PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664822

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1664822

Construction Toys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032

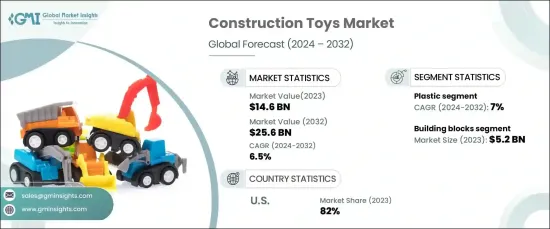

The Global Construction Toys Market, valued at USD 14.6 billion in 2023, is expected to experience robust growth, with a CAGR of 6.5% from 2024 to 2032. As parents become more conscious of the developmental benefits that toys can offer, the demand for construction toys that foster learning, creativity, and cognitive growth is surging.

The construction toys market is divided into several key product types, including building blocks, construction sets, themed construction toys, magnetic construction toys, and others. Among these, building blocks dominate the market, with a valuation of USD 5.2 billion in 2023. This segment is anticipated to grow at an impressive CAGR of 6.9% during 2024-2032. Building blocks are cherished for their ability to enhance spatial awareness, stimulate problem-solving skills, and ignite creativity. These toys continue to be a favorite choice for parents and educators alike due to their proven contributions to children's cognitive development.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $14.6 Billion |

| Forecast Value | $25.6 Billion |

| CAGR | 6.5% |

In terms of material, the market is categorized into plastic, metal, wood, and other materials. The plastic segment accounted for 41% of the market share in 2023 and is projected to grow at a steady CAGR of 7% from 2024 to 2032. Plastic construction toys are particularly favored for their durability, lightweight design, and resistance to breakage, making them perfect for active play. This material allows for extended play sessions without worrying about damage, making it an ideal choice for both parents and children.

The United States remains the largest market for construction toys, holding a significant 82% market share in 2023. The demand in the U.S. is fueled by the easy accessibility of construction toys through online platforms and specialized toy retailers. Consumers can compare various products, read reviews, and make informed decisions from the comfort of their homes. Additionally, the growing popularity of subscription-based toy services has further boosted market demand. These services offer parents convenient access to regular deliveries of educational toys, including construction kits, ensuring children have engaging and developmental play experiences without the need for in-store visits.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increased interest in developmental toys

- 3.6.1.2 Rising disposable income and spending on toys

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2032 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Building blocks

- 5.3 Construction sets

- 5.4 Themed construction toys

- 5.5 Magnetic construction toys

- 5.6 Others (magnetic tiles, etc.)

Chapter 6 Market Estimates & Forecast, By Material, 2021-2032 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Wood

- 6.4 Metal

- 6.5 Others (magnetic, etc.)

Chapter 7 Market Estimates & Forecast, By Age Group, 2021-2032 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Infants (0-2 years)

- 7.3 Toddlers (2-4 years)

- 7.4 Preschool (4-6 years)

- 7.5 Early school age (6-8 years)

- 7.6 Middle childhood (8-10 years)

Chapter 8 Market Estimates & Forecast, By Price Range, 2021-2032 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Mid

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Gender, 2021-2032 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Boys

- 9.3 Girls

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2032 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Supermarkets

- 10.3.2 Specialty stores

- 10.3.3 Others (departmental stores, etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021-2032 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Brio

- 12.2 Bristle Blocks

- 12.3 Fisher-Price

- 12.4 Haba

- 12.5 Hasbro

- 12.6 Jakks Pacific

- 12.7 K'NEX

- 12.8 LeapFrog

- 12.9 LEGO

- 12.10 Lincoln Logs

- 12.11 Mattel

- 12.12 Melissa & Doug

- 12.13 Playmobil

- 12.14 Schleich

- 12.15 Toysmith