PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664840

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664840

Laser Diode Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

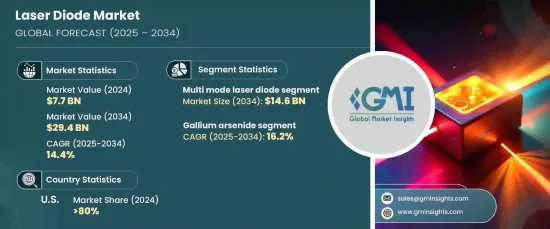

The Global Laser Diode Market, valued at USD 7.7 billion in 2024, is projected to grow at an impressive CAGR of 14.4% from 2025 to 2034. A laser diode is a semiconductor device that generates coherent light through stimulated emission, utilizing materials such as gallium arsenide (GaAs). These devices offer compact size, energy efficiency, and precise modulation capabilities, making them integral to a wide array of industries including telecommunications, healthcare, and consumer electronics.

This market growth is primarily driven by the increasing demand for advanced data transmission technologies, innovations in medical lasers, and the expanding use of laser diodes in industrial automation. The shift towards miniaturized, energy-efficient electronics further propels advancements in laser diode technology. Substantial investments in research and development, coupled with rising demand across various sectors, ensure a steady expansion of the market in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.7 Billion |

| Forecast Value | $29.4 Billion |

| CAGR | 14.4% |

Based on mode of operation, the market is segmented into single-mode and multi-mode laser diodes. The multi-mode segment is expected to dominate, reaching USD 14.6 billion by 2034. These diodes are recognized for their ability to support multiple light propagation modes, enabling high-power output. Their growing adoption in industrial applications and medical equipment underscores their increasing relevance in both commercial and industrial sectors.

In terms of doping material, the market includes infrared gallium aluminum arsenide, gallium arsenide, aluminum gallium indium phosphide, indium gallium nitride, gallium nitride, and others. Gallium arsenide emerges as the leading segment, anticipated to grow at a CAGR of 16.2% during the forecast period. Its unique properties, such as efficient photon generation and high quantum efficiency, make it a preferred material for laser diodes. Gallium arsenide's ability to perform well at elevated temperatures enhances its application across various industries.

In North America, the United States dominates the regional market, accounting for over 80% of the share in 2024. The country's strong technological ecosystem, investments in innovation, and advancements in semiconductor technologies drive demand for laser diodes across multiple sectors. The focus on high-speed communication, advanced manufacturing processes, and cutting-edge applications ensures that the US remains a significant contributor to the global laser diode market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Growth drivers

- 3.7.1.1 Growing demand for miniaturized laser diodes

- 3.7.1.2 Rapid proliferation of high-power laser diodes in autonomous vehicle technologies

- 3.7.1.3 Surge in demand for high-speed data transmission

- 3.7.1.4 Rise in development of vertical cavity surface-emitting laser (VCSEL) technology

- 3.7.1.5 Emergence of renewable energy applications

- 3.8 Industry pitfalls & challenges

- 3.8.1.1 High initial investment required

- 3.8.1.2 Concerns over using rare earth elements

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Mode of Operation, 2021-2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Single mode laser diode

- 5.3 Multi mode laser diode

Chapter 6 Market Estimates & Forecast, By Wavelength, 2021- 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Infrared laser diode

- 6.3 Red laser diode

- 6.4 Blue laser diode

- 6.5 Green laser diode

- 6.6 UV laser diode

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Doping Material, 2021-2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Gallium aluminum arsenide

- 7.3 Gallium arsenide

- 7.4 Aluminum gallium indium phosphide

- 7.5 Indium gallium nitride

- 7.6 Gallium nitride

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 Distributed feedback laser diode

- 8.3 Double heterostructure laser diode

- 8.4 Quantum cascade laser diode

- 8.5 Quantum well laser diode

- 8.6 Vertical cavity surface emitting laser diode

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Consumer electronics

- 9.4 Healthcare

- 9.5 Industrial

- 9.6 Military & defense

- 9.7 Telecommunication

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alpes Lasers S.A.

- 11.2 Ams-OSRAM AG

- 11.3 Arima Lasers Corp

- 11.4 BluGlass Limited

- 11.5 Coherent Corp.

- 11.6 Frankfurt Laser Company

- 11.7 Hamamatsu Photonics K.K.

- 11.8 IPG Photonics Inc.

- 11.9 Jenoptik AG

- 11.10 Lumentum Holding Inc.

- 11.11 Lumics GmbH

- 11.12 MKS Instruments

- 11.13 Nichia Corporation

- 11.14 Panasonic Industry Co., Ltd.

- 11.15 Power Technology Inc

- 11.16 ROHM Co., Ltd.

- 11.17 RPMC Lasers, Inc.

- 11.18 Sharp Corp.

- 11.19 Sheaumann Laser, Inc.

- 11.20 Thorlabs, Inc.

- 11.21 TOPTICA Photonics AG

- 11.22 TRUMPF SE + Co. KG

- 11.23 Ushio, Inc.