a leader in the P2P rental industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Software provider

- 3.2.2 Technology provider

- 3.2.3 Cloud service provider

- 3.2.4 System Integrators

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing adoption of shared economy principles and resource optimization

- 3.7.1.2 Rising smartphone penetration facilitating app adoption

- 3.7.1.3 Implementation of secure and user-friendly payment systems

- 3.7.1.4 Growing environmental consciousness promoting collaborative consumption

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Diverse regulatory landscapes across markets

- 3.7.2.2 Trust and security concerns among users

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Rental, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Property rental

- 5.2.1 Residential

- 5.2.2 Vacation rentals

- 5.2.3 Shared spaces

- 5.3 Vehicle rental

- 5.3.1 Cars

- 5.3.2 Motorcycle & scooter

- 5.3.3 Recreational vehicle

- 5.4 Equipment rental

- 5.4.1 Tools & machinery

- 5.4.2 Sports & fitness equipment

- 5.4.3 Photography equipment

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Platform, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Mobile apps

- 6.3 Web-based platform

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Individual consumers

- 7.3 Businesses & organizations

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Argentina

- 8.5.3 Mexico

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Airbnb

- 9.2 BabyQuip

- 9.3 Booking.com

- 9.4 Fat Llama

- 9.5 Getaround

- 9.6 KitSplit

- 9.7 Lime

- 9.8 Neighbor

- 9.9 Outdoorsy

- 9.10 Peerby

- 9.11 Poshmark

- 9.12 Rent the Runway

- 9.13 Ruckify

- 9.14 RVshare

- 9.15 ShareGrid

- 9.16 Spinlister

- 9.17 Style Lend

- 9.18 Turo

- 9.19 Vrbo

- 9.20 Zillow Rentals