PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664834

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664834

Immersion Cooling Fluids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

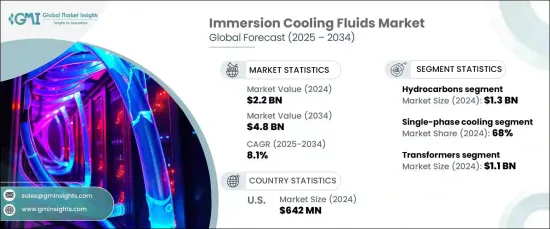

The Global Immersion Cooling Fluids Market, valued at USD 2.2 billion in 2024, is anticipated to grow at a CAGR of 8.1% between 2025 and 2034. Immersion cooling fluids, designed to submerge electronic components, excel in efficiently dissipating heat from devices such as servers, transformers, and batteries. This technology is gaining traction for its superior cooling performance and energy efficiency.

Increasing demand for energy-efficient solutions in high-performance systems is a significant factor driving market growth. As industries face challenges related to heat management, immersion cooling offers a more compact and effective alternative to conventional cooling methods. Its adoption is further propelled by advancements in fluid technology that enhance thermal conductivity and cooling efficiency. These improvements broaden the usability of these fluids across multiple industries, paving the way for sustainable and efficient cooling solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $4.8 Billion |

| CAGR | 8.1% |

The market is categorized by fluid type into hydrocarbons and fluorocarbons. Hydrocarbons, including mineral oils and synthetic variants, generated USD 1.3 billion in 2024 and remain the preferred choice due to their superior heat transfer capabilities and cost advantages. Their compatibility with diverse system designs and lower environmental impact bolster their widespread use. While fluorocarbons are gaining attention for their stability, hydrocarbons maintain dominance due to their overall performance benefits.

From a technological standpoint, the market is divided into single-phase and two-phase cooling. Single-phase cooling captured 68% of the market share in 2024, thanks to its simplicity, reliability, and lower maintenance requirements. Its widespread use in high-performance applications highlights its effectiveness in addressing critical cooling needs. Although two-phase cooling offers enhanced performance for managing elevated heat loads, single-phase systems remain the favored choice due to their established infrastructure.

By application, the market includes segments such as transformers, data centers, and batteries. Transformers led the market in 2024 with USD 1.1 billion in revenue. Their cooling requirements emphasize the role of immersion fluids in maintaining optimal functionality and prolonging equipment life. As industries increasingly prioritize energy efficiency, demand for these fluids is expected to grow across various applications.

In 2024, the US led the regional market, earning USD 642 million in revenue. The country's emphasis on sustainability, coupled with advancements in infrastructure and growing industrial demands, positions North America as a key player in driving the adoption of immersion cooling technology.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for energy-efficient cooling solutions in data centers

- 3.6.1.2 Increasing adoption of immersion cooling technology in electric vehicle (EV) batteries

- 3.6.1.3 Advancements in fluid technology enhancing heat transfer and cooling efficiency

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial cost and capital investment for immersion cooling systems

- 3.6.2.2 Limited awareness and adoption in industries outside data centers and EV batteries

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Fluid Type, 2021-2034 (USD Billion, Metric Tons)

- 5.1 Key trends

- 5.2 Hydrocarbons

- 5.2.1 Mineral

- 5.2.2 Synthetic

- 5.3 Fluorocarbons

Chapter 6 Market Size and Forecast, By Technology, 2021-2034 (USD Billion, Metric Tons)

- 6.1 Key trends

- 6.2 Single-phase cooling

- 6.3 Two-phase cooling

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Metric Tons)

- 7.1 Key trends

- 7.2 Transformers

- 7.3 Data centre

- 7.4 EV batteries

- 7.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Metric Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 Cargill

- 9.3 Chemie

- 9.4 Chevron

- 9.5 Dow

- 9.6 Engineered Fluids

- 9.7 Ergon

- 9.8 ExxonMobil Chemical

- 9.9 Shell

- 9.10 Soltex

- 9.11 Valvoline